“Trading activity can impact gas prices in the short term… beyond that, fundamentals are king.”

“Speculative activity from hedge funds is driving gas prices”. Some variation of this reasoning is becoming increasingly common across price reporters, trade press & energy market analysts.

But is it really the case that hedge funds are now a structural driver of gas pricing dynamics? Or is ‘hedge fund activity’ just a convenient explanation for price movements that market analysts don’t understand?

It is an objective statement of fact that hedge funds have grown their presence in the LNG market & European gas markets across the last 3 or 4 years. A clear catalyst for this was the extreme price volatility triggered by the European gas crisis across 2021-22.

Growth has been led by large multi-asset hedge funds such as Citadel, Millenium & Balyasny, which have aggressively headhunted traders & analysts from established market players.

In this article we set out a summary of the role of hedge funds in the gas market, what drives their trading activity & how they impact market price. We also look at a recent case study of hedge fund price impact across the Feb-Mar 2025 gas price decline.

How do hedge funds fit into the gas market?

Gas markets are strongly physical in nature. As such, trading activity & flows are dominated by utilities, producers, large end users and physical commodity trading companies (see first 4 rows of Table 1 below).

There are then two other important market player types with a focus on financial trading: hedge funds & banks (last 2 rows of Table 1). Hedge fund presence in gas markets has grown markedly as banks have become increasingly constrained by regulatory & risk captial requirements.

Table 1: Key European gas market players (Source: Timera Energy)

Hedge fund business models drive market impact

Let’s focus in on hedge funds and how their business models impact their role in gas markets. We focus on large multi-asset hedge funds (e.g. Citadel, Millenium) as the most relevant in terms of impact on gas markets.

There are other types of hedge funds active in gas markets, including smaller energy focused funds (e.g. Andurand Capital) and hybrid hedge fund / commodity traders (e.g. Hartree Capital, Castleton Commodities). However their trading activity is rarely of a size that impacts markets.

