“I’m going to make them an offer they can’t refuse”

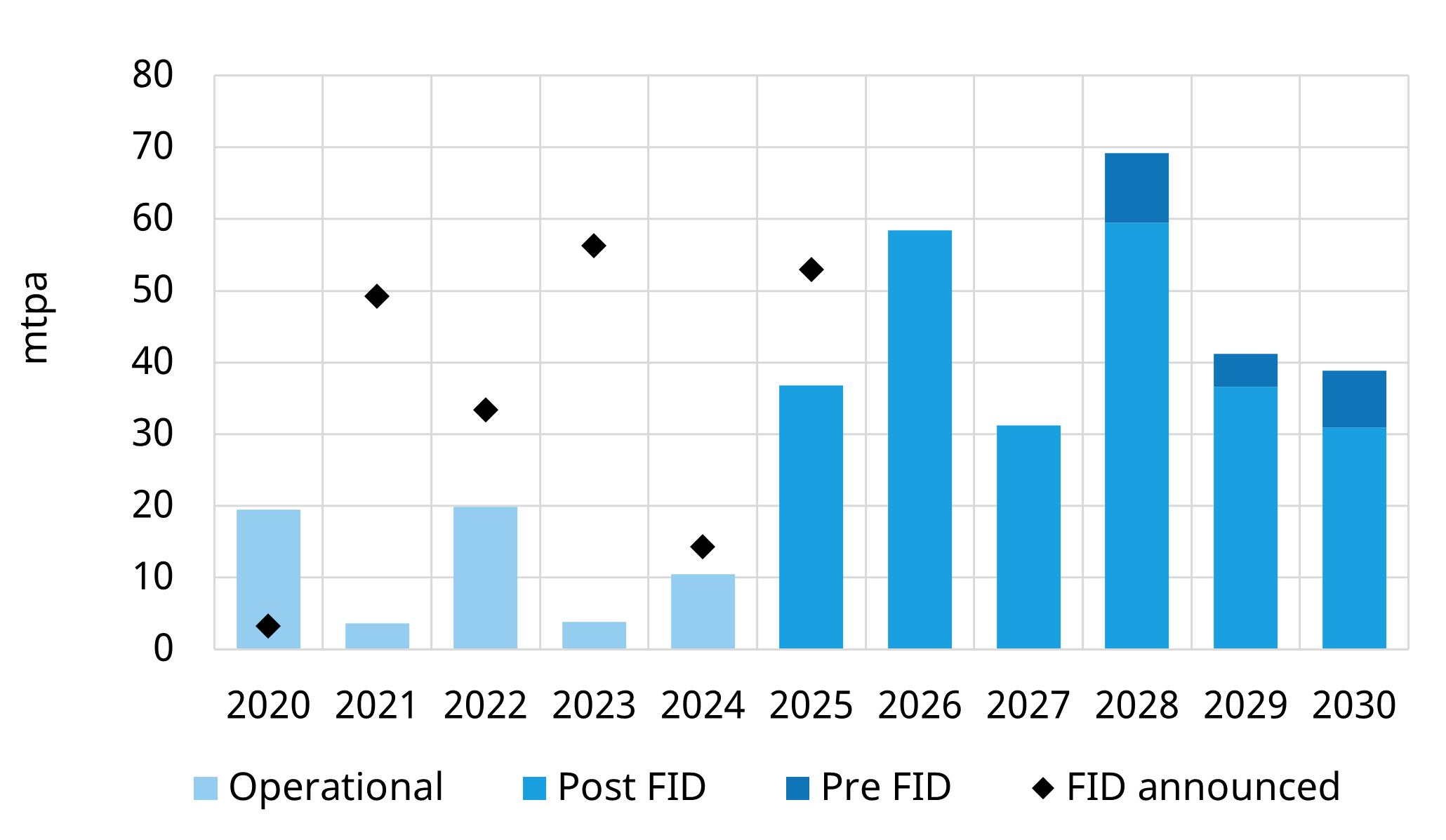

A new supply wave of more than 200 mtpa of LNG is set to come online over the next 5 years as shown in Chart 1. More than half of this volume will be sourced from the USA.

7 min

“I’m going to make them an offer they can’t refuse”

A new supply wave of more than 200 mtpa of LNG is set to come online over the next 5 years as shown in Chart 1. More than half of this volume will be sourced from the USA.

