The UK gas market is undergoing two major long term structural shifts. UK import dependency is increasing as domestic gas production declines. At the same time, short term fluctuations in UK power sector gas demand are increasing as intermittent renewable generation capacity rises. Both of these factors are driving an increasing requirement for system flexibility. This will in turn drive the need for investment in new gas storage facilities.

The UK’s gas storage requirements are however commonly misunderstood. As well as specific storage sites, the UK is very well interconnected with other large sources of longer range gas flexibility. For example pipeline imports from Norway, Belgium, Netherlands and a high level of LNG regas capacity. As a result, there is ample existing import infrastructure capacity which can be used for seasonal balancing.

However imports can be susceptible to supply disruptions or time lags in response to market price signals. Fast cycle gas storage plays a key shorter term ‘bridging’ role in providing deliverability to insure against issues with imported supply. It also provides important short term flexibility to enable gas fired power plant to support renewable intermittency.

Structural market changes

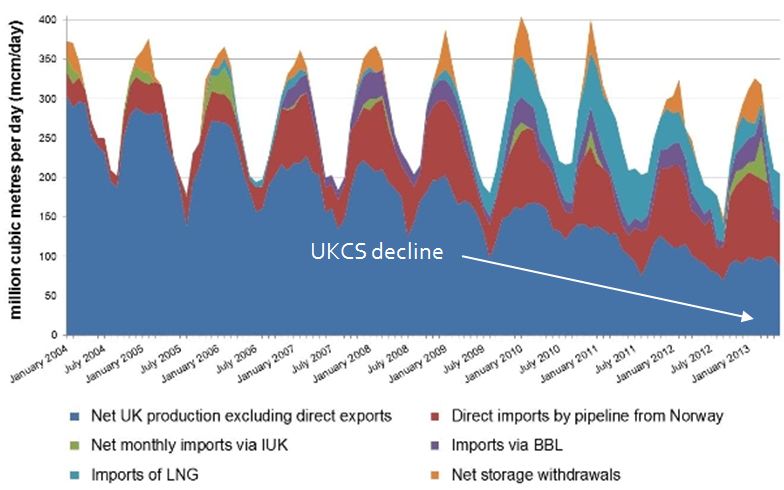

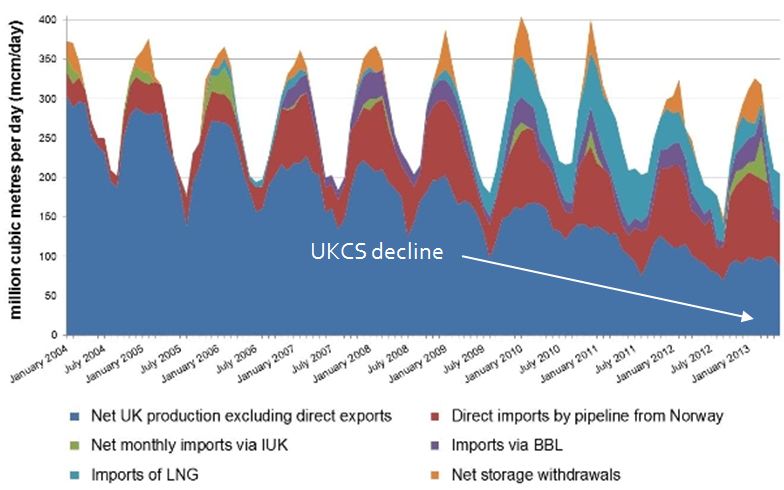

The increase in UK import dependency is a function of declining UK Continental Shelf production as shown in Chart 1. The UK is becoming more dependent on several larger supply sources (e.g. Norwegian pipelines, interconnectors and LNG imports) as opposed to a diversified mix of UKCS fields, pipelines & processing plants. This is resulting in a greater UK exposure to external supply shocks and an increase in dependency on key import infrastructure.