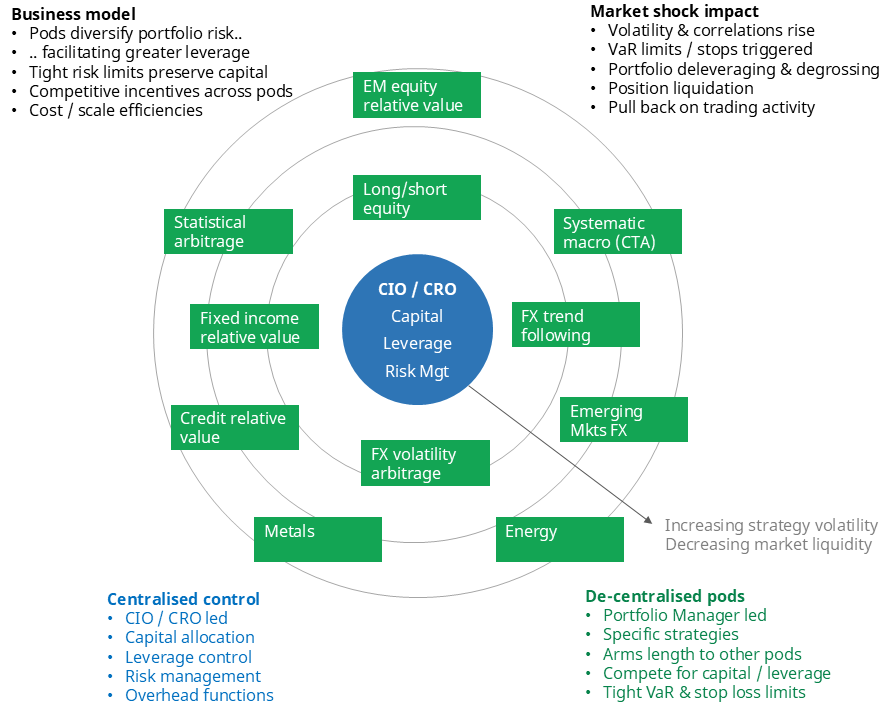

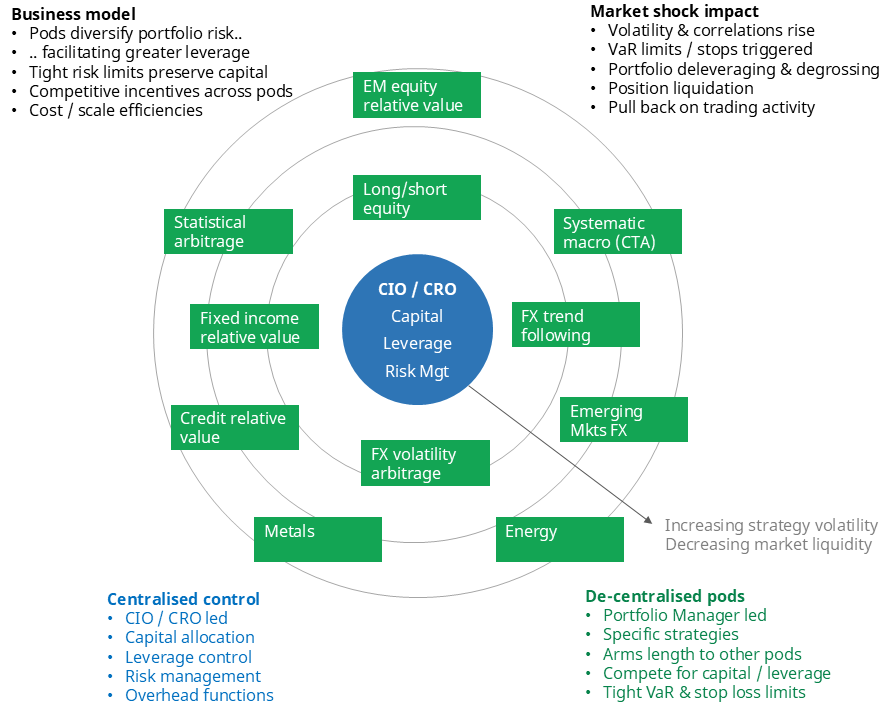

Multi-asset hedge funds typically share the following business model characterstics:

- Centralised risk capital allocation, leverage control & risk management

- Arms length trading teams or ‘pods’, focused on a specific trading strategy (led by a Portfolio Manager responsible for P&L)

- Strong focus on diversifying portfolio risk across pod strategies, enabling leveraging of capital base

- Sophisticated quantitative analysis capabilities, targeted at value creation from market volatility

- Stringent stop loss & VaR risk limit controls on pod exposures.

A simple summary of this is shown in Diagram 1.

Diagram 1: Multi-asset hedge fund business model

Source: Timera Energy (note: pod strategies are simplified & illustrative only)

Gas markets present clear opportunities for hedge funds in the form of:

- high volatility

- lower correlation of gas prices to financial markets (i.e. portfolio diversification benefit)

- competitive advantage over incumbents with respect to quantitative capabilities.

Hedge funds operating in gas markets are however exposed to:

- a lack of physical assets (in what are physically dominated markets)

- very limited physical trading capability (focus on financial trading)

- market liquidity challenges when rapidly exiting leveraged positions.

The recent sharp pull back in European gas & LNG markets is a useful case study of how hedge funds exiting positions can impact gas prices.

Case study: Feb-Mar 2025 price drop

Front month TTF & JKM gas prices fell around 35% across 3 weeks from mid Feb to early Mar 2025, as shown in the top panel of Chart 1 below. The front of the forward curve fell by a similar amount, given the impact of storage linking prompt & forward price movements.

This price decline was triggered by clear fundamental drivers which we have covered in separate articles:

However the decline was exacerbated via hedge funds (who were net long) liquidating gas positions and pulling back on trading activity (reducing market liquidity). And this liquidation of gas exposures was linked to a broader reduction in exposures in other asset classes across financial markets.

In the bottom panel of Chart 1 we show a price chart of the US S&P 500 equity index as a simple benchmark for global risk asset performance (i.e. a broader financial markets barometer).

The chart shows the reversal in gas prices (fundamental drivers -> relaxing storage mandates, warmer weather, US peace deal push), preceding a broader sell off in global risk assets by a week or so.

The green shaded zone on Chart 1 shows a 2 week ‘risk off’ period of aggressive selling in both gas markets and broader financial markets. This was triggered by fears of aggressive US tariffs & economic slowdown risk.

During a pronounced ‘risk off’ period like this, hedge funds will typically:

- Experience an increase in correlations across markets (eroding portfolio diversification benefits)

- Experience VaR limit & stop loss driven exposure liquidations

- Rapidly reduce leverage & raise cash to protect capital & service margin calls, triggering further liquidations

- Pull back on market trading activity, exacerbating market illiquidity.

Because of the centrally controlled allocation of risk capital and leverage, these exposure liquidations can cascade across markets. Gas positions are liquidated not for fundamental reasons, but for portfolio risk management reasons.

It is important to note that the impact of these broader ‘risk off’ macro events on gas markets is not that common. There are also idionsyncratic fundamental drivers that can cause gas markets to rally despite a broader financial market sell off.

Takeaway on hedge fund price impact

It is difficult to objectively measure how much of the recent gas market decline was driven by hedge fund liquidations. But anecdotely hegde funds were active in the market and exposure liqudations likely contributed to the pace of price decline and the ‘overshoot’ below 40 €/MWh support.

However its important not to overstate the role of hedge funds in driving gas prices. There are clear fundamental reasons behind the recent gas price fall. The pace & magnitude of the decline is also underpinned by relatively inelastic 2025 supply & demand curves as our global gas modeling shows.

Trading activity can impact gas markets across a short term horizon. Beyond that fundamentals are king given the strongly physical nature of gas as a commodity.

Feel free to reach out to David Duncan (LNG & Gas Director) for a free sample copy of our Global Gas Report with more details on current drivers of LNG & European gas market pricing dynamics (david.duncan@timera-energy.com).