Germany is attempting the energy transition equivalent of landing a person on Mars. This is not to say it is impossible – it seems quite plausible that a person could land on Mars in the next 25 years. But like Germany’s energy transition, it’s going to require enormous investment & innovation… and may take significantly longer than hoped for.

“There will be no energy transition in Germany without huge investment in flexible capacity”

Germany’s path towards much higher wind & solar penetration is clear, driven by both energy independence & decarbonization. But at the same time Germany has closed its nuclear fleet, plans to retire its coal fleet and to substantially increase power & hydrogen demand as it decarbonises other sectors.

Germany sits at the hub of Europe’s highly interconnected network of power markets. Price formation in the German market has a key influence across Europe given market size and high interconnection capacity. So the impact of Germany’s energy transition on marginal price setting will play an important role in driving pan-European pricing dynamics.

In today’s article we set out analysis of how marginal price setting capacity in Germany is set to change between now and 2035.

What sets marginal power prices in Germany?

Power prices in Germany are currently anchored by substantial volumes of gas, coal & lignite generation capacity (65 GW total). This flexible thermal capacity (& interconnectors) are required to balance Germany’s rapidly increasing wind & solar generation output.

By the mid-2030s the coal & lignite fleet is set to retire, or at least be relegated to system reserves with no material impact on pricing. This could happen earlier depending on the political landscape.

That leaves an ageing gas fleet, new-build flexible capacity (e.g. BESS, CCGTs, peakers) and limited demand side response, to service a rapidly increasing requirement for system flexibility as wind & solar penetration increases.

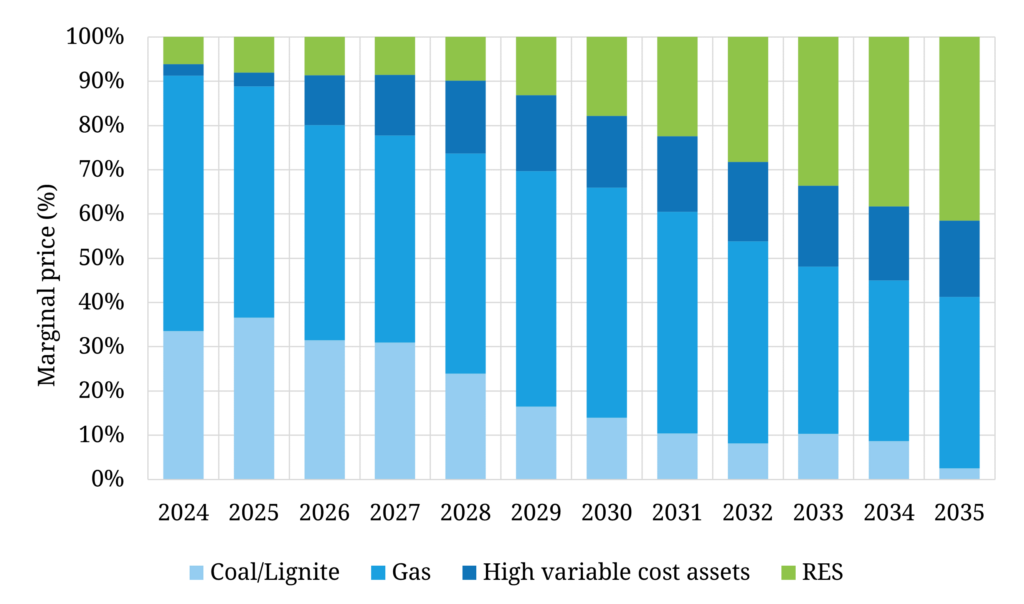

In Chart 1 we set out analysis showing the evolution on Germany’s marginal price setting capacity to 2035.

Data behind the chart comes from our pan-European stochastic power market model. We model a granular build-up of different sources of supply & demand in Germany & neighbouring countries to project the evolution of future pricing dynamics. Importantly, we run a large number of correlated simulations of load, wind & solar profiles through the stack model to capture the requirement for system flexibility & analyse marginal price setting dynamics.

Some notes on the scenario shown for German power market nerds:

- Analysis assumes Germany falls short of 2030 RES targets

- Coal phase out assumed by 2035 (some reserves may remain)

- New CCGT build assumed to enable coal phase out

- Impact of storage discharge primarily captured in ‘High SRMC plant’ category

- Impact of CHP offtake in reducing downwards thermal flex is captured.

German supply stack is structurally changing

The closure of coal, lignite & gas capacity in Germany is rapidly reducing flexible capacity in the lower & middle section of the supply stack.

This capacity is being replaced by:

- Low variable cost & intermittent wind & solar capacity

- Higher variable cost peaking capacity e.g. batteries, demand response & gas peakers

- New CCGT capacity to enable coal retirements

- Imported flexibility across interconnectors e.g. hydro from the Nordic & Alpine regions and thermal flexibility from Poland & Czechia.

Policy details expected this year on the size, timing & support mechanism for Germany’s implementation of a strategic gas reserve will be important in shaping the role of new-build gas capacity.

These changes are driving an increasing incidence of (i) low prices set by RES capacity & (ii) high prices set by peaking capacity & batteries as can be seen in Chart 1.

How price setting dynamics are shifting

The impact of these changes in the capacity mix on marginal price setting is clearly illustrated in Chart 1. Some key takeaways:

- RES dragging down prices – rapid increase in low variable cost wind & solar plants setting prices during periods of high RES output (green bars in Chart 1)

- Peakers & BESS dragging up prices – rapid emergence of high variable cost capacity setting prices in the top ~20% of hours (dark blue bars)

- Role of coal eroded – temporary increase in the influence of coal (& lignite) setting prices as gas prices decline by 2026; then influence of coal in terminal decline as capacity closes (significantly reducing Europe’s gas for coal switching response)

- Gas still key – gas-fired capacity remains a strong anchor for power prices (in the middle of the price duration curve) until at least the mid 2030s, before its influence steadily erodes.

In addition interconnectors are set to play a more important role influencing price going forward e.g. thermal capacity flex from Eastern Europe.

Price shape & volatility set to increase

The structural transition in capacity mix we set out above is causing the German supply stack to steepen (driven by RES growth at the low variable cost end & peaking / BESS capacity at the higher variable cost end).

At the same time, rising wind & solar capacity is causing rapid increases in supply stack fluctuations (e.g. from high to low wind output periods).

The combination of these factors is set to significantly increase:

- intraday price shape e.g. RES setting lowest price hours, peakers setting highest priced hours

- price volatility e.g. greater swings in steeper (more inelastic) supply curves.

These are the two key price signals for investment in flexible capacity e.g. batteries, peakers, longer duration storage & DSR. There will be no German energy transition without huge investment in flexible capacity. Both policy and market tailwinds are strengthening to enable this to happen.