Britain formally left the EU on 31st January 2020, however it is remaining a part of the EU emission trading scheme (EU ETS) until the end of the transition period in 2021. Beyond the transition period, the UK is establishing its own domestic trading scheme (UK ETS), due to start in 2021. The scheme will be a stand-alone market, with the UK open to coupling the market with the EU ETS at a later date.

“The UK ETS replicates the workings of the EU scheme, so assets which do well under the current system will continue to do so.”

Uncertainty around the UK’s future carbon price signals has weighed on investment. However earlier this month details of the proposed new scheme started to emerge. Initial indications suggest a similar scheme to the EU ETS but with enhanced emission cutting targets.

Clarity over UK’s carbon policy is a welcome relief, boosting market confidence and removing another obstacle to investment. In order to achieve net-zero emissions by 2050, a strong carbon price signal is needed. The UK carbon price floor has been important in driving coal plant closures and investment in low carbon power assets. But it is likely that the carbon price will need to rise above 50 £/t to decarbonise the heat and industrials sectors.

In this article, we examine the key differences between the new UK scheme and the EU ETS and what these mean for investors.

UK ETS v EU ETS

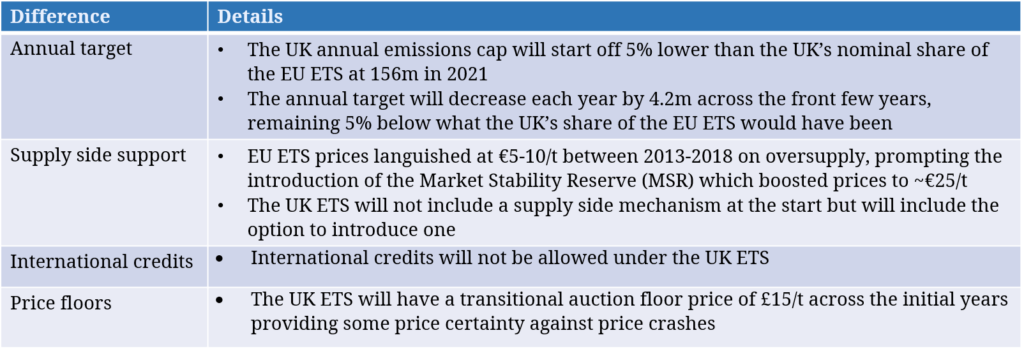

The UK ETS is based around the design of the EU scheme. The UK government sets an annual emissions target which decreases over time. Emitters must then procure carbon certificates to cover their emissions via auctions or secondary trading. There are however a few key differences to the EU scheme as summarised in Table 1.

In summary there are several important differences between the schemes but the underlying framework is familiar to investors.

Winners & Losers

The UK ETS replicates the workings of the EU scheme, so assets which do well under the current system will continue to do so. In particular, small embedded generation that is not covered by the EU ETS will not be covered by the UK scheme either.

The UK ETS is more ambitious than its EU counterpart, due to its lower annual cap. As such, UK carbon prices could well exceed EUA prices, supporting EUA exempt engines, batteries, interconnectors and efficient gas plant that benefit from higher carbon prices.

EUA exempt engines will benefit as they will continue to be exempt under the proposed UK ETS, increasing their competitive advantage over non-exempt engines. Generation that qualifies under the small installation provision (<35MW thermal input, < 25,000t emissions p.a.) can opt out of the UK ETS into a simplified scheme whilst generation that qualifies under the ultra-small provision (<2500t p.a.) are only required to monitor emissions.

Batteries will benefit as intraday price spreads between periods of high and low carbon intensity widen, improving arbitrage opportunities.

Interconnectors may well see the UK maintain a carbon price premium to the EU, widening price spreads between the UK and the continent, which should incentivise higher UK import flows (all else being equal).

High efficiency gas plant will benefit from a widening variable cost advantage relative to less efficient gas plants setting marginal prices, improving captured clean spark spreads.

On the other hand, the key losers are consumers and less efficient coal & CCGT plant. Carbon prices are passed through to power prices via the variable cost of marginal units. This means lower carbon intensity plants will see profits increase, whilst less efficient, more carbon intensive plants will see load factors fall as imports increase.

So what next?

We now have a clearer view of the UK government’s intentions on carbon, but further clarity is still needed to underpin investment in low-carbon flex. The industry needs clarity on the rate of emissions cap decline beyond the front few years, in order to understand likely carbon price evolution. Further information is also needed around any new supply side mechanism to be introduced into the market: when will it be introduced and what thresholds will trigger an action?

In addition to these outstanding questions, the government is launching a carbon tax consultation as a back-up option to the UK ETS, causing some doubt as to the readiness of the UK system.

Despite the remaining uncertainty, the emerging details of the UK ETS are helpful for all investors. But they are particularly good news for low carbon investment, given initial indications point to a higher carbon price than in the EU ETS.