As of June 2013, the official view of security of supply risk in the UK power market has increased again. Ofgem’s recently released Capacity Assessment report sets out a further deterioration in the regulator’s projections of the UK capacity balance. The risk of customer disconnections, measured as high as a 1 in 4 chance in a scenario where the impact of the government’s efficiency measures fails to materialise, is again making national headlines.

The capacity crunch unfolds

The risk of a UK capacity crunch mid-decade has been one of the consistent themes of this blog. In August 2011 we published an article setting out the case for a UK capacity crunch driven by closures of conventional capacity and lower renewable build rates.

In October 2012 Ofgem presented its first UK Capacity Assessment supporting the view that there was an increasing risk of a capacity crunch mid-decade. At the time, we published another article setting out our view that:

- Ofgem’s public concerns and a deterioration in the UK capacity situation would significantly increase the political pressure for regulatory action

- Ofgem’s assumptions on capacity levels looked overly optimistic (particularly given risks around the retirement of conventional capacity)

- The likely reaction of the regulatory authorities would be to enable Grid to contract reserve to support existing conventional capacity

All three of those views appear to have been confirmed in Ofgem’s latest Capacity Assessment.

What is Ofgem worried about

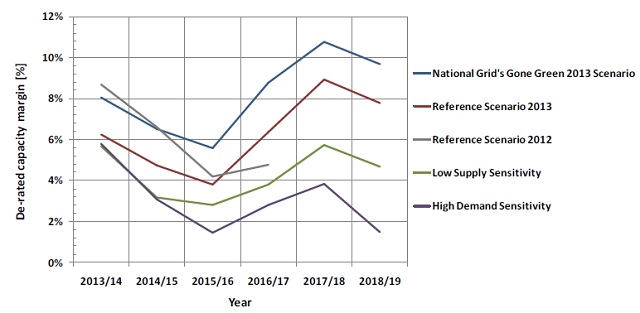

Conventional plant retirements are a key cause of concern for Ofgem. Since its first Capacity Assessment (Oct 12) market participants have announced an additional 2GW of imminent capacity closures. Ofgem estimates a further 1GW by 2015/16. These factors have caused Ofgem to project a more rapid tightening of the UK power market capacity margin compared to their analysis in October last year (as shown in Chart 1 below). But we again believe that these numbers may be optimistic.

Utilities are still suffering from an historically weak UK spark spread environment. Generation margins on older CCGT are at the level, or in some cases, below the level of station fixed costs. This capacity is at risk of mothballing or closure if spreads remain weak.

The most vulnerable CCGT plants for retirement are older, less flexible gas plant built in the 90’s dash for gas. These assets were not designed for current conditions of low load factor running, with constant ramping and multiple starts causing increased costs through asset fatigue. With some assets, investment in measures to improve flexibility can improve plant economics. But there are a number of CCGT plants where flexibility improvements and fixed cost reductions are technically constrained by plant components and configuration (particularly in relation to the Heat Recovery Steam Generator). It is these assets that are at greatest risk of retirement over the next three years, causing a further reduction in the UK capacity margin.

There are two other key risks to the capacity equation:

- Renewable build falls further behind target, with a particular risk around offshore wind as we set out here

- Ofgem’s assumption of a 3GW reduction in peak demand by 2018/19 due to the impacts of government efficiency measures does not materialise

Both of these factors depend on an improvement in the fortunes of the government’s EMR policies.

How will Ofgem react

In its first Capacity Assessment Ofgem raised the yellow flag on the risk of a capacity crunch. Ofgem has taken a step further in this Assessment by proposing policy measures to stem the risk. Ofgem’s report contains what appears to be a carefully worded joint statement:

Ofgem, DECC, Grid all agree ‘that it is prudent to consider the case for additional tools to help National Grid balance the electricity network during the middle of this decade when capacity margins could be tight.’

But Ofgem also makes it clear that they expect DECC to define an acceptable level of security of supply risk:

We expect DECC to define a reliability standard for the GB market through their EMR Delivery Plan. A reliability standard indicates the accepted level of risk in the market. It represents a trade-off between the level of security of supply and the investment required to achieve that level.

Ofgem’s concern around security of supply has lead it to propose two intervention options outside the wholesale market for industry consultation:

- Demand Side Balancing Reserve payments which allow Grid to contract demand side reductions

- Supplementary Balancing Reserve payments which allow Grid to contract generation capacity to protect security of supply

The latter payment looks to be consistent with what we were suggesting last October. A ‘stop gap’ mechanism for Grid to bilaterally contract capacity reserve before the Capacity Market comes into effect after 2018.

This is important news for existing UK CCGT owners and investors. Balancing reserve payments from Grid represent an additional potential asset revenue stream. Given these will likely be fixed, off market capacity payments, they also de-risk CCGT returns. In our view this only strengthens the increasingly compelling case for investing in flexible existing UK CCGT assets at current depressed values.