Source: Timera Energy

Rapid US LNG supply growth is driving a wave of offtake contracting activity. Liquefaction project developers are courting Asian & European buyers to underpin the large capex investments required to develop new terminals.

Market price exposure sits at the core of these contract negotiations. Two key sources of price risk need to be managed by the offtaker:

With very large values at stake, portfolio players are increasingly nervous about the looming impact of market regime shift as a record wave of new supply comes online.

This is driving innovation in contracting strategies as offtakers look for new ways to manage price exposures across the coming supply cycle.

One emerging focus is feedgas sourcing, as offtakers seek to manage the short Henry Hub exposure embedded within conventional tolling agreements.

Some players are taking the upstream route, investing directly in U.S. gas production. For example, JERA recently acquired $1.5 billion of Haynesville assets.

Others are developing netback-linked feedgas structures that transfer part of the global gas price risk to U.S. producers. This is being supported by the potential for win-win deals between offtakers and US gas producers who wish to diversify some of their exposure away from Henry Hub.

In today’s article we look at a case study that explores the netback approach.

US offtakers face dual risk of margin squeeze

Offtakers with US supply contracts (e.g. Asian & European utilities and LNG portfolio players), face the following market price exposure:

Market regime shift across the next couple of years could squeeze contract margins from both directions:

Cargo cancellation options embedded in U.S. LNG contract provide some downside protection. However, US supply contract fixed cost remain substantial. That is sharpening offtaker focus on more active risk management strategies.

US gas producers are looking to diversify risk… setting up deals in the global market

U.S. gas producers are increasingly looking to participate in global gas price upside after several years of watching international prices trade well above Henry Hub. Many are now pursuing some degree of index diversification to reduce reliance on U.S. hub pricing while gaining exposure to global benchmarks (i.e. JKM, DES NWE).

However, most producers do not want to take on the midstream complexity of managing an LNG export position themselves.

This creates a natural partnership opportunity. LNG offtakers seeking to hedge short Henry Hub exposure can align with producers seeking global price participation, through netback-linked feedgas deals that share exposure and value between both sides.

This mirroring of risk appetites is driving constructive negotiations between producers and offtakers. The following case study illustrate how these structures can create win-win outcomes across the LNG value chain.

Case study 1: US LNG offtaker perspective

Risk appetites we describe above set up the potential for LNG offtakers to procure feedgas from a US producer at JKM / TTF netback prices.

The offtaker retains midstream flexibility while removing US hub price exposure & replacing it with their domestic market hub price exposure (e.g. JKM or TTF). This can substantially reduce portfolio risk associated with US supply.

