Italian BESS investors are now focusing on business models & MACSE bidding strategy

2025 is set to see the start of a surge in Italian storage asset investment, led by BESS. The catalyst for this is the implementation of the new MACSE policy support mechanism, offering 15 year indexed contracts on up to 100% of asset capacity.

MACSE is a game changer. 15 year contracts provide key downside risk protection for infrastructure investors. They also ensure highly bankable projects given a strong credit counterparty (the government backed system operator Terna).

There have been some important updates this month that impact investors targeting MACSE support. In today’s article we set out:

- Details of Terna’s new zonal storage capacity targets

- Key implications for BESS investors

- How to frame BESS investment cases & MACSE bidding strategies.

Terna storage demand underpinned by new policy release

On 1st October 2024, the Italian TSOs Terna and Snam jointly published a new document outlining the expected Italian energy system evolution to 2040. This document is called “Documento di Descrizione degli Scenario 2024” (DDS2024) and represents an updated Italian TSO long-term view of market evolution (vs the previous document published in 2022 – DDS2022).

The 2022 document was key for Italian market and BESS investors because it outlined:

- A first estimate of the zonal needs for storage capacity (based on RES & demand scenario forecasts)

- The volume of that capacity that should be supported via MACSE.

We have set out these numbers in previous articles and a webinar on MACSE implications for BESS investors, along with an overview of the MACSE regulations that were under consultation and subsequently approved by the Italian Ministry on 11th October 2024.

New zonal storage capacity targets

The new document released in Oct 2024 (DDS2024) includes latest NECP government targets for zonal RES buildout. This has resulted in significantly changed projections of storage capacity needs at a zonal level (compared to DDS2022).

