“Every investment has its price”

Power prices across Europe surged last week. Day ahead prices peaked on Wed Nov 6th at 820 €/MWh in Germany and 330 £/MWh in GB, levels not seen since the energy crisis in 2022.

The cause? Wind & solar output were low across several days. These episodes of low RES induced temporary market tightness are becoming an increasingly familiar challenge as the energy transition gathers pace.

Battery capacity is playing a key role in supporting intraday balancing of RES output swings (up to 4 hours of duration currently). However during more prolonged low RES output periods, European power markets remain entirely dependent on gas fired generation to keep the lights on.

This uncomfortable fact has profound implications for investors deploying capital into power assets, as well as for policy makers. We explore some key value drivers in our article below.

Visualising the challenge

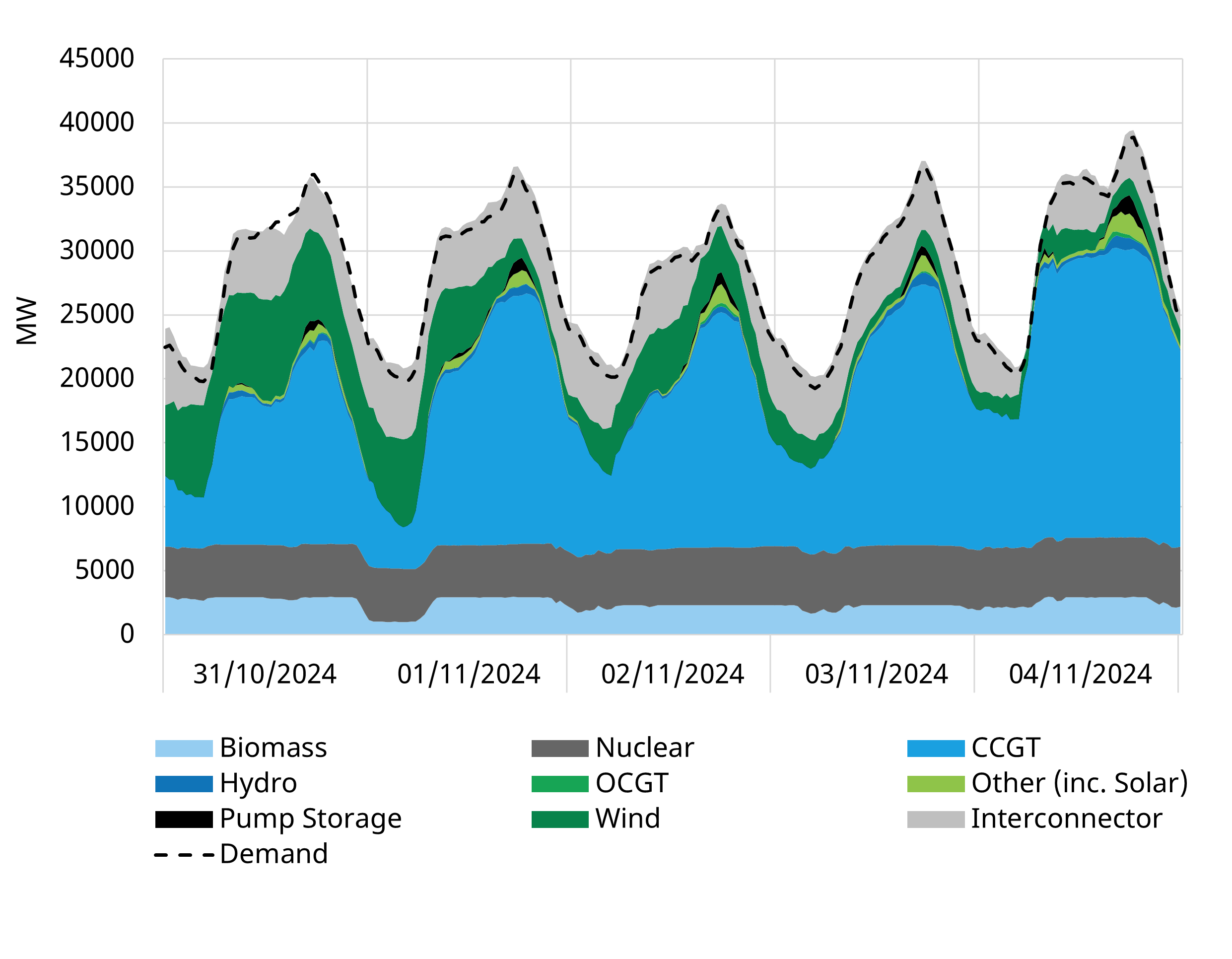

Let’s look at a case study showing last week’s market tightness. Chart 1 sets out how the GB market balanced across the first few days of November.

