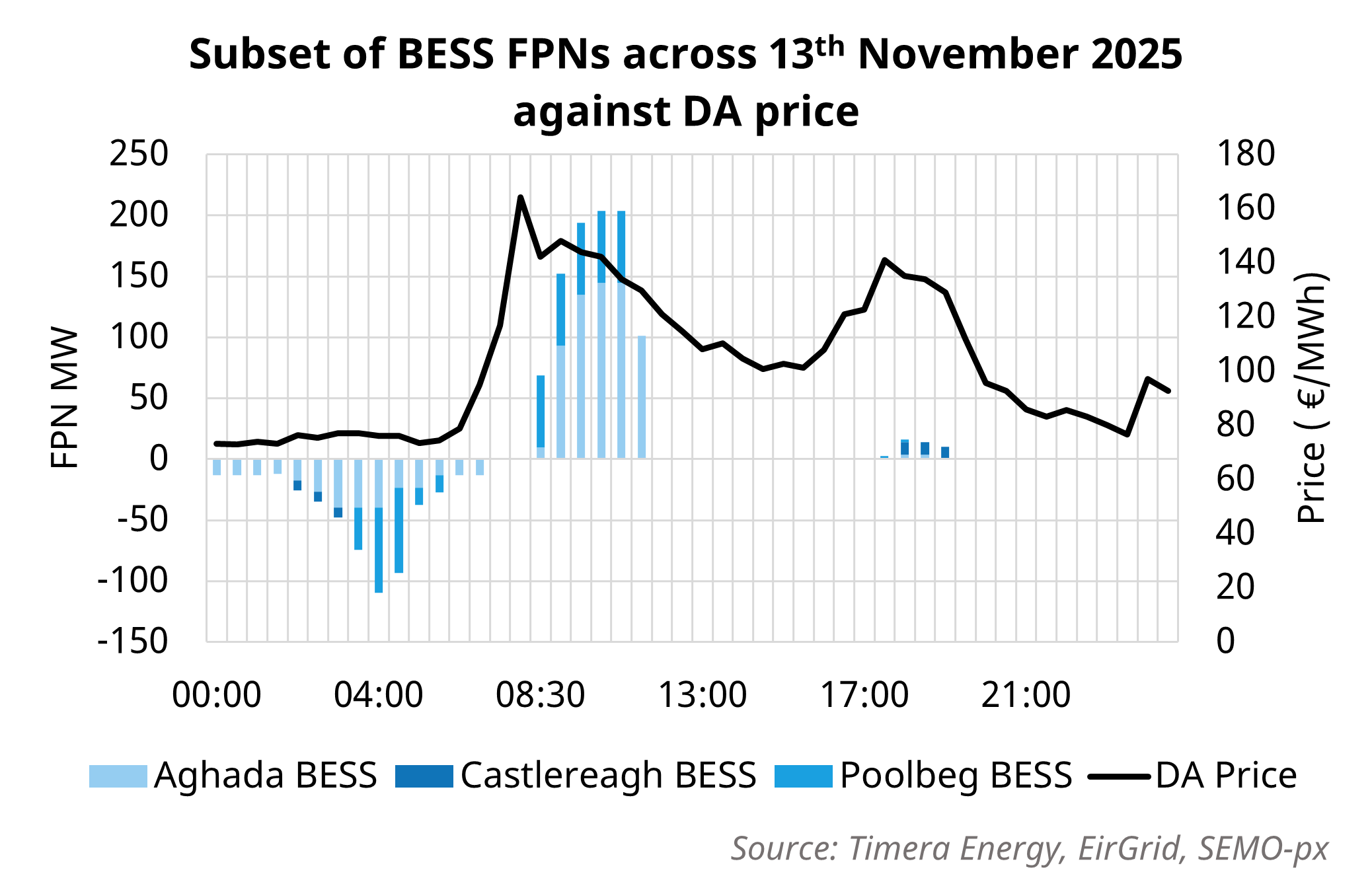

Mid November saw the launch of Scheduling and Dispatch Programme Initiative 2 (SDP-02) in Ireland which is a key inflection point for BESS. For the first time, batteries can submit negative physical notifications (FPNs) as shown in the chart, and receive negative dispatch instructions, properly opening the door to full wholesale participation rather than being structurally limited in trading. This change comes as DS3 revenues are likely to erode into 2027 under Future Arrangements of System Services (FASS), as procurement of key ancillaries shifts from tenders to day ahead auctions, echoing the shift from EFR to the Dynamic suite which was seen in GB a few years ago.

