The UK power market is preparing for two capacity auctions in Q1 2018. There is no shortage of competition to provide capacity. The outcome of these auctions will be key to determining how the capacity mix will evolve over the next 5 years.

In today’s article we look at auction dynamics. We also consider what a changing capacity mix means for the supply stack, price formation and prompt margin capture of flexible assets.

Capacity market balance & pricing

This month’s T-1 auction for the 2018/19 capacity year looks very well supplied against a demand target of only 4.9GW. This points to a single digit clearing price, potentially low single digits.

The auction will be fought out at the margin between the older CCGTs (e.g. Peterborough & Corby) and 36% efficient coal units (e.g. Fiddler’s Ferry, West Burton) that missed out in the 18/19 T-4 auction. Bidding will be driven by complex end of asset life economics. At least 2 or 3 large grid connected units are likely to miss out and may close as a result.

The Feb 18 T-4 auction for the 2021/22 also features a large surplus of existing and prequalified capacity over the 49.5GW demand target. Key drivers to watch for in this auction are:

- Older existing thermal How much existing capacity is knocked out by cheaper new build, with a specific focus on the older 36% coal units with 35+ £/kW fixed costs and very low forward energy margin.

- New gas engines The volume of gas engines that manage to bid below 25 £/kW, despite a substantial reduction in triad avoidance revenue. A number of engine developers look to be under-pricing the risk associated with wholesale and BM margins in a chase for volume.

- New CCGTs Further efficiency increases with latest generation CCGT technology help with wholesale energy margin capture. This could lead to new CCGT projects bidding under 25 £/kW. Damhead Creek 2 looks to be the most advantaged project given its location.

- Batteries Large volumes of prospective battery projects will not necessarily translate into large cleared volumes in the auction. Developers of short duration batteries were dealt a heavy blow in Dec 17 with derating factor reductions (18% for 30 min, 36% for 60 min). Frequency response revenues are also at risk given the rapid scale up in battery volumes.

Marginal price setting in the T-4 auction is likely to be dominated by competition between new gas engines, new CCGTs and older coal units. Unit economics suggest bids converging around the 25 £/kW level. But growing investor enthusiasm, and in some cases under-pricing of risk, is driving down project cost of capital. This opens up the risk of another downside price surprise e.g. to 20 £/kW.

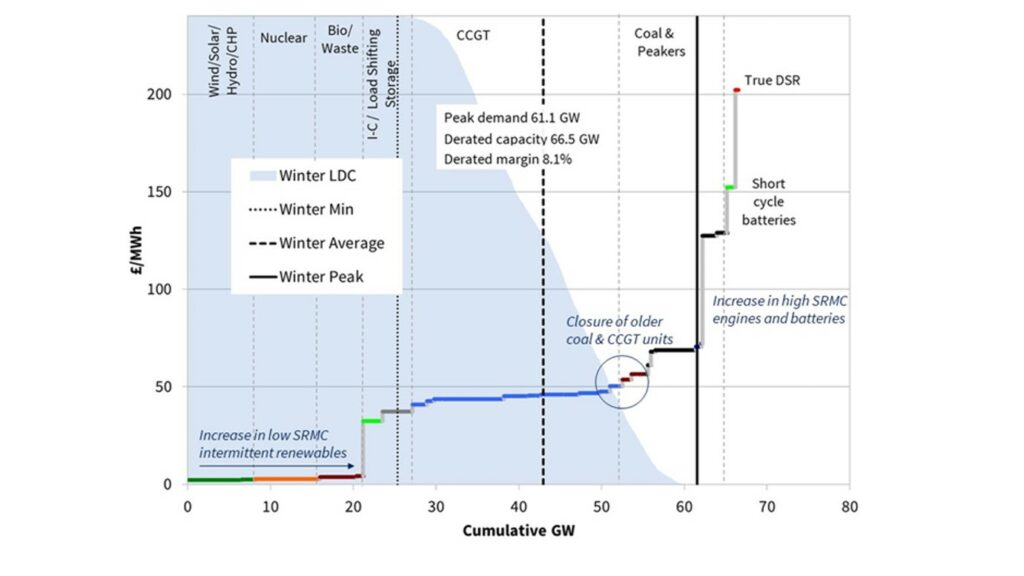

Supply stack transition & peak pricing

The UK supply stack is set to rapidly evolve over the next 5 years as older coal and gas units are replaced by renewables, interconnectors, gas engines and batteries. Chart 1 shows a simplified view of the 2021/22 supply stack.