“Zonal pricing is dead but locational value is not”

A key pillar of GB power market policy was defined In July 2025. The UK government officially abandoned plans for zonal or locational marginal pricing (LMP), deciding to maintain a unified national pricing model (via a “reformed national price”).

This ruling materially reduces uncertainty for GB BESS investors. A range of structural changes to market design to address locational issues have effectively been brushed off the table.

However regulatory clarity does not remove location as an important BESS value driver. Significant locational discrepancies remain in both asset revenues and costs. In today’s article we explore the value impact of location on BESS post the recent ruling.

3 key locational value drivers for BESS

We are publishing a special feature section on GB BESS locational value in our Q3-25 GB BESS report (to be released this month).

Table 1 summarise the 3 main drivers of locational value for BESS projects.

Table 1: Locational value drivers for BESS

Of these, value creation from system balancing actions is typically the most important & complex value driver.

Modelling & quantifying the impact of locationally driven BM value capture is an important component of a robust GB BESS investment case. Let’s unpack this.

System vs Energy actions in the BM

It is important to distinguish between system actions and energy actions in the BM:

- System actions are locational, targeting regional congestion management. They are the most material source of incremental revenue for batteries in constrained areas.

- Energy actions resolve national imbalances, and are less sensitive to where a BESS asset sits.

The original case for LMP centred on rising system costs, particularly in Scotland where wind build-out is far ahead of transmission reinforcement. But policymakers judged the complexity and investor risk too high.

Instead, the BM remains the tool for redistributing locational congestion rents. This happens via system BM actions are Bid-Offer-Acceptances (BOAs) that are undertaken to manage either local or regional congestions.