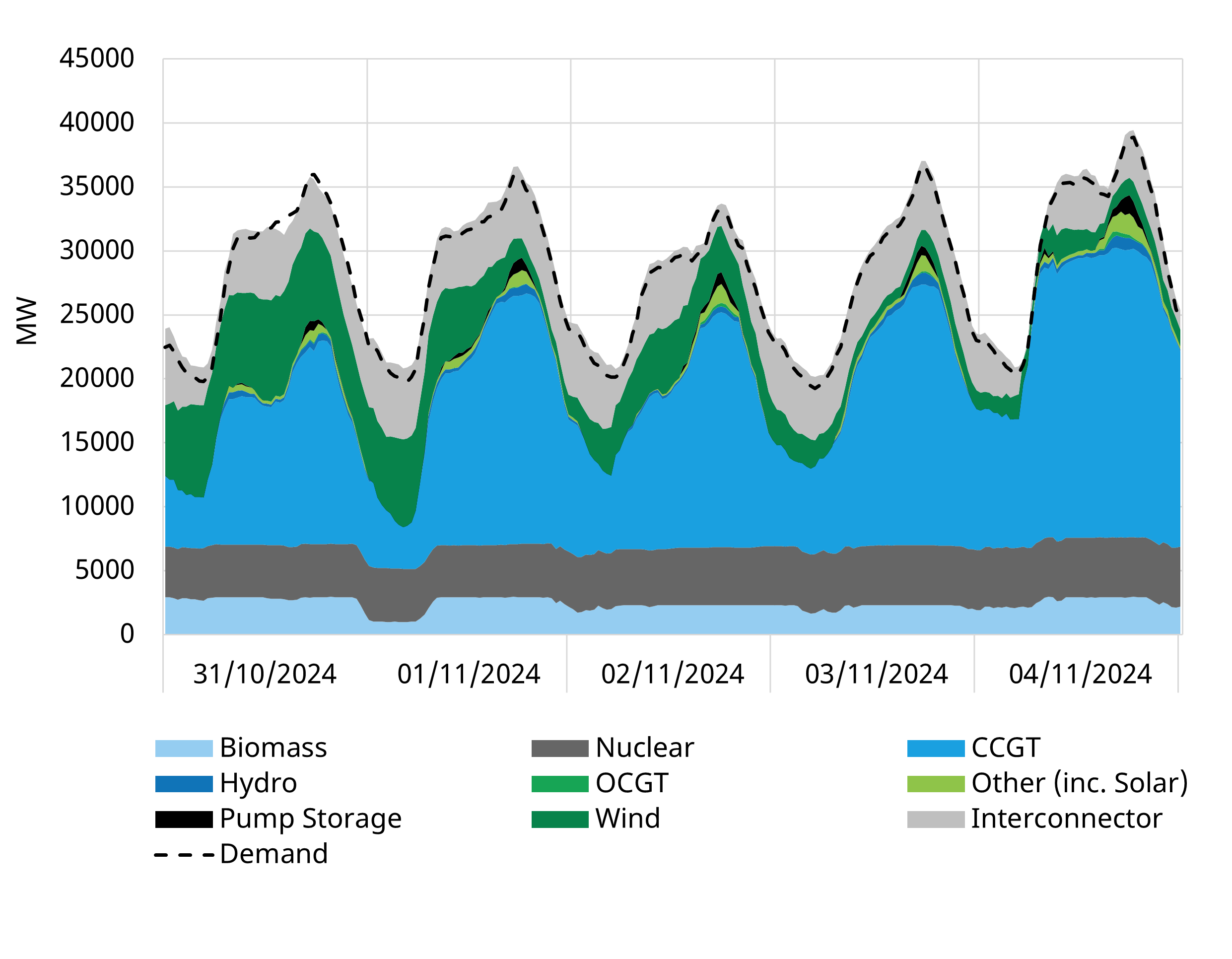

Chart 1: GB supply & demand balance 31st Oct to 4th Nov 2024

Source: BMRS; note chart shows transmission system supply & demand

As wind output (dark green) declines, large volumes of gas generation (dark blue) are required to plug the gap. This is particularly the case across periods of peak demand. Across these periods of low RES output gas generation plays a dominant role in meeting demand.

