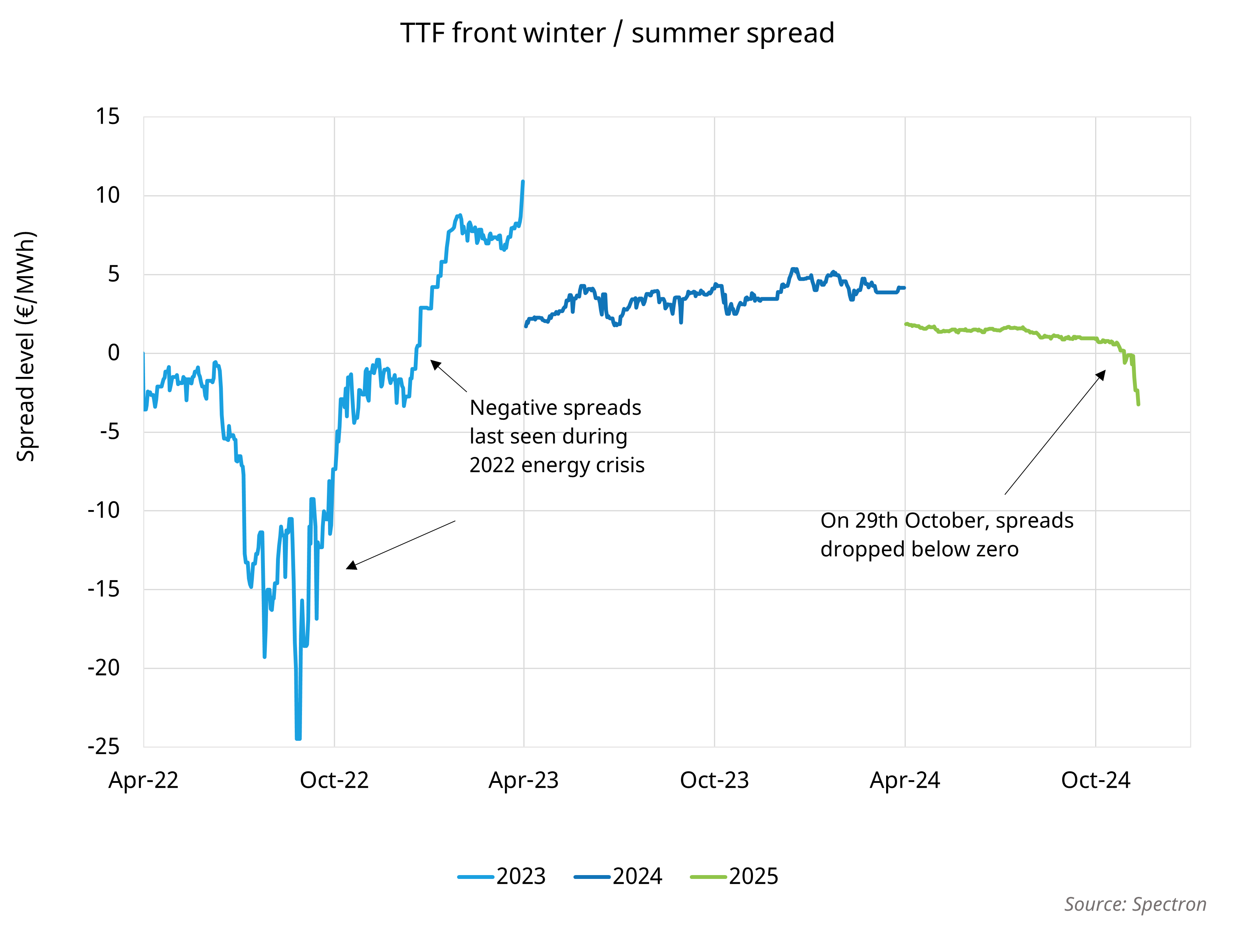

TTF front seasonal storage spreads (next winter – next summer) have fallen to negative territory for the first time since December 2022. The negative spreads reflect market participants’ expectation of a tighter global gas balance next summer when European storage injection requirements will need to out-compete Asian buyers for spot LNG, prior to the start-up of incremental LNG supply projects in late 2025. A combination of colder early winter forecasts; coming halt of Russian gas transit through Ukraine; and continual geopolitical risks have increased the likelihood of stronger storage drawdowns this winter, are heightening summer refill challenges.

The EU’s gas storage regulation requires continental underground storage levels to hit at least 90% by the 1st of November each year, and the required 2025 injections to hit the target storage inventory are acting against the grain of the market price signals (i.e. pulling more gas out of the market and contributing to market tightness across the summer). However, the negative spreads lead to negative intrinsic value for storage capacity. This increases challenges for both storage operators (selling capacity on a year ahead basis) and capacity buyers (extracting value from volatility which can be impaired if flex is reduced from having to follow mandates).