Vladimir Putin’s political brinkmanship has brought security of gas supply firmly back into focus across Europe. The importance of gas sales to the Russian economy means that disruptions to gas supply are likely to be temporary rather than structural. But Russia’s use of energy supply as a means of political leverage presents an uncomfortable situation for European governments.

The UK government has displayed a clear concern, given domestic reserves of conventional gas are in rapid decline. The UK also sits at the outer edge of European gas transport infrastructure network. Growth in LNG regas capacity over the last decade has increased the UK’s insurance policy against pipeline supply cuts. But with the cost of LNG supply currently driven by Asian spot prices, this is an expensive insurance policy to fall back on. As a result, security of supply is a key factor supporting the long term case for investment in UK shale gas.

Government backing

We wrote previously on the gap between rhetoric and reality in the UK government’s case for shale gas support. Government arguments in support of shale have been refocused in the last six months. The government appears to have understood that shale gas is very unlikely to have a significant impact on marginal wholesale price setting. Instead support for shale gas has been re-focused around a more realistic package of security of supply, balance of payments and jobs. The government has also announced a number of practical policy support measures.

Shale developers will have access to generous tax breaks. For example they will be granted tax allowances for developing gas fields, where exploration expenditure can be offset against tax for a decade.

The government has also announced incentives to encourage local support, given local planning permission is one of the biggest hurdles to shale gas development. These are focused on channelling financial benefits from shale gas back into the local communities, for example:

- Local councils are able to retain 100% of business rates raised from fracking sites.

- A lump sum of £100,000 plus 1% of revenues may be available for distribution to local communities when test wells are fracked.

- Direct cash payments may also be made to property owners living near fracking sites.

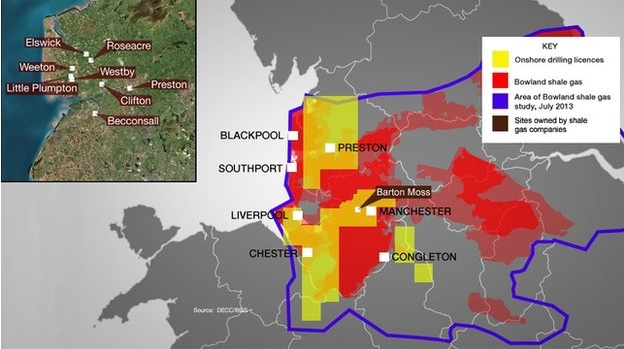

As well as direct financial incentives, the other carrot for local communities is jobs. Diagram 1 illustrates how UK shale gas development potential is focused around a belt across Northern England. This is an area that continues to suffer from the fallout of the financial crisis and if shale gas development took off it could provide a valuable boost to the local economy. But in order for that benefit to transpire, shale gas production economics remains the biggest of all hurdles.