Wind & solar farms represent increasingly cost competitive sources of incremental power capacity. The challenge that comes with these technologies is ensuring adequate flexibility to balance power markets through increasingly large variations in RES output.

BESS capacity can provide intraday balancing flexibility. BESS duration is currently limited to around 4 hours of duration but is set to increase to at least 8 hours of duration as cell costs decline into the 2030s. But that leaves two other key challenges to achieve the twin policy goals of security of supply & decarbonisation:

- A scalable long duration storage (LDES) solution beyond 8 hours of duration.

- A low carbon source of energy generation across periods of low RES output.

At the moment gas-fired generation effectively covers both these rolls. And it will continue to do so until viable alternatives are developed & deployed.

Why gas plant investment remains key to energy transition

Investing in gas-fired generation capacity to enable energy transition seems counterintuitive. But it is an uncomfortable reality resulting from policy & technology hurdles.

In Table 1 we set out 5 reasons why investment in gas-fired generation capacity remains important.

Table 1: 5 drivers of requirement for gas generation investment

Despite these drivers, achieving decarbonisation means by definition that gas fired generation output will need to decline over time as low carbon output scales.

This dichotomy presents some key challenges for both policy makers & investors in defining a viable approach to support adequate gas fired capacity to enable transition to a decarbonised power sector.

