UK energy regulator OFGEM is assessing a proposal to align National Transmission System (NTS) entry/exit capacity fees across the gas grid. The reform would see lower charges for imports into the GB grid and shift a greater portion to exit points.

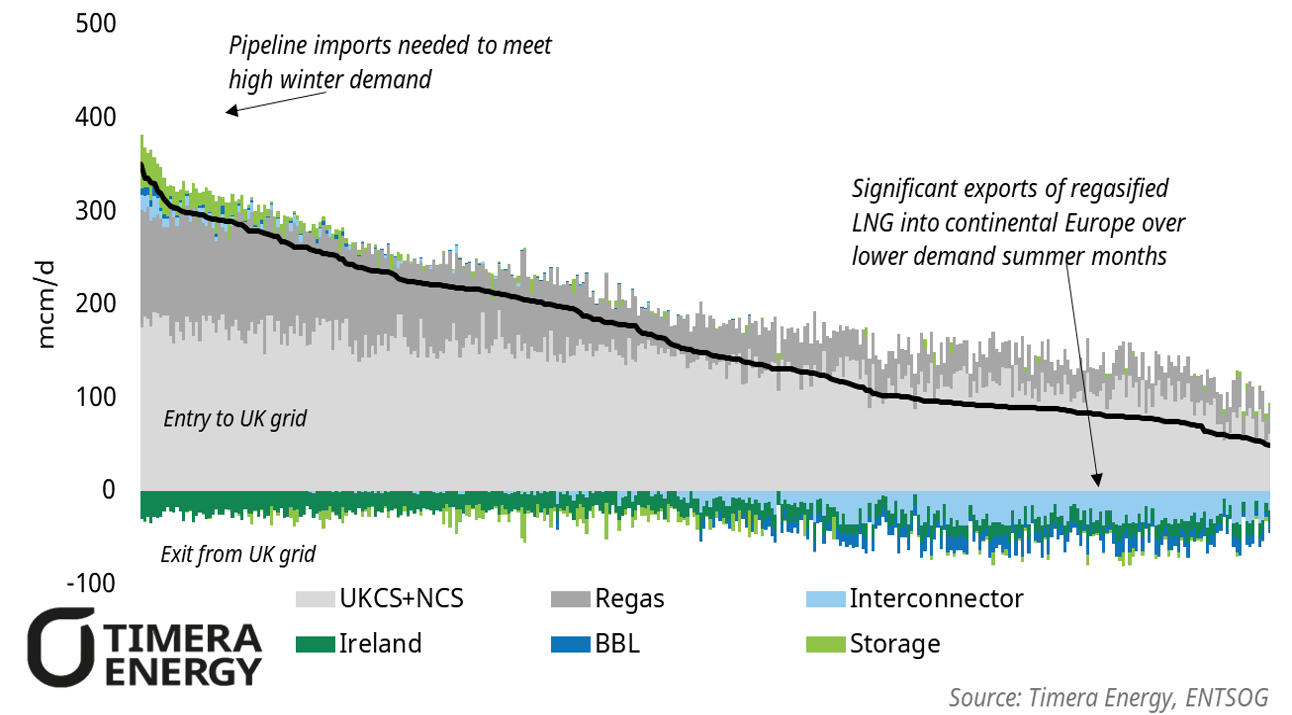

GB gas balances show a pronounced winter-summer asymmetry, as seen in the chart.

- In winters, the UK relies on flexible LNG, NCS and pipeline imports via Interconnector and BBL as domestic baseload supply (UKCS, base NCS) falls short of heating demand. NBP typically rises above TTF to attract flows.

- In summers, ample UKCS and NCS supply make UK less competitive for regas volumes against Northwest European hubs. This enables the UK to net export and play a transit role for LNG, with deliveries into the UK offset with higher exports via the Interconnector and BBL. The load duration curve highlights this reversal, with net exports dominating at lower demand levels.

Currently, UK grid entry tariffs are among the highest in Europe, with average entry costs over GY25 – 29 estimated near 0.44 $/mmbtu. By contrast, exit tariffs for pipeline exports (Interconnector, BBL) currently average just $0.14/mmbtu, incentivising re-exports when island demand is low.

The reforms impact will therefore vary seasonally. Lower entry costs could help narrow the NBP premium to TTF by reducing the incentive required to attract incremental regas and pipeline inflows. Conversely higher exit costs will raise the marginal cost of exports in summer, reducing the attractiveness of exports.

Overall, the proposal alters the relative competitiveness of UK regas capacity compared with Northwest European terminals.