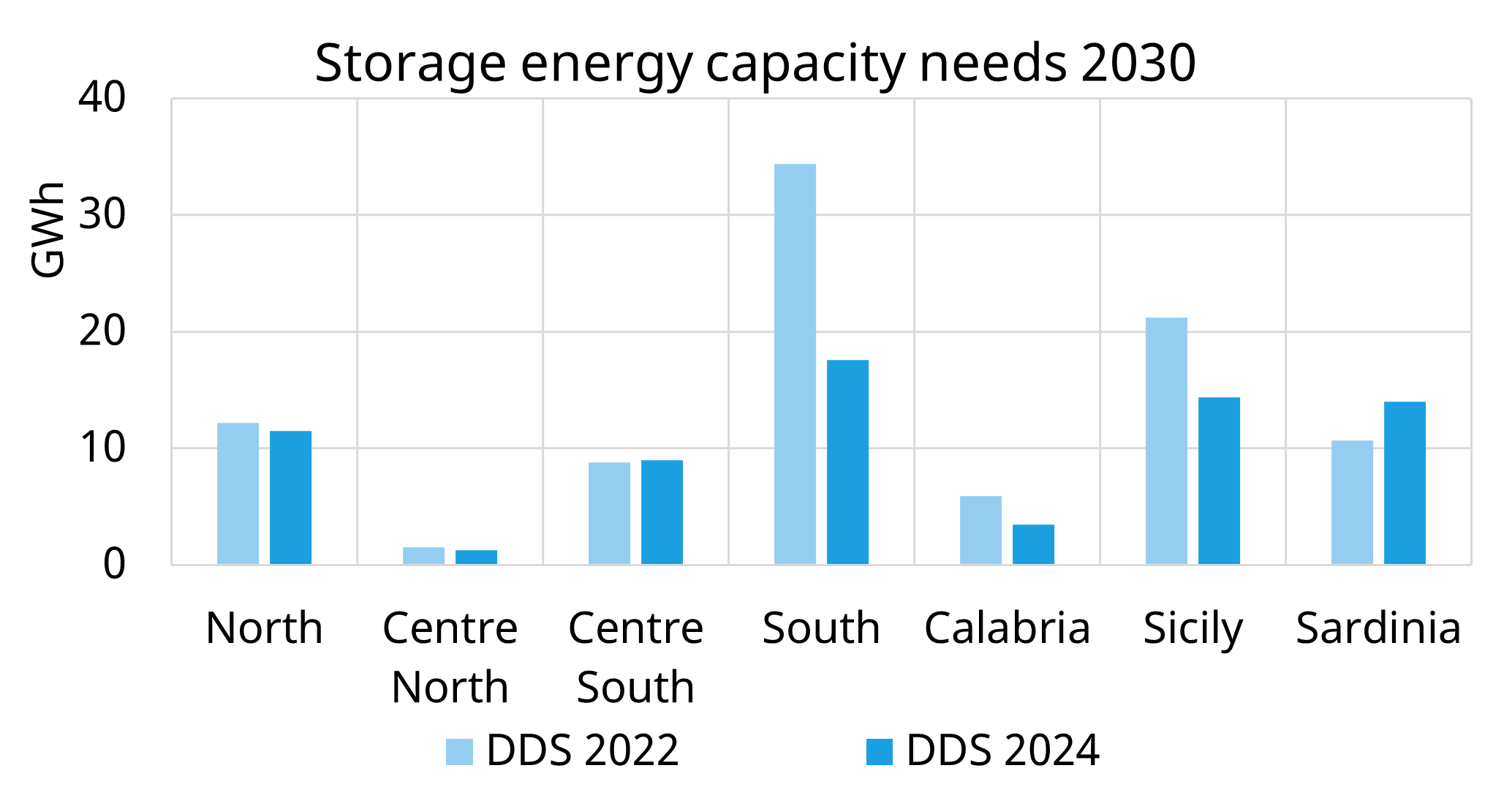

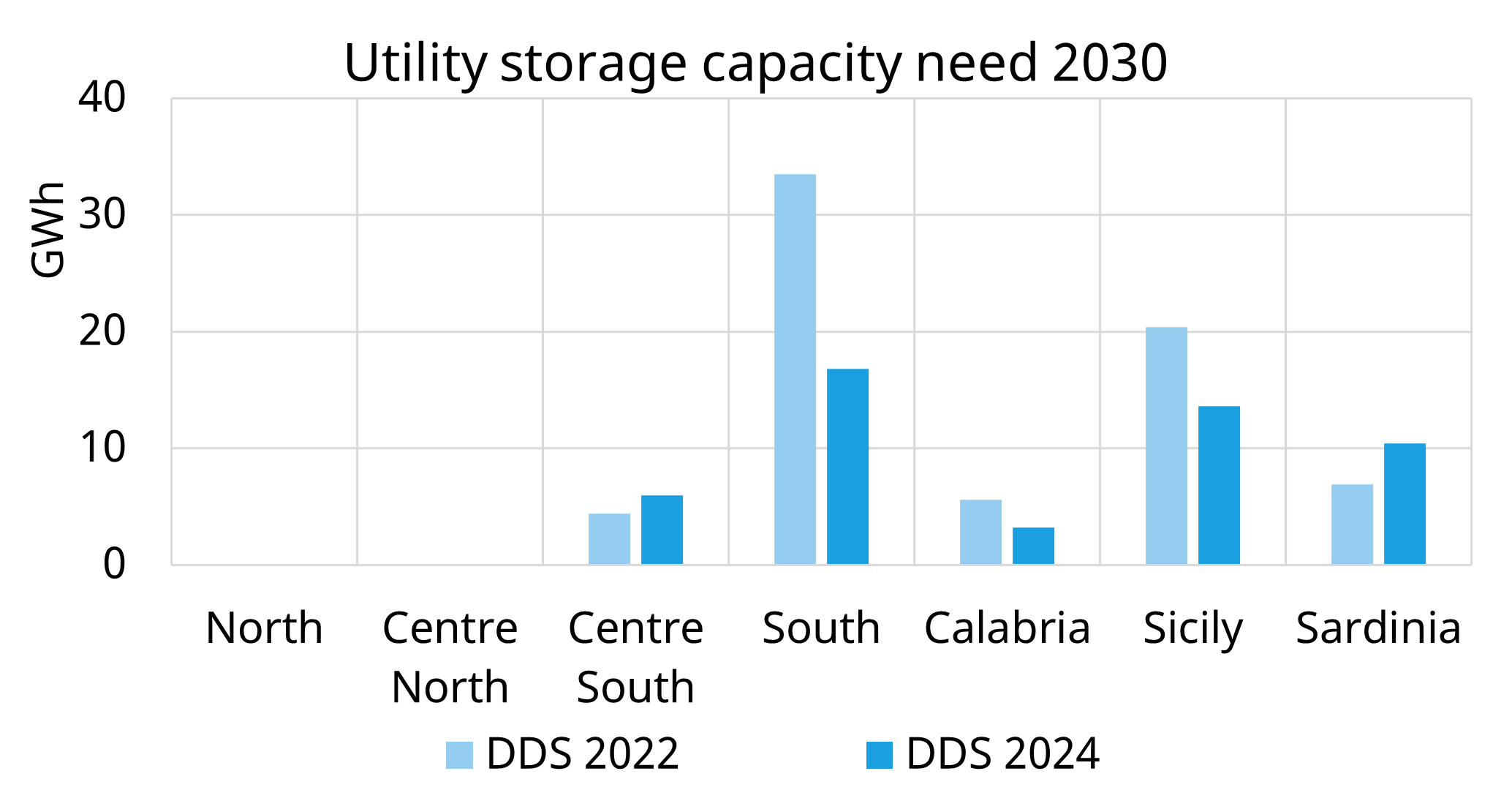

Chart 1 outlines differences between the two scenarios at zonal level for Terna’s latest targets for storage capacity (including both BESS & pumped hydro). The top panel of the chart shows total storage capacity targets. The bottom panel shows utility storage capacity targets that are set to be predominantly fulfilled via MACSE.

The comparison between the 2022 vs 2024 TSOs scenarios shows how storage capacity targets have somewhat declined in the new scenarios. This relates to changed projections of RES buildout (especially solar), with capacity moved more toward the North where most of Italian demand is.