The energy margin challenge

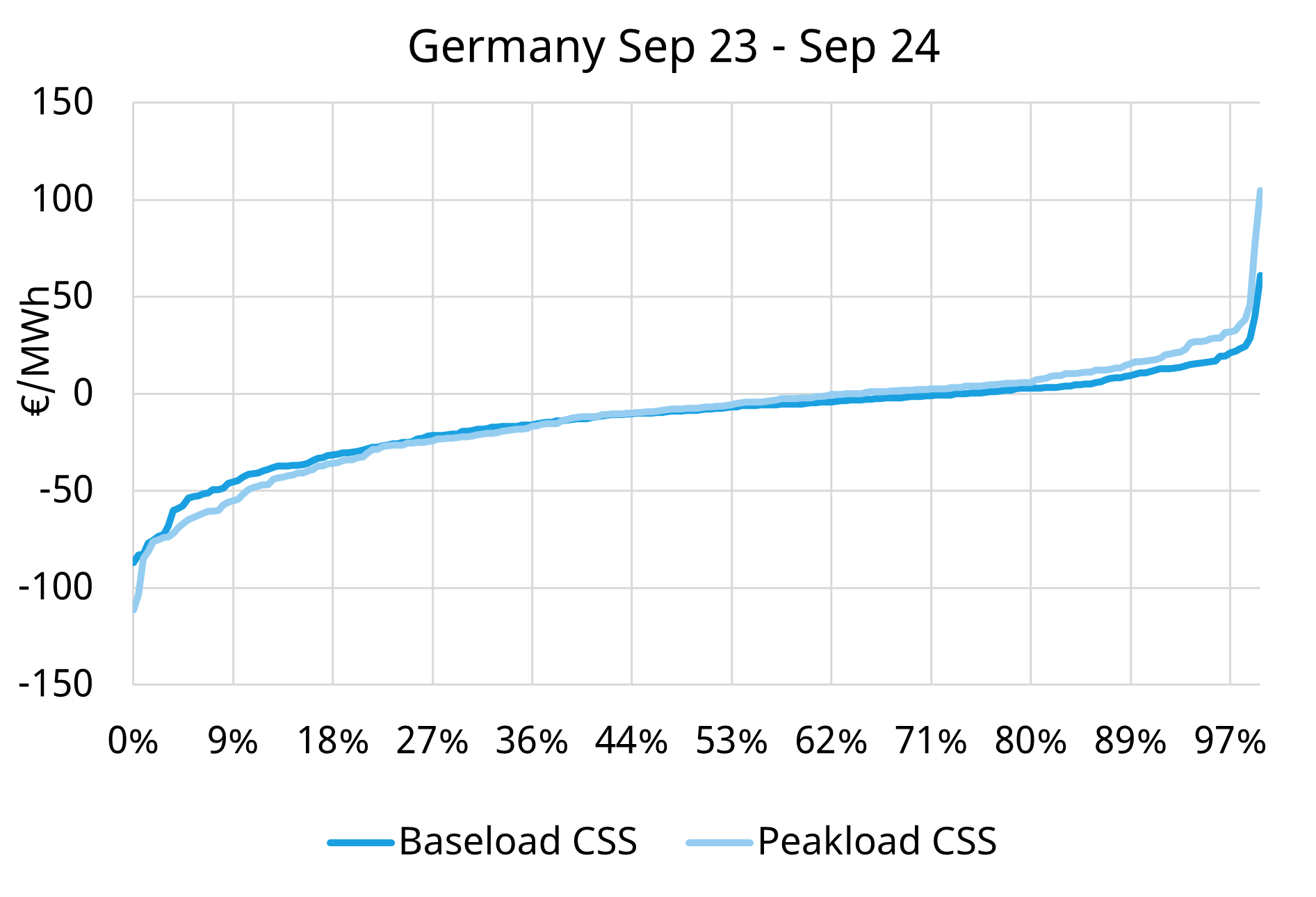

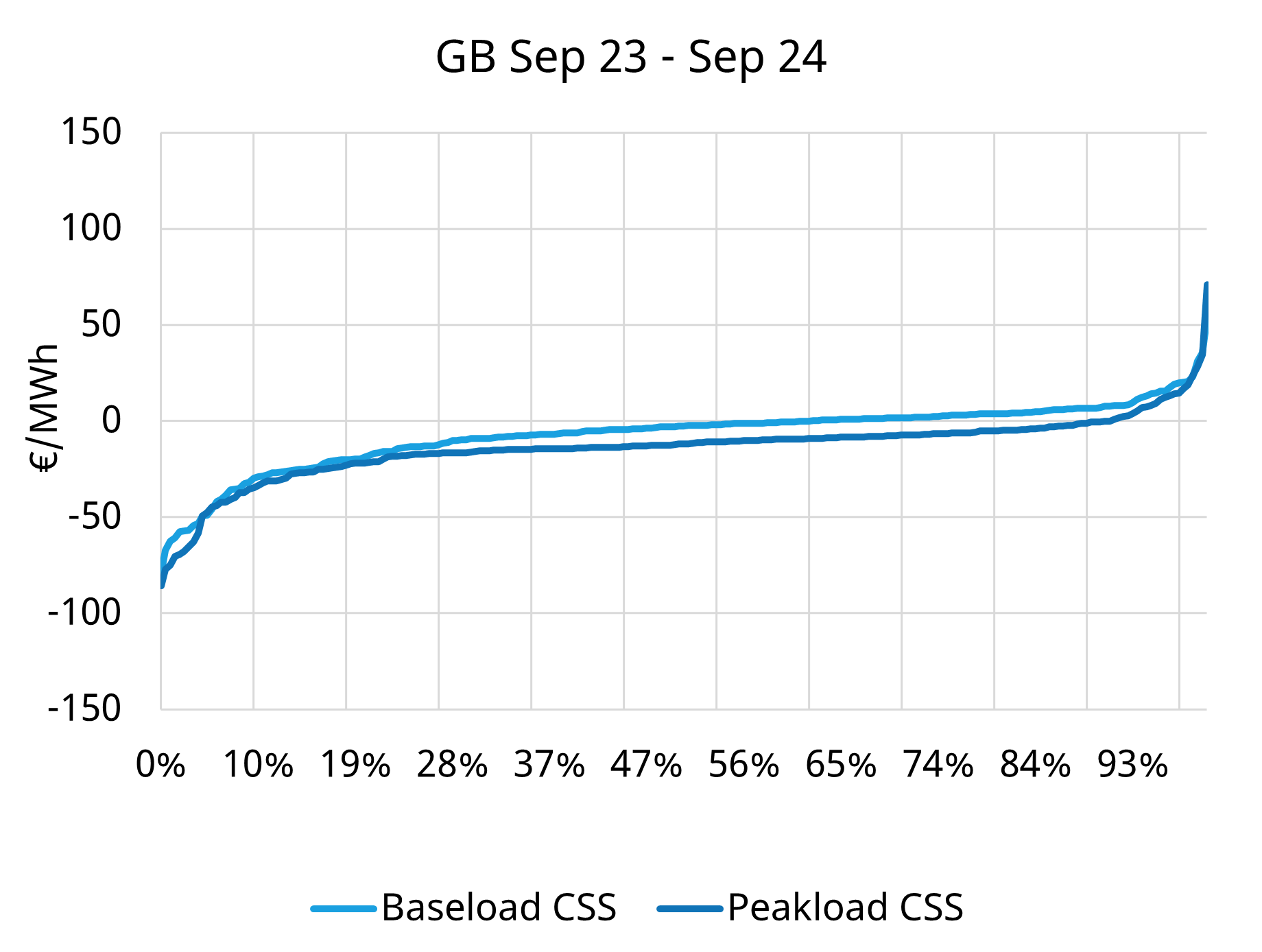

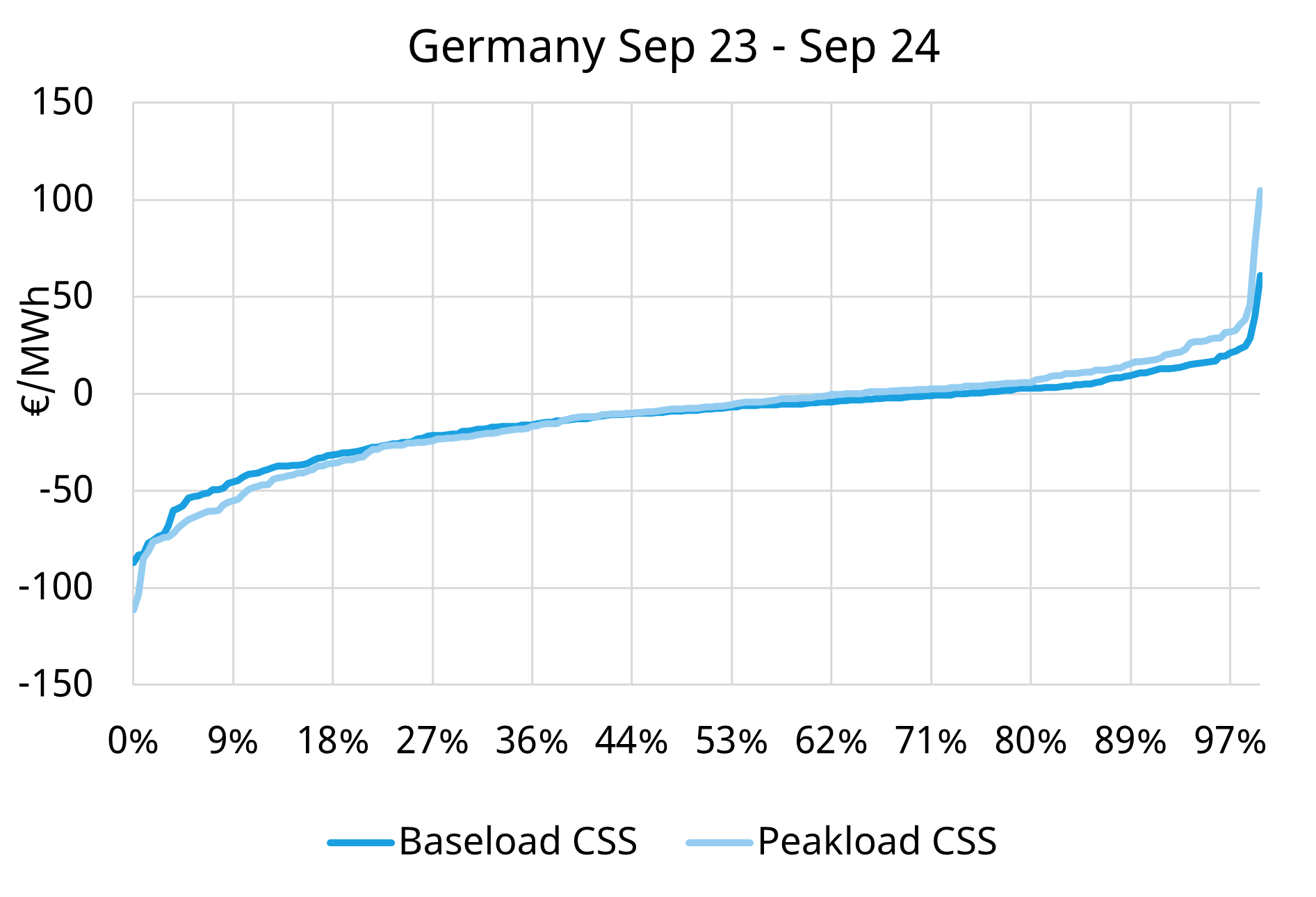

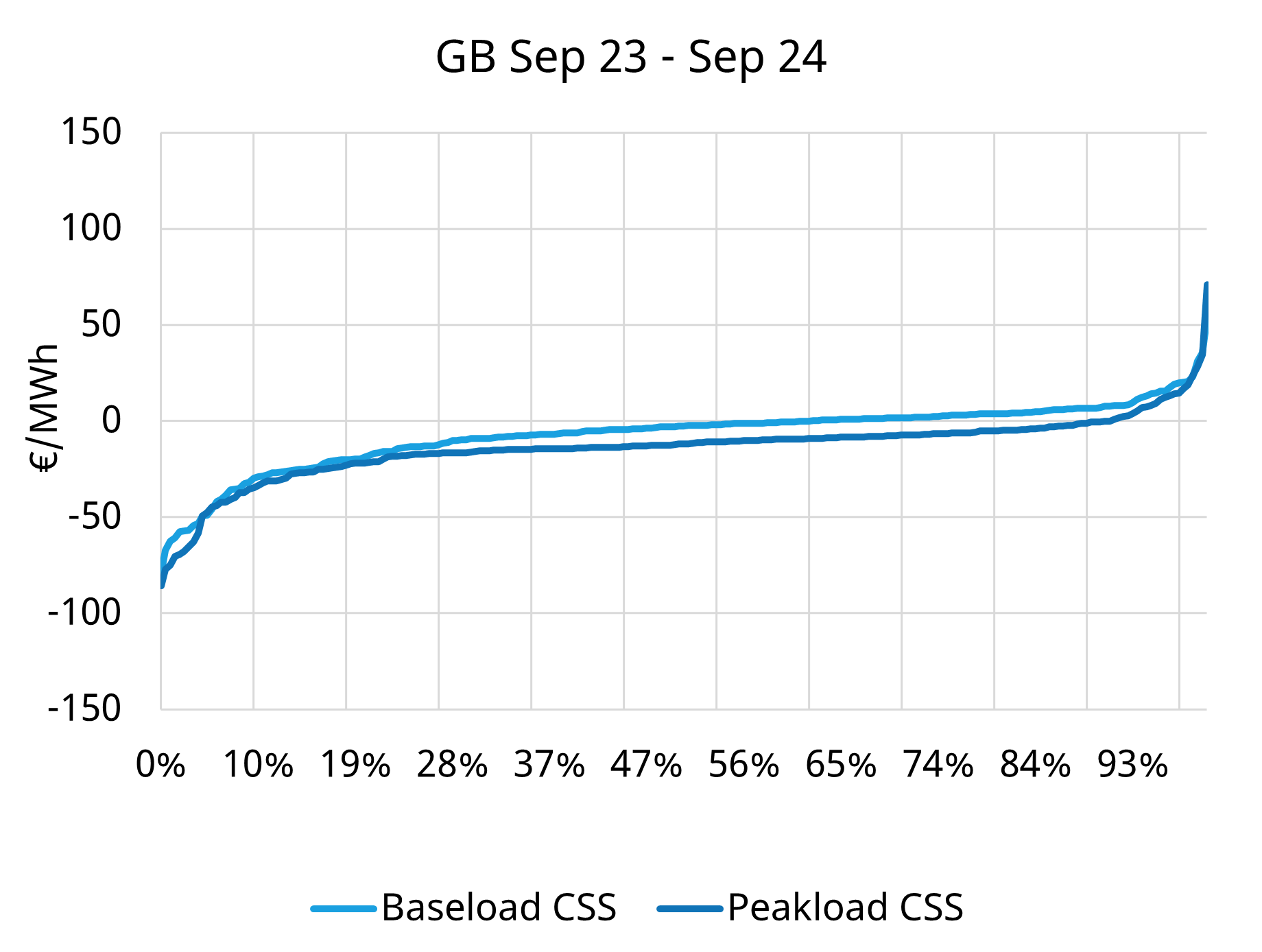

We show the value erosion faced by CCGT plants in the German and GB market in Chart 2. This shows daily achieved CCGT generation margins or Clean Spark Spreads (CSS) stacked from order of lowest to highest across the last 12 months.

Chart 2: Peak & Baseload CSS duration curve chart

Source: Timera, ICE, Spectron, Nordpool

Clean Spark Spreads were positive on a baseload basis only around 20% of the time in Germany (less in GB). Peak CSS was positive about 35% of the time (50% in GB).

As wind & solar output increases, value capture for gas-fired plants is increasingly being compressed into low RES output periods like the one we show in Chart 1.

This undermines the economic viability of gas plants based on energy margins only. Capacity payments are key to underpinning the economics of plants that by clear policy intention will run less and less over time to enable decarbonisation.