Chart 1: Evolution of UK gas supply mix (2004-2013)

Source: DECC Energy Trends 2013

The UK’s aggressive targets for renewable generation also have significant implications for the gas market. The UK has around 30 GW of CCGT capacity that is the marginal provider of flexibility in the power market. As intermittent output from wind and solar capacity rises, so to do the short term fluctuations in gas demand from CCGTs as they respond. This will over time act to increase UK gas system stress and price volatility.

Increases in import dependency and renewable intermittency both drive a requirement for an increase in shorter term gas deliverability (as opposed to longer term seasonal flexibility).

Why deliverability is key

The UK has ample import capacity across the Norwegian pipelines, interconnectors and LNG terminals. In a medium to longer term horizon (e.g. greater than a 1-2 month horizon), a strong price signal can respond to pull more gas into the UK. DECC to their credit understand this logic and used it to support their decision not to intervene in the gas storage market last year (a position we supported).

The vulnerability of the UK gas market is to short term swings in demand, infrastructure outages & supply chain response delays. In periods of system pressure what is most important is the bridging role played by short term deliverability, not higher volumes of gas in store. This importance will increase with intermittency.

Evidence of this short term requirement for deliverability and the longer term effectiveness of the NBP price signal in attracting imports can clearly be seen across the last three winters. For example, the price spikes of Mar 2013 reflected a period of deliverability scarcity over 4 to 6 weeks, until higher prices attracted additional LNG imports (as described here).

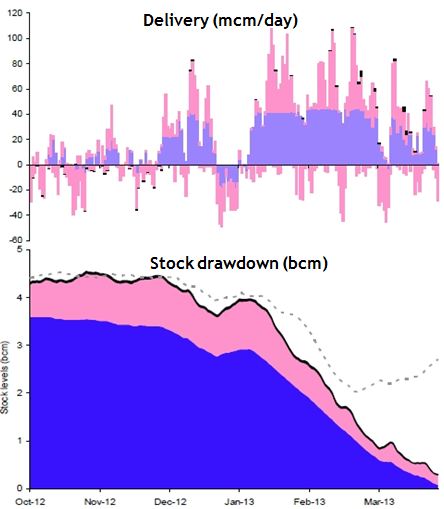

It is in these periods of system stress that fast cycle storage facilities play a critical role. There is just under 5bcm of operational storage capacity in the UK. The large seasonal Rough storage facility represents about 75% of this on a working capacity basis. While salt cavern facilities such as Holford and Aldbrough are small relative to Rough on a capacity basis, their flexibility to cycle working capacity multiple times a year means they punch well above their weight.

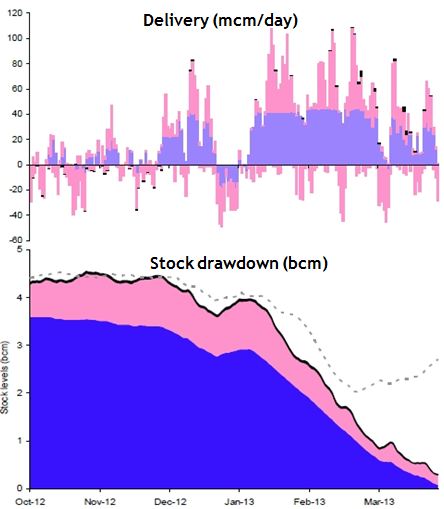

This is illustrated in Chart 2 where Rough is represented by the blue areas and faster cycle facilities by the pink areas. Rough tends to withdraw gas in a reasonably steady pattern across the winter. The faster cycle facilities on the other hand are constantly cycling and adjusting patterns of injection and withdrawal in response to market conditions.

Chart 2: UK storage delivery and stock drawdown (Winter 12/13)

Source: National Grid 2013-14 Winter Consultation

As well as providing deliverability in periods of supply disruption or system stress, fast cycle storage also provides ideal support for increasing intermittency. Fast cycle storage can be thought of as a rapid charge and release ‘gas battery’. Gas can be withdrawn in periods of low renewable output when CCGT gas demand is high and re-injected in higher output periods when gas demand (and prices) fall.