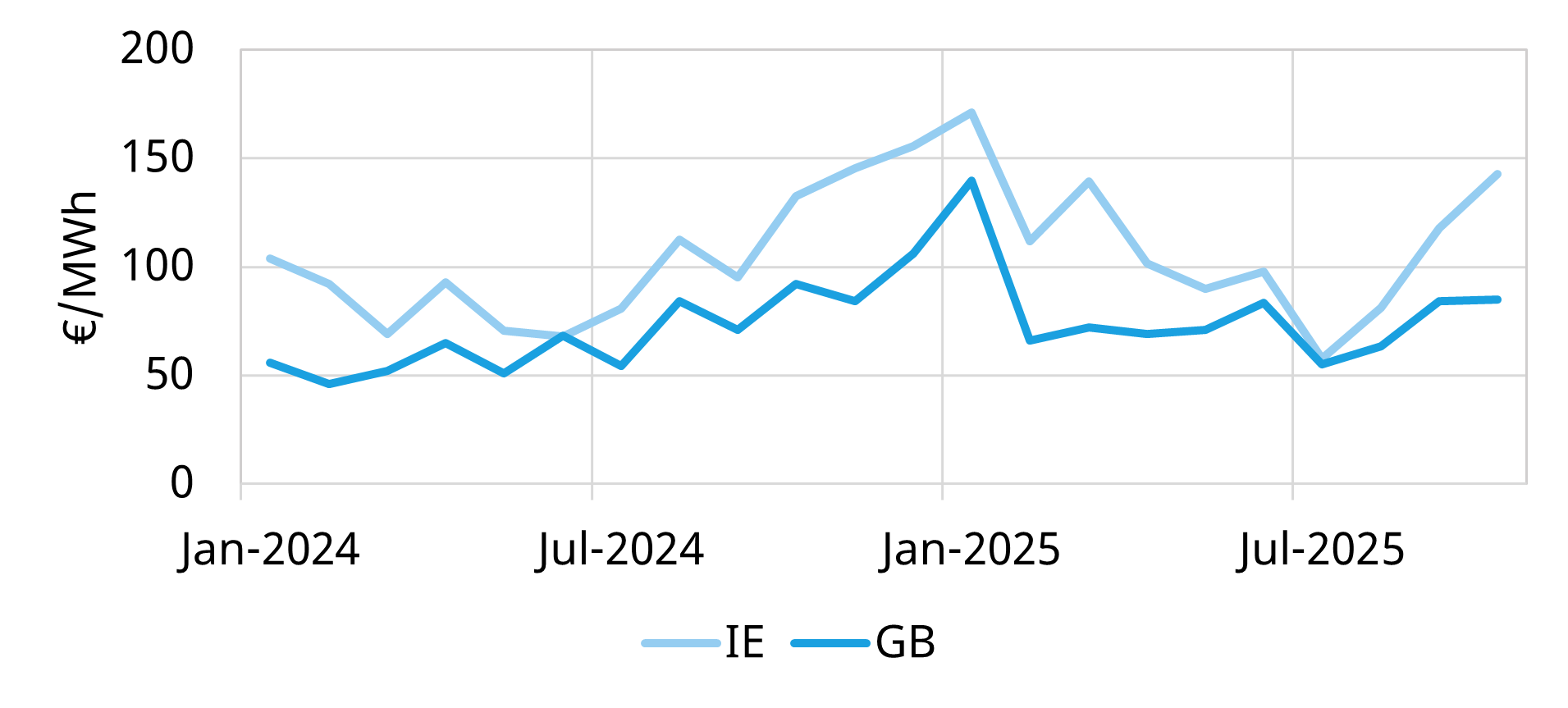

IE vs GB Day Ahead spreads 2024/25

Source: Timera Energy, EPEX, SEMO-px

With wholesale markets opening up, BESS are now positioned to capture value from what remains a structurally tight Irish system. Unlike many European counterparts, Ireland is one of the few countries which has seen strong demand growth driven by data centres, and has seen day ahead spreads ~40% higher than GB with frequent price spikes. Until now, Irish BESS simply haven’t had the means or the need to chase wholesale arbitrage due to the rules preventing full bi-directional trading, and as DS3 was lucrative enough on its own. SDP-02 changes that equation, enabling a path for storage to pivot from a DS3 centric model over the next couple of years to one that monetises Irish volatility through wholesale trading.

Timera has deep experience in the Irish power market, supporting in the Greenlink Interconnector transaction and most recently supporting in the acquisition of Energia in summer 2025 Timera supports Ardian on their acquisition of Energia – Timera Energy. With our proprietary European stochastic model, we help investors and asset owners understand risk adjusted value in Ireland and Europe, whether in BESS, gas or other flex capacity. For more information please contact Arshpreet Dhatt, Senior Analyst, at arshpreet.dhatt@timera-energy.com.