A practical example of the key role of capacity payments for decarbonisation was illustrated in the UK National Energy System Operator (NESO) “Clean Power 2030” report released last week. The report sets out how the UK will need to retain a gas fleet of similar size to today (around 35GW) in a ‘backup reserve’ in order to maintain security of supply. That can only be achieved via substantial capacity payments.

The challenge for gas plant owners & investors

Gas plant investors face 3 key risks:

- Capacity market risk – from revenue support for maintaining installed capacity

- Energy market risk – from revenue for providing flexible output in wholesale energy & balancing markets (against a backdrop of steady growth in RES output)

- Decarbonisation risk – from policy intervention to constrain plant operation, increase costs or accelerate retirement (as well as broader investor reputation risk).

As part of managing the third risk, a viable path to asset decarbonisation or retirement is key. This may involve the ability to absorb load factor or emissions constraints, adapting to H2 or CCUS or transition to capacity reserves.

Who would invest in a gas plant? It may surprise you that the implied returns on gas plants in some cases are rising not falling. This is a direct function of the dwindling pool of capital willing to deploy into gas-fired assets given the risks above. In other words declining investor competition is driving down asset prices and increasing implied returns.

There are however important caveats to this concept of rising returns. Firstly, everything depends on cost (whether it be acquisition or development cost). Secondly, value is very specific to market, location & asset.

In Table 2 we set out several gas-fired asset investment examples to illustrate value divergence.

The table contains some simple illustrative examples of gas asset investment options. All of these examples draw on our experience working with investors on analysis, valuation & due diligence of specific CCGT or peaking assets across these markets.

Table 2: 5 examples of gas plant investment options

We have purposely selected a range of value propositions. As you move down the examples in the table, returns tend to go down while risk increases.

The key takeaway is that a robust capacity payment mechanism is critical to support a viable gas plant investment case. This is the price policy makers have to pay to keep the lights on until alternatives can scale to replace gas.

The asset owners & investors who are successful in this space are the ones that can quantify & price the three risks we set out above, while structuring a viable margin stack to cover these.

Webinar recording available

Thank you for attending our webinar “Absorbing the supply wave” – how demand and supply side flex mechanisms will balance the global LNG market, which took place on Wednesday 27th November 2024 09:00 GMT (10:00 CET, 17:00 SGT).

The webinar was focussed on:

- What’s been setting global gas prices?

- Importance of market flex in the coming regime

- Overview of LNG supply response & Asian demand flexibility

- Demonstrating market flex impact on marginal price formation through (i) HH price impact (ii) Asian demand growth trajectory

Click here for a recording of the webinar.

Click here for a copy of the webinar slidepack.

If you are interested in a sample copy of our Global Gas Quarterly Report & Databook, or further information on the bespoke services we offer, feel free to contact David Duncan (Director) david.duncan@timera-energy.com or David Stokes (Managing Director) david.stokes@timera-energy.com