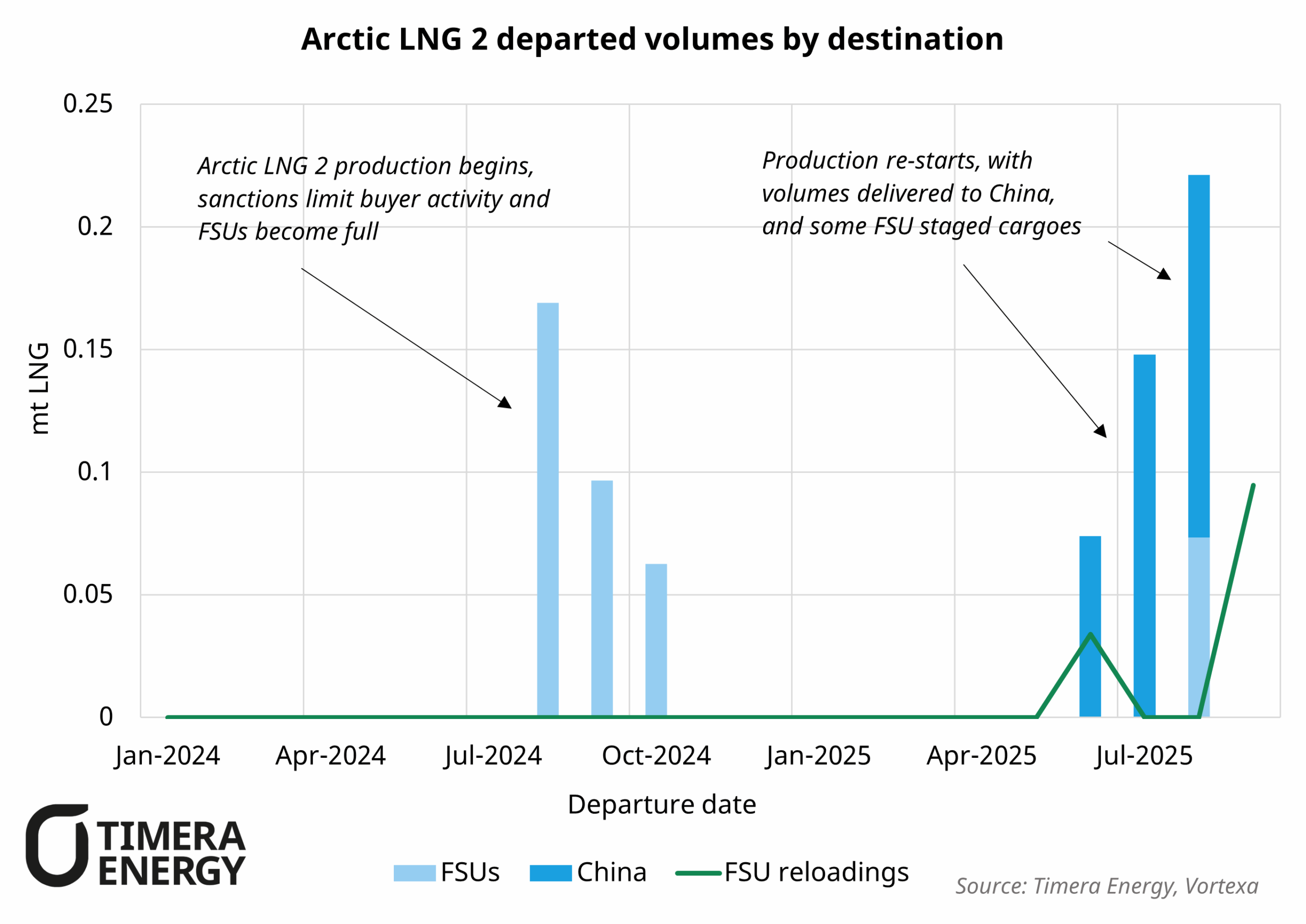

Russia’s Arctic LNG 2 train 1 has partially re-started after a year of sanction related disruptions, delivering multiple cargoes into the Beihai LNG terminal in China at prices reportedly below spot value. When production began in H2’24, volumes were delivered into the Novatek owned Koryak and SAAM FSUs due to an absence of willing buyers. Staged cargoes at the FSU have in the past couple of months been re-loaded for delivery into China. This week, evidence has also emerged of a vessel loading at the terminal’s 2nd train.

Meanwhile, the European Union’s 19th sanctions package sets out an accelerated timeline for halting all imports of Russian LNG. The ban is now set to be imposed from the 1st of January 2027, a year earlier than previously planned. This would mean Russia would be required to either reduce LNG output from Yamal, or redirect volumes into Asia. The latter poses a major logistical challenge, especially in the winter months when the NSR (Northern Sea Route) freezes over, leading to increased risk of disruptions to loadings at Yamal.

However, the 19th sanctions package does not appear to directly accelerate the phase-out of Russia’s major pipeline exports into Europe, with spot sales still set to end in mid-2026, and long-term contracted volumes at the end of 2027. This hold of pace reflects the increased challenge for landlocked Eastern European markets such as Hungary and Slovakia, both still dependent on Russian pipeline supply, in diversifying their supply mix, as well as reluctance from the governments to endorse stronger EU sanctions.