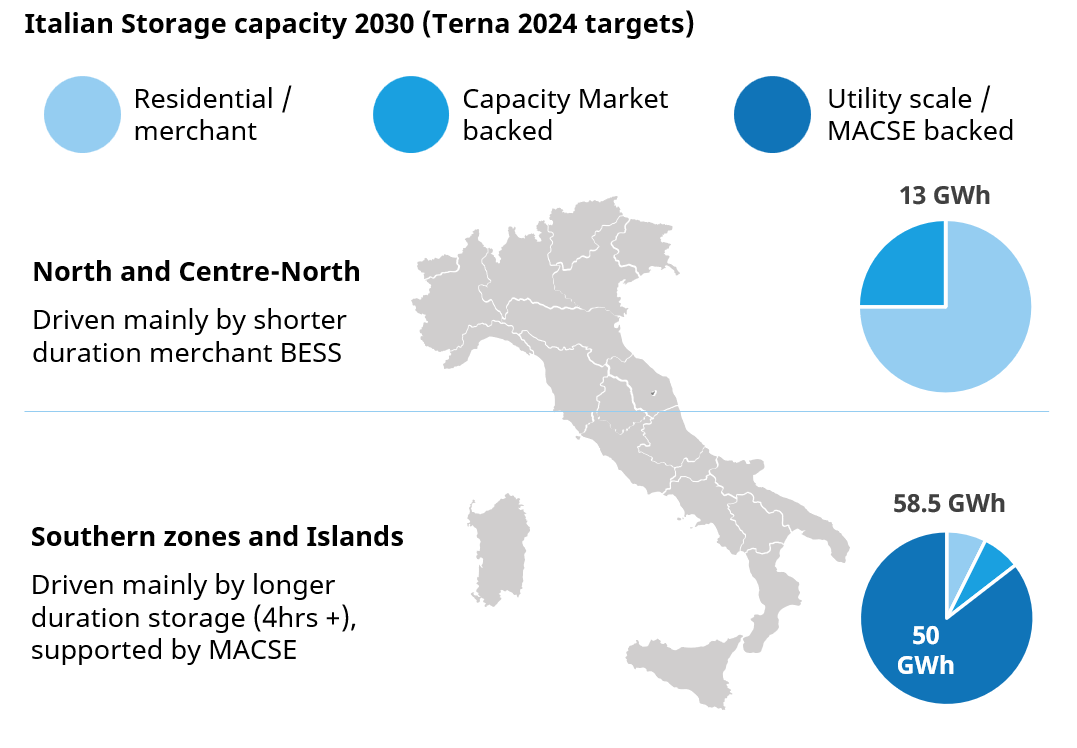

This has reduced the need for procurement of utility storage capacity mainly in the South, resulting in lower MACSE volume targets. However, Terna still has a substantial procurement target of 50 GWh of storage capacity by 2030 under the MACSE scheme.

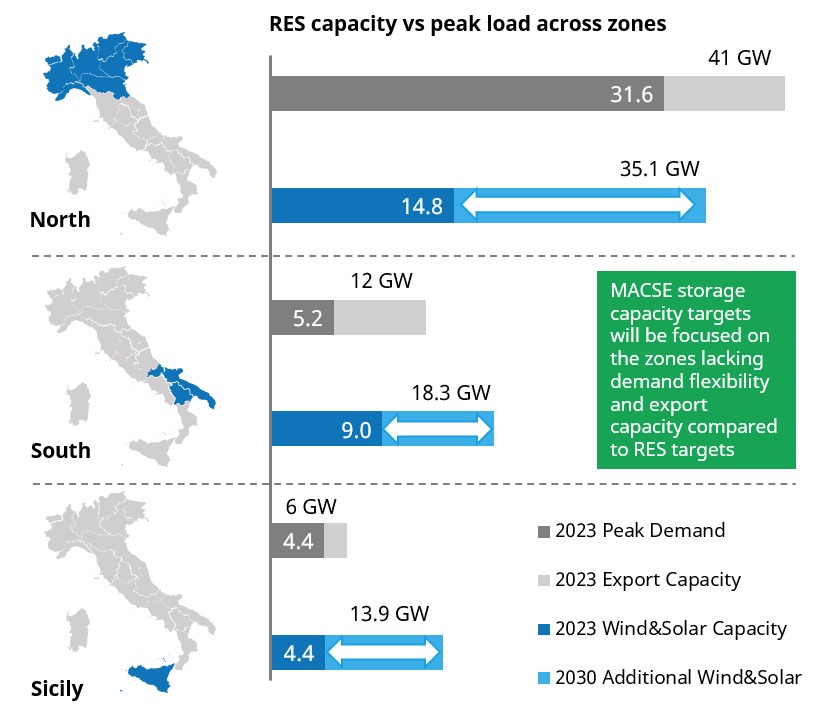

In Diagram 1 we summarise how storage flexibility will be key to support RES deployment (top panel) & Terna’s target storage capacity volumes (bottom panel). This takes into account the latest TSO projections published this month (DDS2024).

The Diagram illustrates how storage is particularly key in the Southern & Island regions which will soon face a critical flexibility deficit due to lack of storage and interconnection capacity.

Key takeaways for Italian BESS investors

Let’s now focus on 3 key takeaways for investors from the latest system operator updates.

1.Dynamic assessment of storage needs drives MACSE auctions

The MACSE auction quotas will evolve dynamically through time with the evolution of the Italian power market. There are a range of factors driving this including evolution of capacity mix, interconnectors & demand, both within and outside of Italy.

