As Christmas approaches fast again it’s time to reflect on what has happened in 2021. Our first article in January each year sets out 5 surprises to consider. Today’s article revisits those 5 surprises and considers how the year has evolved.

“The 2021 energy price shock is off the Richter scale”

From an energy market perspective this year is hard to beat for surprises! You are a very cool blooded animal if you have not been surprised by some of the events of 2021.

Let’s recap what we proposed as our 5 surprises on Jan 11th 2021.

- Decarbonisation accelerates beyond all expectations – structural inflection in policy & industry response

- Surge in energy prices – gas, power, carbon & oil prices surge as demand recovery rides up constrained supply curves

- Flexibility crunch comes into focus – increase in focus on flex requirement with policy action to support investment

- Upswing in LNG portfolio value – tightening market drives big value increase for flexible LNG portfolios

- Gas asset ownership transition – growing decarbonisation risks are a catalyst for asset sales to private equity & integrated traders.

Let’s do a quick review of what has happened in each of these areas.

1.Decarbonisation accelerates beyond all expectations

2021 has seen a step change in global response to decarbonisation. A post-Trump US back onside has helped. But Europe continues to lead the way from a policy action perspective.

This was illustrated for example by increases in national renewables targets and accelerating coal closure timelines. The UK also followed its net zero 2050 target with a pledge to decarbonise its power sector by 2035, a move which may spur other countries to set similar goals.

Elsewhere in Europe, the incoming German government has pledged a complete coal phase out by 2030, bringing forward the closure dates of 17GW of coal and lignite by 8 years. This is a significant policy acceleration for Germany and should ensure Western Europe enters the 2030s coal free.

The outcome of COP-26 was dampened by a last minute wording adjustment around global coal phase out. But even discussing such a commitment seemed implausible at the underwhelming COP-25 in Madrid in 2019, and there was much more united agreement this year on the requirement to take major action to tackle climate change.

2.Surge in energy prices

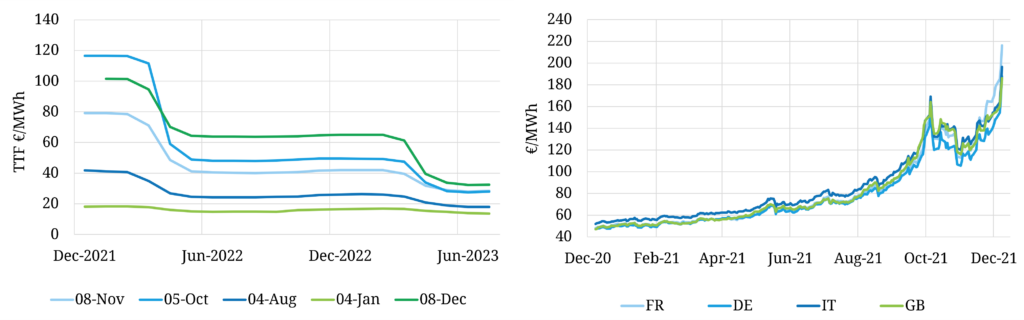

We expected a surge in prices in 2021, but not like this! Chart 1 illustrates the scale of the move that has hit European gas & power markets this year.

Let’s look at a few basic stats to drive home just how unprecedented the 2021 price moves have been:

- TTF gas: Winter 2021 prices started the year under 18 €/MWh and are currently trading above 100 €/MWh (a more than 5x increase). Calendar Year 2022 prices are up ~450%, Cal 23 ~270%.

- Power: Power price curves across Europe have broadly followed gas higher (up 400-500% across the front of the curve), although some markets have seen more acute tightness e.g. French prices for Jan 22 have broken above 400 €/MWh.

- Carbon: EUA prices are up about 250% across the year as decarbonisation momentum has accelerated (hitting 90 €/t last week, before pulling back).

- Oil: Brent has been a relative laggard, with front month prices only rising about 140% since the start of the year. This of course is still a big move!

The word ‘surprise’ does not do justice to the energy market events of this year. The 2021 energy price shock is off the Richter scale!

3.Flexibility crunch comes into focus

The big move higher in power curves across Europe has been predominantly driven by gas & carbon price rises. But there have also some periods & pockets of acute power market tightness due to shortfalls in flexible capacity (e.g. during a very low wind period in Sep).

The starkest explosion in flexibility price signals has been in the UK where baseload Clean Spark Spreads for the current winter are in the order of 10x higher than at the start of the year (Jan 22 currently above 100 £/MWh). Battery & peaking plant margins have also been at record levels across the second half of 2022.

