It is almost a decade since a fire at Centrica’s Rough storage site sent shock waves through the UK gas market. Market infrastructure has evolved since the fire, with significant increases in gas import capacity reducing the UK’s dependence on Rough flexibility. But Centrica’s recent announcement of the temporary withdrawal of more than 25% of Rough capacity caused a notable market reaction.

The Rough news was followed by an announcement by SSE that it would mothball 33% of withdrawal capacity at its Hornsea storage site. SSE, one of the largest investors in UK storage capacity over the last decade, cited ongoing weakness in UK storage market returns. SSE’s unwillingness to invest in maintaining Hornsea’s capacity illustrates the challenge the UK is facing in ensuring new fast cycle storage capacity is developed to shore up security of supply as import dependency increases.

Nature of capacity reductions

Centrica has announced it needs to reduce pressure at the Rough facility to 3000 psi for up to six months while it resolves a ‘well integrity issue’. The practical impact of this will be to restrict gas stored to between 29 and 32 TWh. This represents a ~25-30% reduction in capacity versus a maximum historical volume of 41 TWh in 2014.

Centrica has stopped the sale of further capacity (SBUs) for the 2015/16 storage year to ensure it remains within this capacity constraint. This does not preclude Centrica from selling additional capacity into next winter if the issues are resolved within six months (e.g. in October). But the late sale of this capacity would restrict the length of the injection/withdrawal cycle. And there is also presumably a risk of capacity restrictions being extended beyond six months if the well issues are more serious than anticipated.

SSE’s announcement on Hornsea impacts deliverability rather than space. Withdrawal capacity at the site will fall by 6 mcm/day. While this is relatively small in an overall market context, deliverability is the real constraint the UK gas market faces in winter periods. SSE’s decision is also an important signal as to the appetite for storage owners & developers to commit to further investment spend in an environment of weak market price signals (i.e. low seasonal price spreads and volatility).

Scale of potential market impact

Rough is the UK’s slow giant. It makes up about 70% of total UK storage space, but given relatively slow cycling, only about 25% of the UK’s daily deliverability. So the 25-30% capacity reduction at Rough equates to a roughly 18-20% reduction in UK storage space. But importantly, the capacity restrictions at Rough will not impact deliverability (Rough SBU withdrawal rates are not dependent on inventory levels).

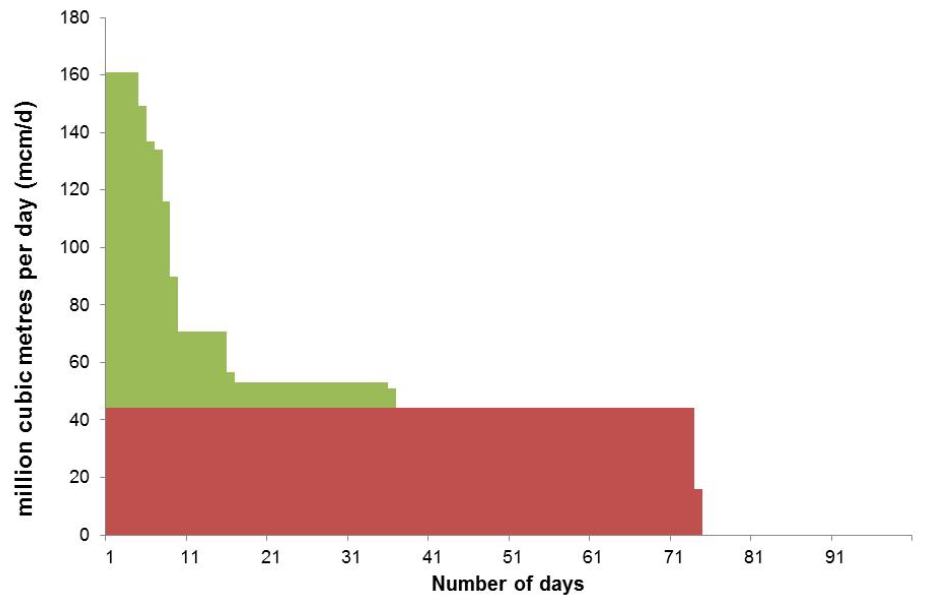

The impact of the Rough restrictions can be visualised in Chart 1 which summarises UK storage capacity. The vertical axis shows deliverability across all of the UK’s operational storage sites. The horizontal access shows how many days that deliverability can be maintained assuming maximum withdrawal.