This cycling flexibility of fast cycle storage acts to reduce market price volatility. It also acts to increase prompt market liquidity (e.g. within day & day-ahead), as storage capacity owners manage their injection and withdrawal exposures in the market. Both of these factors ultimately contribute to reducing the cost of supplying gas to customers.

Investment in new storage capacity

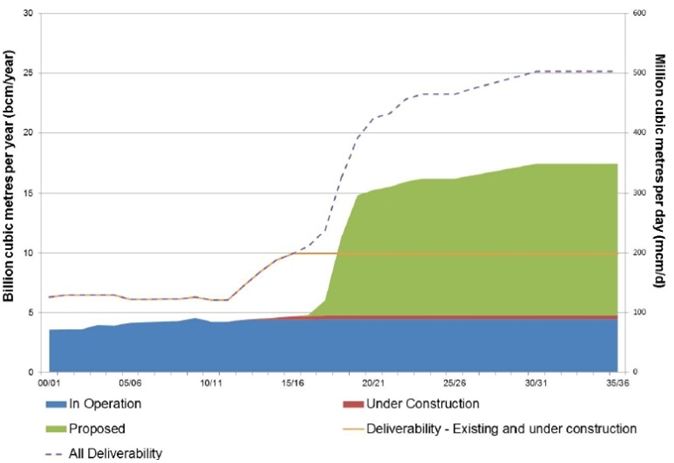

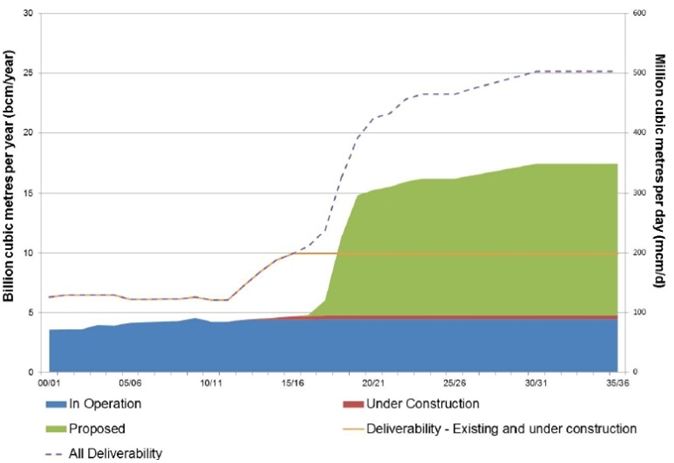

Both the government and the system operator (National Grid) recognise the requirement for further investment in storage deliverability. DECC & Ofgem point to a large volume of consented projects in their Oct 2013 Security of Supply Report, included in the green area in Chart 3.

Chart 3: Operational vs proposed UK storage capacity volume

Source: DECC/Ofgem Statutory Security of Supply Report (Oct 2013)

But a significant volume of this consented capacity is lower cycling seasonal storage that is unlikely to ever be developed, given structural weakness in seasonal price spreads. There is a much smaller volume of consented fast cycle salt cavern capacity. The development & incremental investment economics of this fast cycle capacity is favourable given a value skew towards volatility (as opposed to seasonal spreads).

The UK market has been delivering fast cycle capacity over the last 5 years (e.g. Aldborough, Holford & Stublach) which reflects this characteristic. However investment approval on this capacity was achieved under more favourable market conditions several years ago. The current environment remains tough for developers with a strong market price signal yet to emerge to support further investment.

Chris Lefevre provides a telling statistic on proposed vs developed storage capacity in his 2013 OIES report on UK gas storage. In 2005, DECC listed 5 bcm of additional capacity (10 new projects) to come online by 2010. In reality only 0.35 bcm was actually delivered. If the current market environment leads to a hiatus in storage investment over the next few years, the UK’s deliverability issues may become much more pronounced next decade as import dependency and intermittency increases.

The timing of a market price signal to support storage may be uncertain. But the structural drivers behind a requirement for additional deliverability in the UK gas market are real. Fast cycle salt cavern storage facilities represent a relatively cheap and flexible source of incremental deliverability as well as having low incremental expansion costs. As a result these facilities are going to play a key role in supporting the evolution of the UK gas market.