MACSE tender targets will adapt to the zonal need for storage, but market inefficiencies in predicting fundamental value drivers (e.g., RES buildout, lack of flexibility, interconnection constraints) will likely create locational merchant upside for BESS investors. This factor makes a merchant tranche strategy an important part of Italian BESS investment cases.

2.Quantify & stress test energy arbitrage value upside across zones

Analysis of potential energy arbitrage value upside is important for investors in building a viable investment case. This should take into account market evolution across different zones and how key variables / sensitivities impact the BESS revenue stack.

Crucial factors include interconnector development (with significant delays compared to original Terna plans) and RES capacity buildout (e.g. Sardinia recently facing political pushbacks against RES buildout).

3.Design a business model to manage risk/return profile

A 100% MACSE strategy exposes BESS assets to merchant upside on just 20% of MSD margins. There is substantially more value upside available from wholesale market arbitrage.

Access to energy arbitrage upside value via different BESS models is a key strategic decision for investors. Effective business model selection allows investors to tailor risk/return profile to target bankable investment cases.

Competition for the 15 year MACSE contracts is set to be fierce, acting to drive down returns on MACSE contracted tranches. Project equity IRRs can however be managed via retaining a merchant tranche & ensuring effective debt financing.

BESS business models & bidding strategy

We have done a lot of work supporting Italian BESS investors in 2024. Further to this we have just launched an ‘Italian BESS investment package product’ that includes full analysis of:

- Italian power market & price evolution

- Historic & projected zonal BESS revenue stack projections (to 2050)

- Key commercial insights on BESS business models & MACSE / CM bidding strategy.

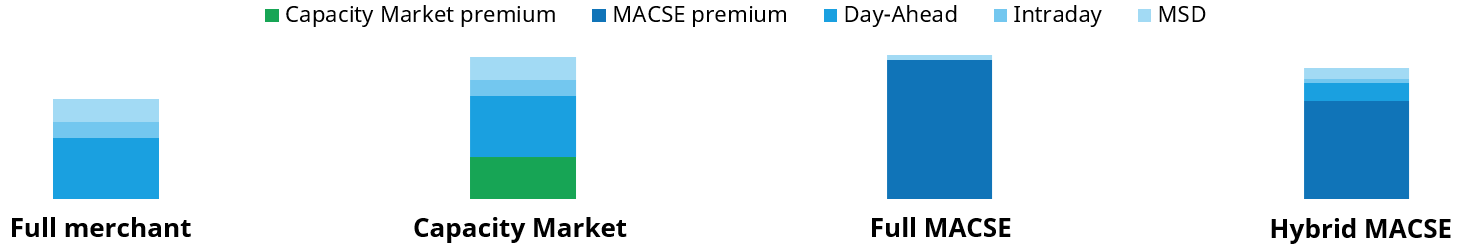

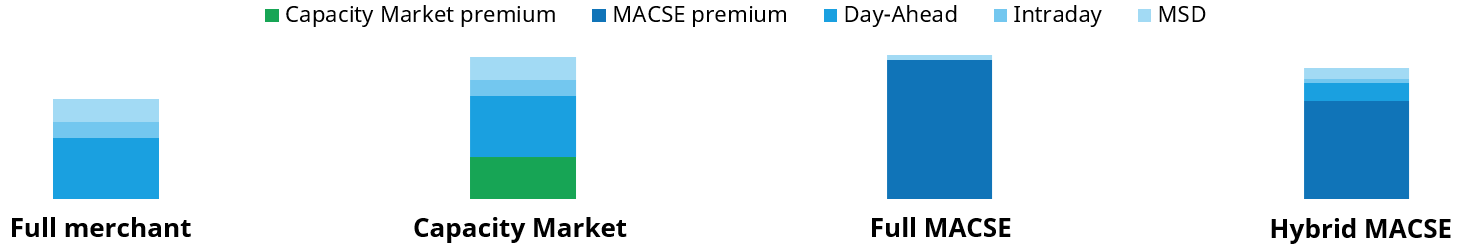

As part of this package we analyse & compare 4 different BESS business models outlined in Chart 3. The ability to tailor individual business models within these 4 categories, enables investors to profile risk/return outcomes and diversify exposure across portfolio projects & locations.