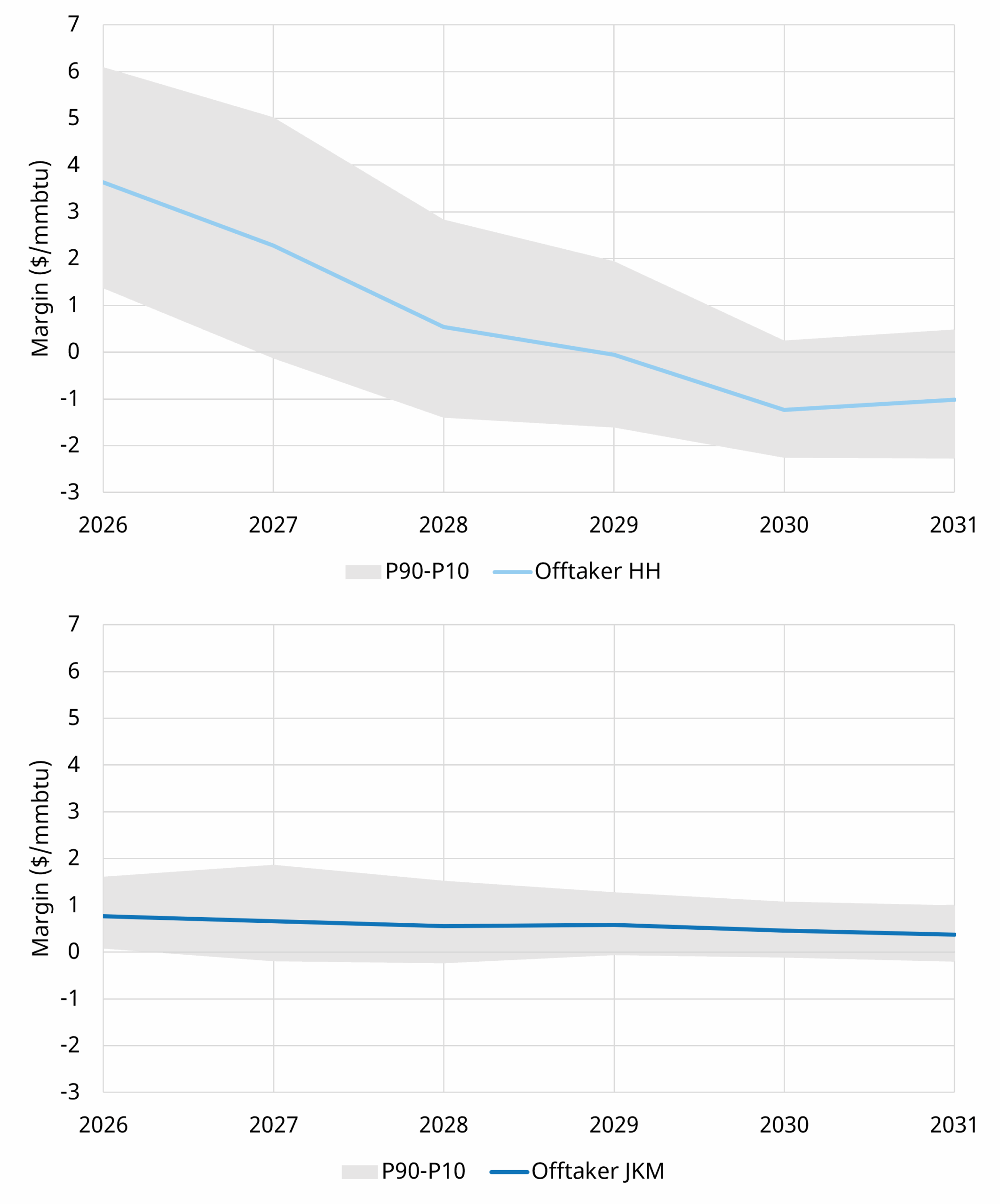

To illustrate, we’ve modelled the value of a US offtake position over 2026 – 2031 under two different feedgas sourcing strategies, with the results are shown in Chart 2:

Source: Timera Energy LNG Bridge portfolio valuation model. Deal 1: 115% HH + $2.50 capacity fee. Deal 2: JKM netback basis (100% JKM – shipping - variable liquefaction cost + $2.50 capacity fee).

The Chart illustrates the benefit to the offtaker of signing a netback deal with a US producer. Henry hub exposure is removed, and JKM exposures netted off, reducing deal exposure to short shipping capacity + long physical cargos (e.g. for delivery into the offtaker’s domestic market).

The impact of this for the offtaker is:

This loss of upside means that netting indexation for offtakers is primarily a risk management play. It is a risk averse strategy that can make sense for a portion of contracted supply in order to manage the extent of portfolio market price & spread risk.

Let’s now look at the perspective of the US gas producer on the other side of the deal.

