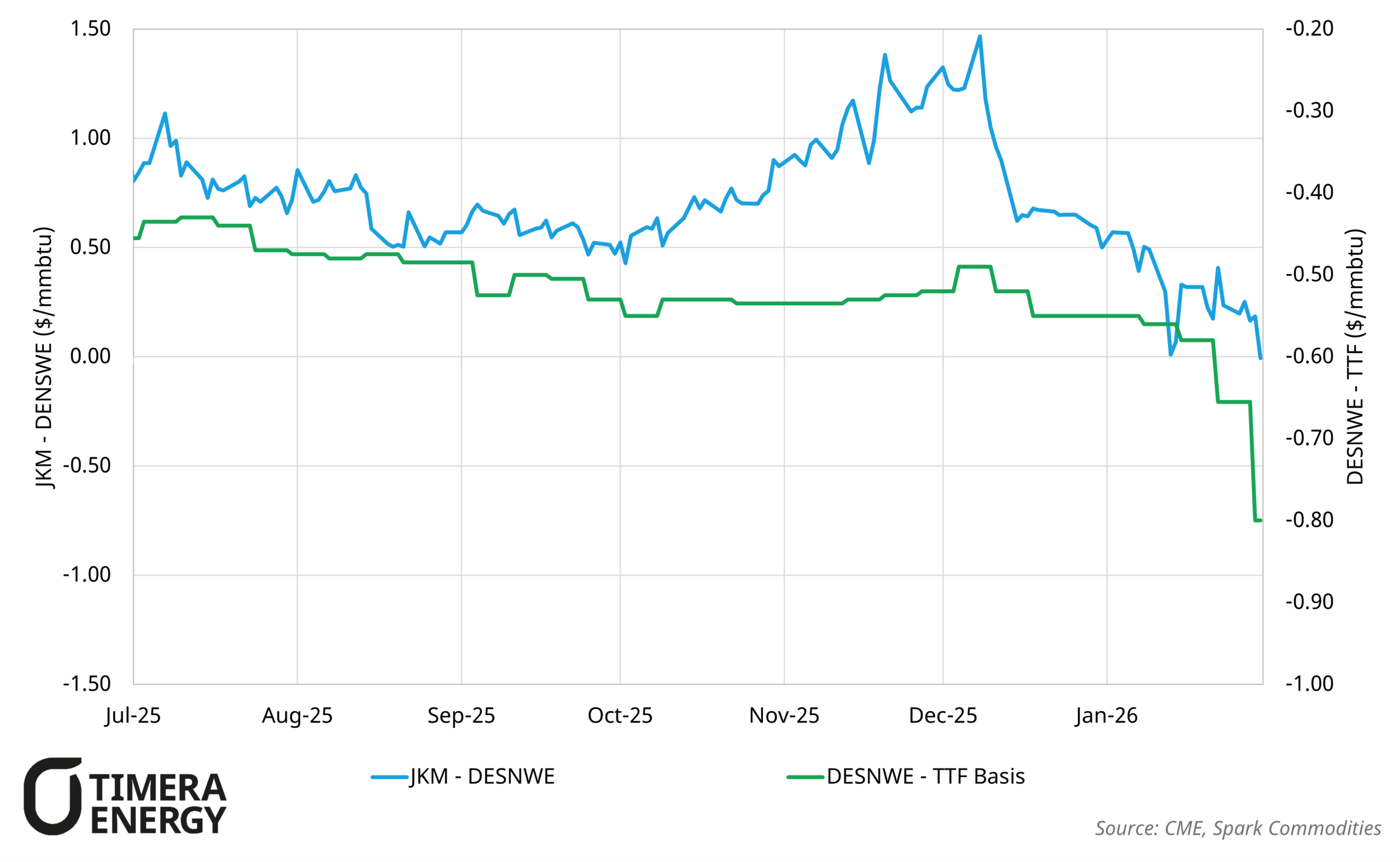

The recent rally across gas prices has compressed cross-basin spreads, pushing JKM to a sustained discount versus TTF and, briefly, versus offshore DES NWE prices. The firmer European bid reflects a structurally tighter storage backdrop, as colder weather has accelerated stock drawdowns. European inventories are now 10 mt (25% ) lower year-on-year, elevating refill requirements ahead of injection season and exaggerating the risk premium over the coming months given a depleted storage buffer.

In response to lower storage levels, European onshore gas prices have rallied relative to Asian prices to attract incremental flexible LNG. Greater volumes of LNG are now set to come to Europe over the balance of winter, with LNG netbacks for US Gulf Coast, African and some Middle East cargoes currently pointing towards Europe.

The growing volumes of LNG set to head towards Europe can also be seen in the DESNWE–TTF spread, which has widened from $-0.65 /mmbtu to -$0.94/mmbtu over past two weeks. This highlights strengthening demand for European regas slots, with higher-cost regas terminals being called upon to accommodate growing LNG arrivals.