US LNG exports are firmly on the gas industry radar. But the primary focus to date has been on whether US LNG is cheap vs alternative sources of supply such as Australia and East Africa. While this focus is understandable from a competitive perspective, US exports are more than just another source of global supply.

The structure of US supply contracts is fundamentally different to that of conventional LNG supply. Importantly, US LNG supply is hub indexed and inherently flexible. As a result, the ramping up of US exports mid-decade is set to significantly impact global LNG pricing dynamics.

US export contracts vs conventional LNG supply

US supply contracts are structured as a liquefaction capacity option rather than a firm commitment to take a volume of cargoes. This capacity option is exposed to the spread between Henry Hub prices and the shipping cost adjusted netback spot prices that can be achieved selling gas into the global market.

Fixed cost: The fixed fee (or option premium) component of cost is a capacity fee. This is designed to cover the costs of liquefaction terminal development. The 2.25 $/mmbtu fixed fee in the first export contract from Sabine Pass between BG and Cheniere, gives a reasonable indication of the cost of brownfield liquefaction development at an existing US regas terminal. Fixed fees in export contracts signed since this have been closer to 3 $/mmbtu, although it will be interesting to see if these levels can be maintained as export project competition hots up.

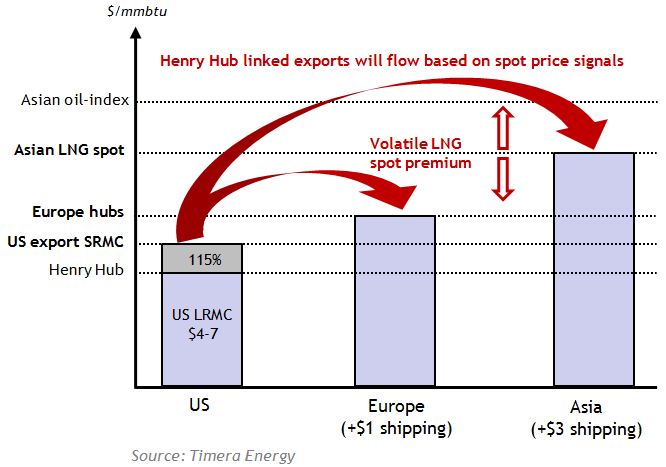

Variable cost: The fixed fee is important from a total supply cost perspective. But once an export contract is signed, this cost is sunk and therefore becomes largely irrelevant in influencing commercial decisions around the flow of gas. The variable cost of exports at Sabine Pass is structured as a percentage premium on top of the Henry Hub price. So the short run marginal cost (SRMC) of exported gas is 115% times the Henry Hub price (about half of this premium covers the actual cost of gas used in the liquefaction process).

Importantly there is an inherently high level of flexibility in export contracts. Flexibility to hedge price levels at Henry Hub. But also flexibility to deliver exported gas to whatever location offers the highest netback spot price. This is a very different structure to traditional fixed destination clause oil-indexed LNG supply contracts.

US export contract flow decisions

The flow decision for US export contracts will be driven primarily by two factors:

- The variable cost (or SRMC) of US export contracts i.e. Henry Hub plus the costs to get LNG onto a vessel (primarily liquefaction).

- The netback global spot price signals that represent the market value for exported gas, adjusted for appropriate shipping costs.

As long market conditions are such that 2. exceeds 1. then US gas will flow into the global market, constrained by the volume of US export capacity.

On a variable cost basis, US exports are relatively cheap. Based on current Henry Hub forward prices, US export SRMC will be around 5 $/mmbtu mid decade, rising to around 7 $/mmbtu by the end of the decade (given forward curve contango). Add $1.00-1.50 for shipping to Europe and $2.50-3.00 for shipping to Asia and these contracts are well in the money on an SRMC basis vs European (9-10 $/mmbtu) and Asian ($15/mmbtu) price benchmarks.

So barring the return of another major global gas glut (not out of the question, particularly later this decade), US export contracts should flow baseload. But given the inherent delivery flexibility in the export contracts, LNG will tend to flow to spot price signals, unlike most of the existing DES long term contracts into Asia.

That does not mean that flexible LNG contracts will always be physically diverted to the highest priced market. There are important liquidity, transactions cost and portfolio effects that will impact the actual flow of gas. But LNG spot price signals will represent an increasingly transparent opportunity cost for the contract owner, of the decision to flow gas to a particular destination. Whether that opportunity cost drives the actual diversion of gas, sale to a third party or internal portfolio re-optimisation will depend on the specific circumstances involved.

Watch out for the spot market impact

The volume of the first tier US export projects looks to be in the order of 45 to 60 mtpa (of a total ‘proposed’ volume in excess of 200mtpa). In a global market context (~240 mtpa) this is not an overwhelming volume when anticipated incremental demand growth is considered. However the volume of first tier US projects is large in the context of spot market pricing dynamics, given only around 20% of global LNG supply is currently flexible.

This significant increase in LNG volumes that flow to spot price signals is set to have two key impacts on global pricing as illustrated in Chart 1.