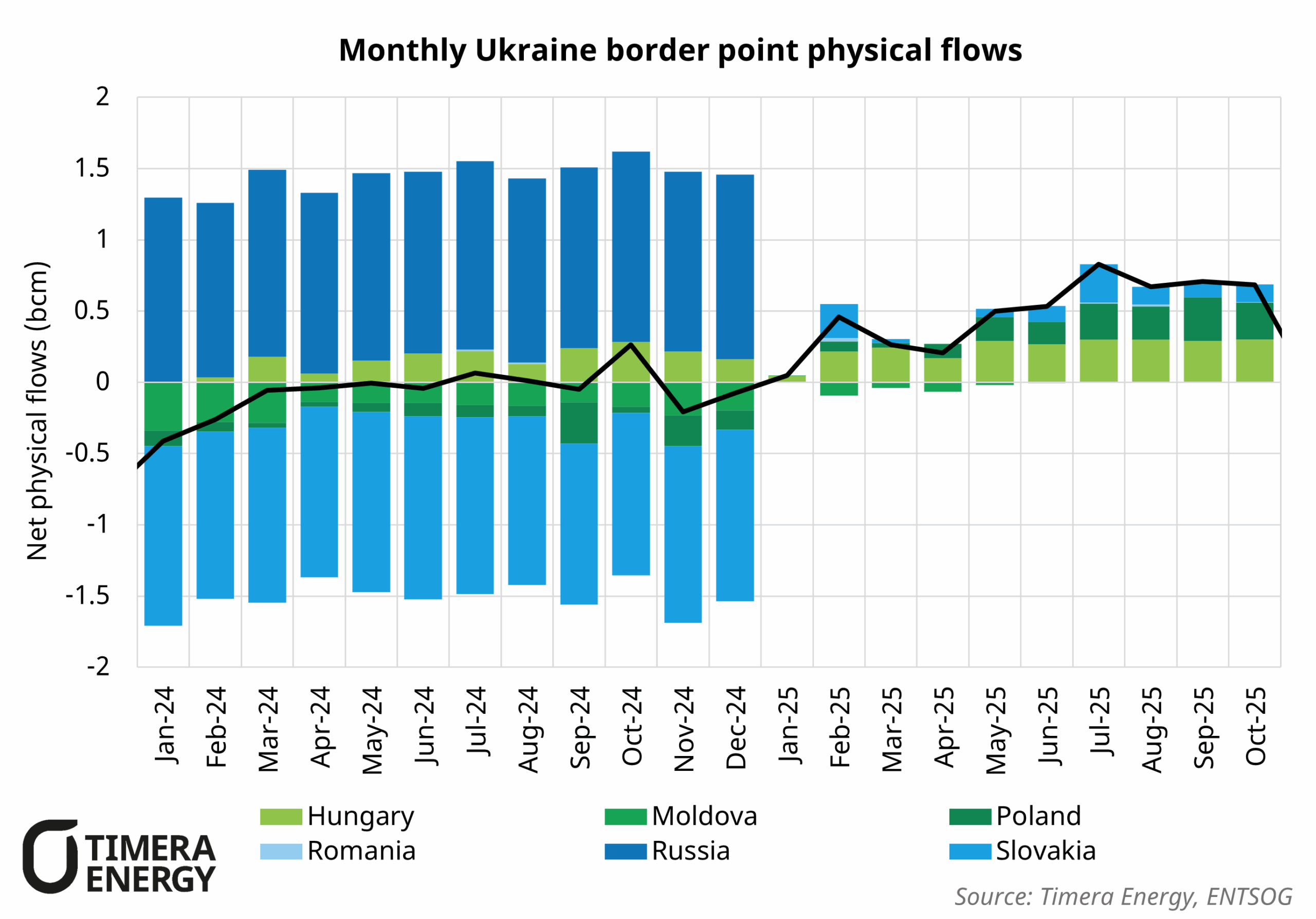

Ukraine’s gas balance has flipped this year as war-related disruption continues to erode domestic production. Declining output is pushing Ukraine towards greater reliance on imports, with rising flows via Poland and Slovakia.

This shift is further reframing Ukraine’s role in the European gas system, following on from the cessation of Ukrainian transit of Russian pipe gas at the end of 2024.

While sizeable storage optionality remains, Ukraine is in 2025 seen operating as an import-dependent market. There is little evidence of use of Ukrainian storages by the wider European market, especially given remaining space in Western facilities and a hesitation to use such capacity given risk of infrastructure damage amidst the ongoing conflict.

While Ukraine’s longer term role in the European gas market remains dependent on geopolitical developments, a longer term importing role is backed up by a pivot towards direct LNG contracting. Earlier this month Ukraine’s Naftogaz Group and Greece’s public gas corporation DEPA signed a Letter of Intent to supply gas to Ukraine via Romania for the upcoming winter demand period. This, alongside an expected increase in imports via Poland is supportive of the wider European gas price outlook.