Surging coal plant generation margins (clean dark spreads) have resulted from high gas prices and a shortage of flexible capacity, an uncomfortable outcome from a policy perspective.

Flexibility is now front and center in policy makers’ sights, with growing momentum behind further support to accelerate investment. Perhaps the biggest evidence of this shift is the appearance of a German capacity market on the agenda of the new coalition government.

4.Upswing in LNG portfolio value

The LNG market has been at the epicentre of 2021 price volatility. And this price volatility has generated very strong returns from optimisation of portfolio flexibility.

Extreme market volatility has manifested itself in several forms:

- Absolute price volatility e.g. large moves in key TTF, JKM & Henry Hub curves

- Inter-regional price spread volatility e.g. JKM vs TTF; JKM vs Asian spot markers

- Cross-commodity spread volatility e.g. Brent vs JKM.

Flex value is being realised from this volatility via optimisation of physical portfolios into delivery e.g. cargo flex, shipping & logistics. LNG portfolios are also harvesting margin via re-optimising forward hedge positions against underlying optionality.

2021 been a good year for portfolios long flex, but the flip side of this is a big jump in the risk associated with sold flex positions. There have also been some very substantial credit & collateral events across the market given price swings & large MtM exposures. LNG portfolio risk management has never been more important.

5.Gas asset ownership transition

It is hard to argue that our 1st four themes from January did not result in surprises. The 5th one is less clear.

Growing decarbonisation risks have been driving growing momentum behind oil & gas asset divestment by large producers and infrastructure investors. This has been a theme on this blog for the last three years.

Assets are being sold to private equity funds and smaller niche players who are better able to price & manage decarbonisation risk and are often less constrained by shareholder ESG mandates. Examples of this in 2021 include:

- A Hitec Vision (Norway’s largest private equity fund) backed acquisition of North Sea oil & gas assets from Exxon

- Ineos acquisition of the Hess oil & gas asset portfolio in Denmark (where the government has announced the phase out fossil fuel production by 2050).

However there was no significant growth in asset sales in 2021 and if anything the surprise has been that more assets have not been offloaded given attractive market conditions.

This may well change across the next couple of years. Wood Mackenzie has estimated another $30 bn of oil & gas assets likely to be sold by majors alone, with the total value of assets for sale globally estimated at $140 bn.

We’ll be back in mid-January with our 5 surprises for 2022. But first some news on Timera happenings this year.

Timera year end news

We finish the year with a round up of interesting Timera client work this year, that provides an insight into where flex asset investors and owners are focusing:

- Batteries & storage: We have supported more than 1GW of UK battery investment projects this year, with the UK continuing to lead European deployment. But we have also seen a jump in projects in Italy & Spain (mostly collocated) as well as some in NW Europe. Interest in long duration storage is also growing fast.

- Hydrogen: Our investment work supporting hydrogen electrolyser and storage projects has grown fast. This has been supported by the evolution of our stochastic electrolyser modelling framework.

- LNG Bridge: Our LNG Bridge model is quickly evolving into a market leading solution for LNG portfolio valuation & optimisation. We continue to implement & use the model across a range of large LNG players including gas majors, producers, utilities & commodity traders.

- Peaking flex: We have been working with both peaking asset owners & investors to understand the impact of rapidly changing flex price signals on asset value.

- Renewables + flex: We have continued to support renewable investors analyse the value & risk diversification impact of adding flexible assets to portfolios (e.g. batteries, electrolysers).

- Transactions: We continue to support buy-side investors with commercial due diligence & valuation work. In 2021 that has included bids for large hydro-electric & thermal asset portfolios, a renewables + battery portfolio, LNG portfolios & SPAs, a large gas storage asset and an energy trading business (+ offtake contracts).

The common theme across all of this work is the flexibility required to decarbonise energy markets.

To support this work we have continued to expand our team in 2021 and are actively recruiting. We have three new members of our team that have recently joined:

- Faisal Wahid (Senior Analyst): an expert in stochastic optimisation & analysis (previously with Mercury, EDF & Artelys)

- Sameer Essajee (Analyst): a market, modelling & data analysis specialist (previously with Candesic)

- Chris Hesman (Analyst): a power market analysis & modelling specialist (previously with Tesla Europe).

We have two more new members of our team to announce in Jan 2022.

This is our last feature blog article for 2021. We will be back with more features from mid-Jan 2022 and in the meantime we’ll continue to publish snapshot articles.