Source: Source: Timera Italian BESS Investment Report (Oct 2024) - more details on revenue stack available in report. Note: the ‘Full merchant’ case is not an attractive option vs the other 3 models but is important for investors as a benchmark.

The inaugural MACSE auction is likely to happen in the first half of 2025. The next Capacity Market auctions for 2026-2027-2028 will now likely follow the first MACSE auctions, after resolution of the legal review now happening on the results of the Capacity Market auction for 2025 capacity delivery.

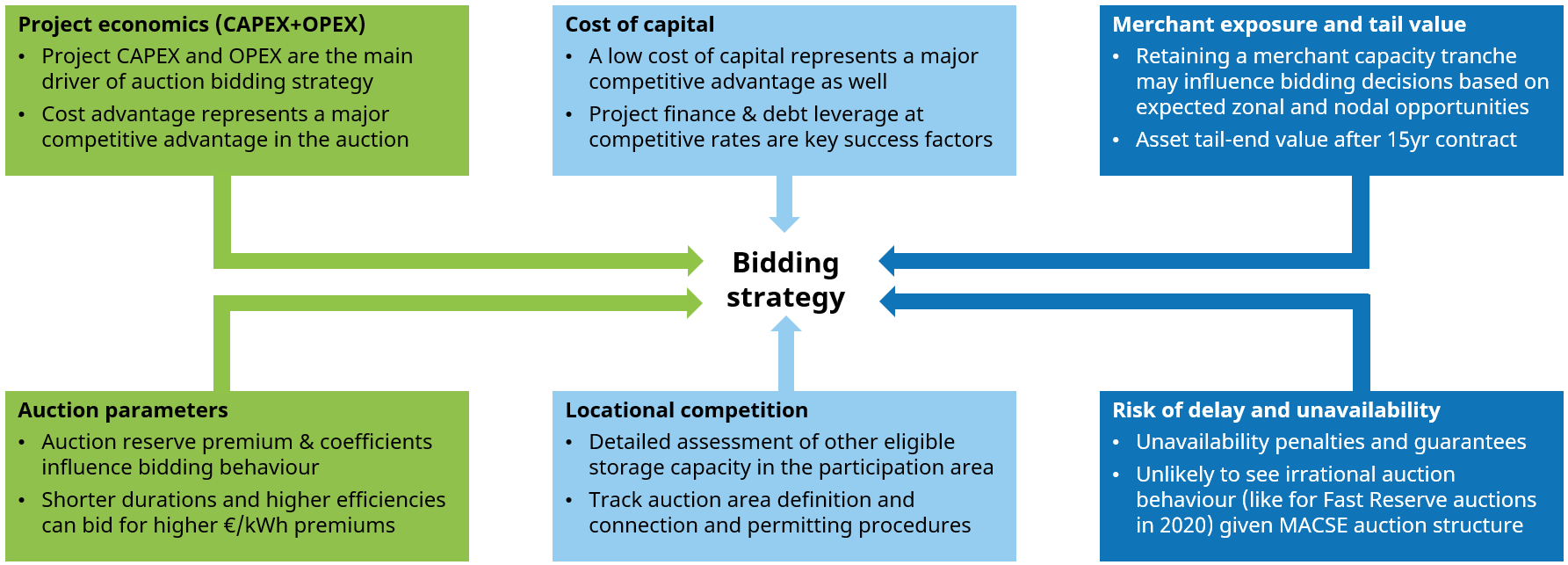

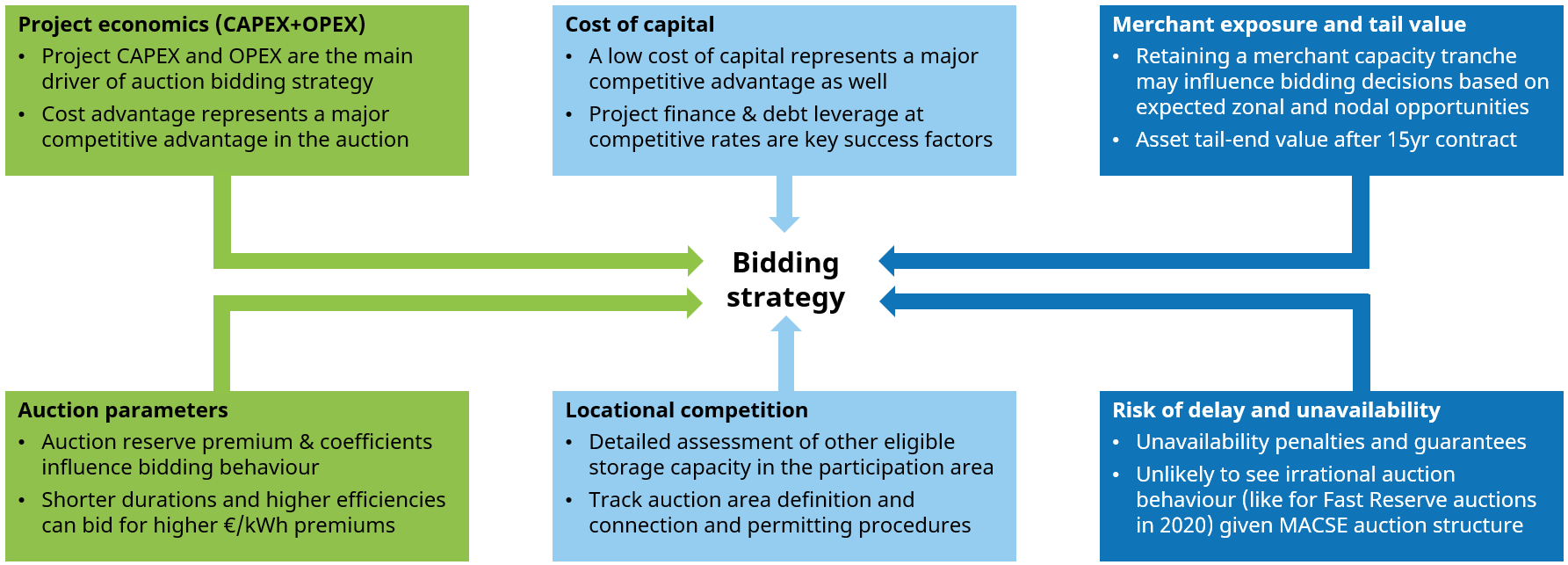

As well as business model design, we are seeing a strong interest from our client base on MACSE bidding strategy. We have detailed analysis of both MACSE and Capacity Market bidding strategy in our Report (see below), but we finish with a summary of some key considerations in Diagram 2.

Diagram 2: MACSE bidding strategy key investor considerations

Source: Timera Italian BESS Investment Report (Oct 2024)

If you are interested in a sample copy of our Italian BESS Investment Report, feel free to contact Alessio Cunico (Senior Analyst) alessio.cunico@timera-energy.com or Steven Coppack (Power Director) steven.coppack@timera-energy.com.

Join our webinar for more on Italian BESS investment

Join an in-depth discussion across our panel of Italian BESS experts, expanding on topics & analysis in today’s article.

Webinar topic: “MACSE strategy” – key Italian BESS investment case drivers & commercial strategy for MACSE & Capacity Market

Time & access: Tue 12th Nov 10:00 CET (09:00 BST)

Registration: Pre-registration required (access is free); webinar registration link – register here

Focus:

- 4 BESS business models that allow investors to profile risk/return

- MACSE vs Capacity Market investment routes for BESS

- MACSE bidding strategy drivers

- Impact of latest TSO capacity target announcements (Oct 2024)

- Key Italian BESS investment case risks & challenges