Case study 2: US gas producer perspective

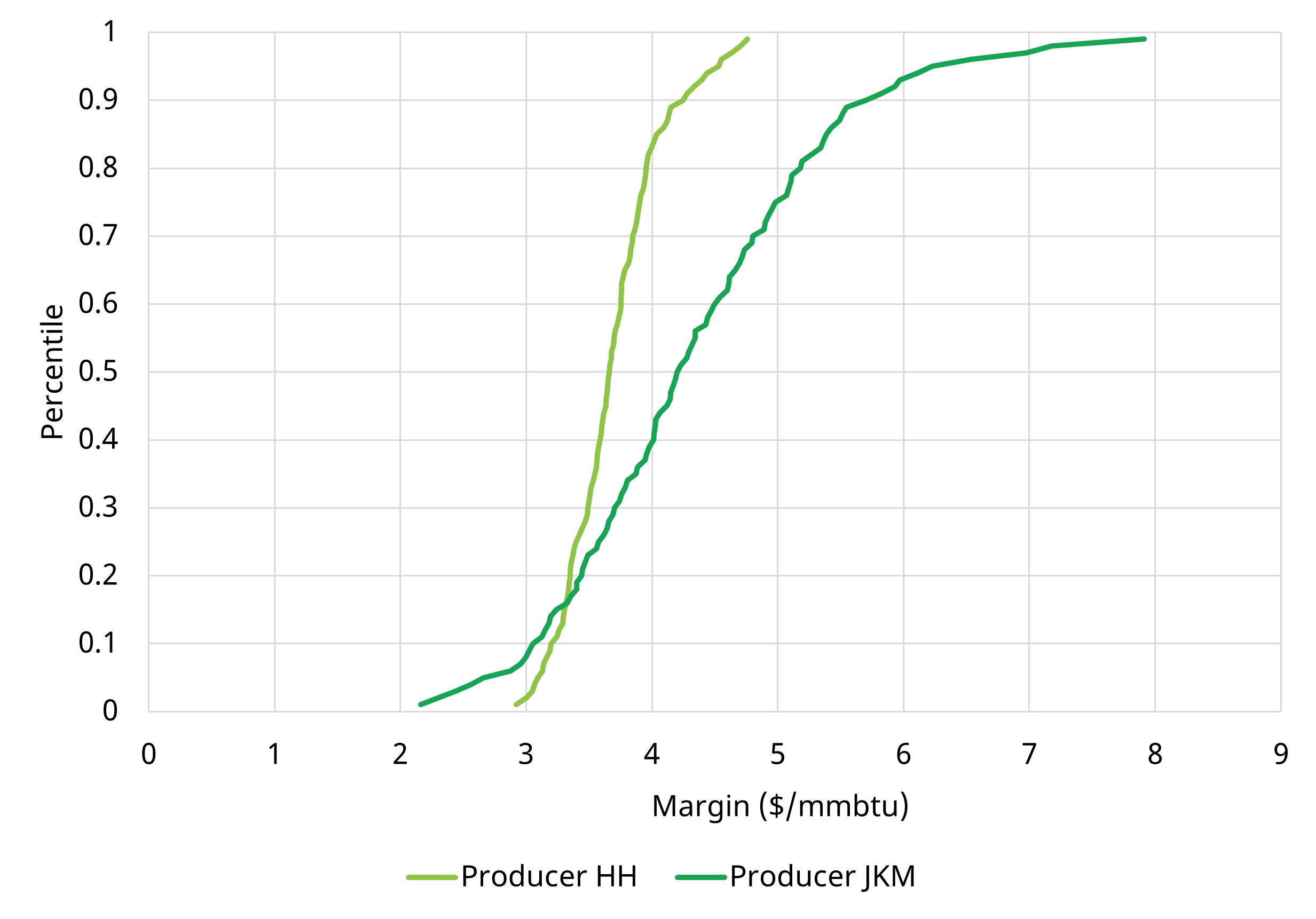

The main incentive of US producers in considering a netback supply deal (in this case JKM) is to diversify away from concentrated US hub price risk in their portfolio.

Chart 3 illustrates the margin impact from the producer’s perspective when delivering feedgas to the offtaker at the plant inlet. Two scenarios are shown:

Source: Timera Energy LNG Bridge portfolio valuation model. Deal 1: 100% HH. Deal 2: JKM netback basis (100% JKM - shipping).

There are three important takeaways for the producer:

In summary the benefit to the US producer of a netback deal is not to remove downside risk but to diversify away from US hub price exposure and open up potential upside.

The key to unlocking a successful deal

The strike price of the JKM netback – the fixed discount to the global price benchmark – is the crux of the deal.

For the offtaker, it needs to be high enough to cover the tolling fee, variable costs, and shipping, while still retaining midstream flexibility and diversion value.

For the producer, the challenge is not to overpay for global price upside, given the counterparty is effectively transferring risk and locking in a margin with higher certainty.

The structure also depends on how cancellation flexibility is allocated between the parties, which can materially shift value and risk. Achieving balanced outcomes requires a robust portfolio valuation model that integrates market fundamentals, forward price expectations, and risk exposures.

We’ve been using our LNG Bridge model to support both U.S. producers and LNG offtakers this year on transactions of this nature—linking together market evolution, fundamentals, and portfolio risk to structure feedgas offtake deals that create value for both sides.

If you would like any more information on risk and value attribution in LNG deals, or any more information on the work we do to support our clients, feel free to contact David Duncan (Director LNG & Gas) at david.duncan@timera-energy.com.

Shifting the risk curve for US LNG supply