Step back to May 2009 in the aftermath of the financial crisis. A prominent keynote speaker at a leading European energy conference gives a speech to a hall full of senior energy industry representatives.

“Higher oil prices in the near term may accelerate enduring demand destruction”v

In his speech he sets out two bold conclusions:

- Decarbonisation is the primary trend that will dominate energy industry evolution to 2050

- As a result, oil prices will never recover from their post financial crisis slump.

The first conclusion was a prescient call, which was far from obvious to most of the audience at the time. The second conclusion was deeply flawed. Brent was around 50 $/bbl at the time, on its way back above 120 $/bbl. So what did he miss?

The ‘decarbonisation will drive oil prices lower’ narrative remains prominent. In today’s article we are going to argue the other way: that oil prices are likely to rise, but in doing so accelerate decarbonisation.

Oil demand decline terminal, but prices can rise anyway

Pretty much everyone now agrees that decarbonisation spells terminal decline for oil production, it’s a question of when not if. However for the time being, global oil demand looks set to hit new records (probably by next year).

Oil demand will likely peak sometime in the mid to late 2020s. The exact timing of this peak is an interesting pub conversation, but not really that relevant.

If you are interested in oil prices, what matters most is how supply and demand dynamics play out across the next decade and their impact on the pricing of the marginal barrel of oil. Three factors will play an important role in determining this:

- The pace of decarbonisation, particularly the electrification of transport (led by EV roll out)

- The strength of oil demand in what looks to be a high stimulus & energy intensive economic recovery (e.g. across aviation, mining, petrochemicals)

- The cost & timing of upstream capital invested in incremental oil production

The first of these factors will substantially erode oil demand over time. But the second and third factors could drive oil well above 100 $/bbl in the next 3-5 years.

The interesting circularity in play is that higher oil prices are likely to accelerate permanent substitution to other energy sources. This is particularly true for electrification of transport given increased competitiveness of electricity (e.g. for EVs) and even hydrogen as oil prices rise.

In other words higher oil prices in the near term may accelerate enduring demand destruction. Higher prices may also fund accelerated business model transition of the European oil majors (e.g. Shell, BP, Total), to alternative low carbon margin streams.

A summary of the oil market balance

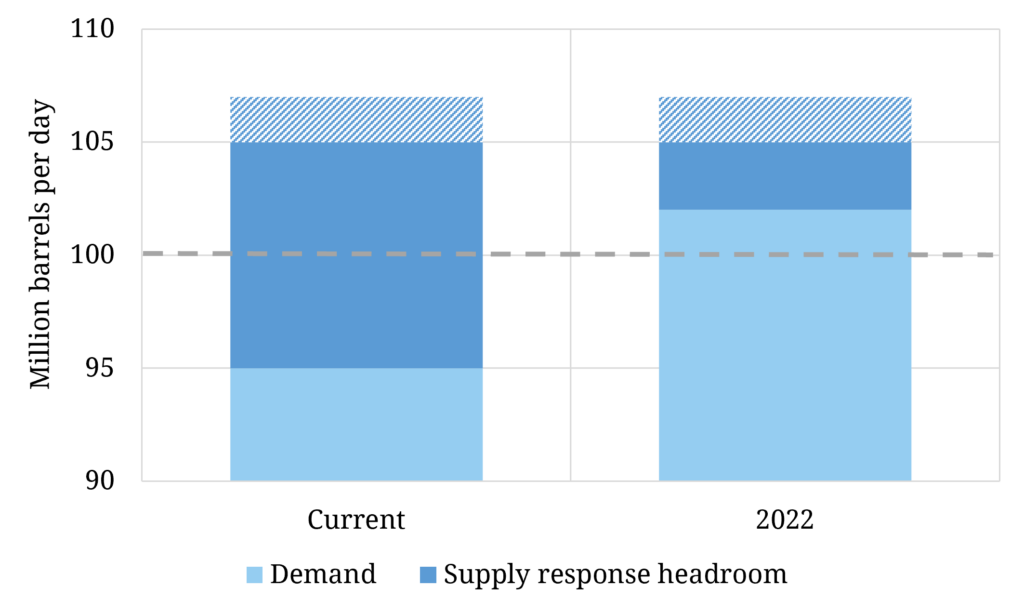

Chart 1 shows a very high level view of the current demand & supply balance, focusing in on the margin where prices are set.

The chart summarises a few high level numbers to frame global crude oil market demand:

- Pre-Covid global demand was around 100 million barrels per day (mbpd)

- Current (2021) demand is around 95mbpd and rising quickly with post-Covid economic recovery, travel constraints easing & large fiscal & monetary stimulus programs

- Oil demand will likely reach a new peak in 2022, somewhere approaching 102 mbpd.

And a couple of key numbers behind global supply response:

- There is around 8-10 mbpd of conventional production capacity upside currently held back across OPEC + Russia + incremental Iranian output

- In addition the US, which provides key price responsive supply via shale plays, is currently producing at around 11 mbpd (vs 13 mbpd pre-Covid).