Evidence of regional divergence

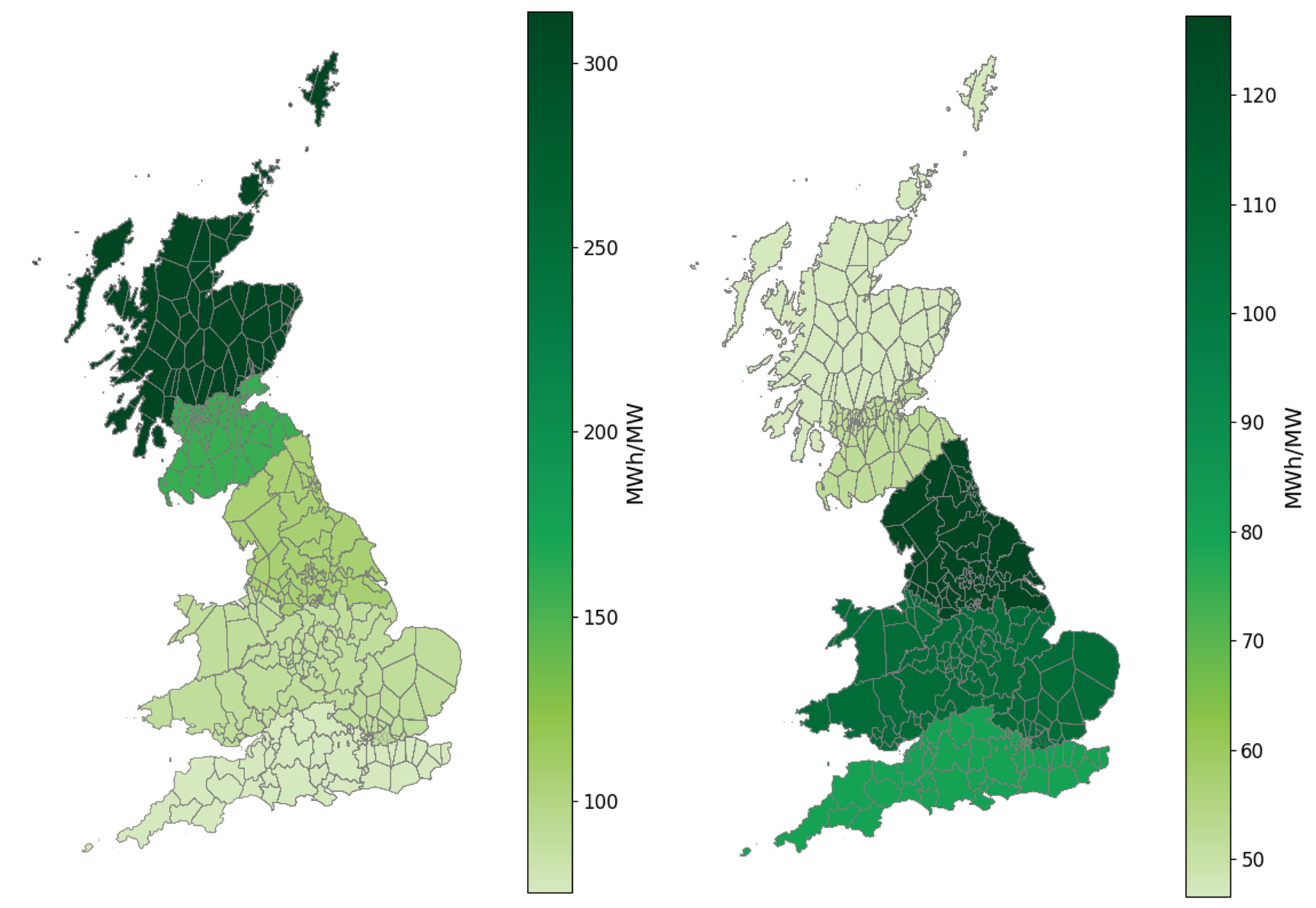

Recent dispatch data shown in Chart 1 confirms just how different BESS operating profiles are across GB. The chart shows per MW of installed BESS:

- total bid volumes (to reduce output) in the left hand panel

- total offer volumes (to increase output) in the right hand panel

A couple of takeaways:

- Bid volumes: Scottish batteries were bid down more than three times as often as those in the South East between April–July 2025. They frequently undercut wind and pumped storage to charge at discount prices (driven by constraints).

- Offer volumes: Southern BESS saw much more offer-side action, reflecting their positioning closer to demand and wholesale price formation.

Notably, aggregate offer volumes remain below bid volumes across GB, underlining the intense competition from conventional generation when batteries seek to discharge.

Value implications for BESS investors

For investors, these divergences are not academic—they are reshaping portfolio strategy:

- Generation-heavy zones (e.g. Scotland): Longer duration assets (3–4hr plus) are increasingly attractive, enabling capture of extended high-wind curtailment periods.

- Demand-heavy zones (e.g. South East): Shorter duration (~2hr) batteries remain well aligned to energy price arbitrage, volatility capture and system balancing.

However, targeting BM congestion rents is not a free lunch. Policy risks remain acute:

- The SSEP process could reframe connection rules, changing the relative attractiveness of constrained nodes.

- Ongoing TNUoS reform poses a structural risk, potentially altering network cost allocation in ways that undermine Scottish returns.

- Transmission Constraint Licence Condition (TCLC) & ongoing regulatory reforms (P462) introduce uncertainty and risk around deeply negative priced system BM bid value.

Locational optionality is therefore as much about risk management as it is about chasing headline revenue.

Why full BM modelling matters

Accurately valuing batteries in this environment requires robust regional BM modelling. Investors need visibility on:

- Revenue curves: stochastic projections of bid/offer activity across zones.

- Cost exposure: network charges and queueing impacts.

- Scenario analysis: policy shocks such as TNUoS or queue reform.

This is at the core of Timera’s GB BESS valuation framework.

The zonal pricing debate is over. GB will price power nationally. But for BESS investors, location is still a key investment case driver. System actions, network costs, and evolving spatial policy ensure that siting decisions remain one of the most powerful drivers of project value.. and risk.

Our Q3-25 GB BESS report & Battery Investment Tool contain a full set of locational revenue and cost curves for GB BESS, alongside case studies of different locational strategies. If you would like a sample copy feel free to get in touch with Arshpreet Dhatt (arshpreet.dhatt@timera-energy.com).

We will also be running a webinar on “locational value impact on GB BESS investment case” on Tue Oct 7th

Webinar: “Zonal pricing dead but locational value lives” – impact of the Jul 25 decision to kill Locational Marginal Pricing (LMP) on GB BESS investors

Time: 09:00 BST (10:00 CET) Tue 7th Oct

- 3 key locational value drivers for GB BESS

- Investor landscape post LMP

- Quantifying BM system value capture

- How to frame locational value in investment cases

- Locational value & key risks

Please register here