To frame how tight the crude market currently is, there is roughly 10-12 mbpd of production headroom across OPEC + Russia + US shale upside. Around 5-7 mbpd of that headroom is likely to be eaten up by 2022 (assuming global demand is 102 mbpd). That leaves only 3-5 mbpd next year, which if oil demand remains strong could well be eroded by 2023-25.

At the point production headroom is absorbed, the oil market supply curve becomes pretty inelastic (unresponsive to price), with demand destruction the main short term mechanism to balance the market. That could mean much higher spot crude prices.

Brent price curve dynamics

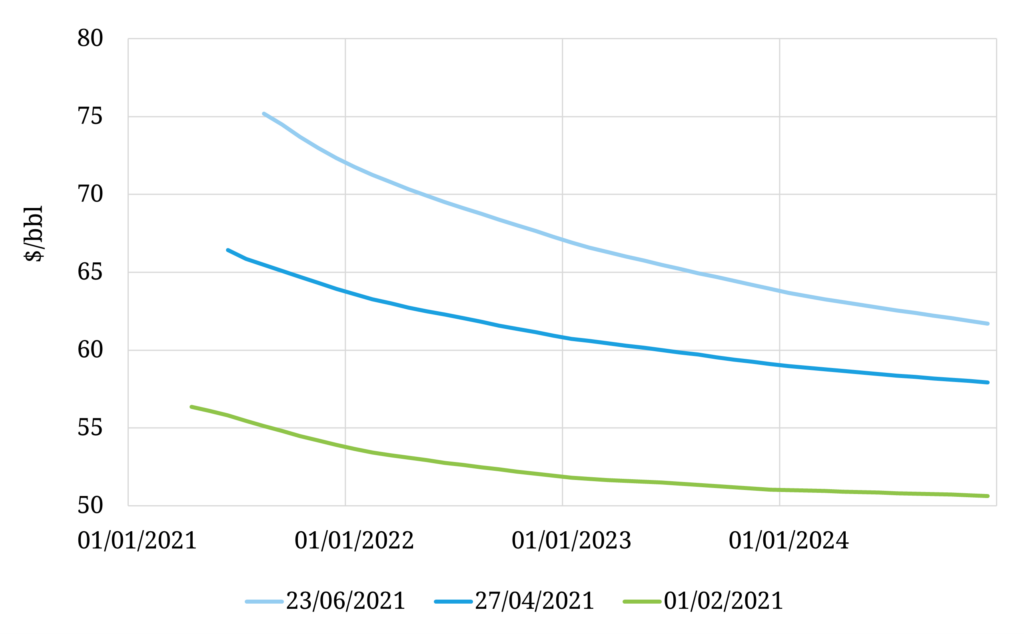

The Brent crude curve is currently in backwardation i.e. it is downward sloping. One of the most common misconceptions in energy markets is that a forward curve in backwardation is bearish. Forward curves do not represent forecasts of future spot prices.

A backwardated curve reflects the fact that the market is paying a premium for near term delivery of oil. That is a sign of near term demand strength and / or constraints on supply response. Curve backwardation is usually bullish.

Chart 2 shows the evolution of the Brent crude futures curve across the last few months and how backwardation has become more pronounced as spot prices have risen.

Chart 2: Brent crude curve evolution in 2021

Source: CME, Timera Energy

For the last decade, longer dated crude prices (e.g. 3 – 5 years forward) have been anchored by US shale production cost dynamics. Pre-Covid crash, this anchor was around a 55-60 $/bbl range for Brent (see our Brent curve animation here for a clear visual).

This anchoring of the curve reflects the fact that US producers hedge shale well investments typically around 2 years forward, to support financing of capex required to drill. If longer dated prices rise to the top of the anchor range, it supports hedging and drilling of more wells. If prices fall to the bottom of the range, investment is choked off.

Why crude prices may be set to surge

US shale investment dynamics have driven a neat and reliable mechanism to anchor the crude curve… until Covid. Across the last year there are 3 factors that have been impacting curve anchor dynamics:

- Cost of capital – Lenders suffered huge impairments in 2020, following on from a similar rinsing in 2016. Once bitten, twice shy. Twice bitten, never again.

- ESG constraints – the new Biden administration has a very different approach to Trump when it comes to regulatory & environmental constraints around oil production.

- Decarbonisation risk – Covid has materially impacted the pricing of decarbonisation risk for hydrocarbon investors who fear oil could be the next coal, or just want out altogether to adhere to ESG mandates.

All three of these factors mean higher costs & barriers for investing in US shale. That is reflected in a subdued US rig count and completed wells, despite sharply higher prices in 2021. In case you are wondering about broader investment in conventional oil plays, these have multi-year lead times and have been at very low levels since the 2015-16 price crash.

The oil market looks like it is about to test the supply response of US shale producers as longer dated prices rise. It will be very interesting to see what the new anchor range may be given the three factors above, it could be closer to 70-80 $/bbl for Brent.

Even if the long end of the curve remains anchored by shale, there is a significant delay (1 – 2 years) in response to bring on new US production. Across this period, spot prices could easily surge above 100 $/bbl, with demand response driving marginal pricing.