We flagged a ‘take off’ in European merchant battery investment as one of our 5 surprises to watch out for in 2019. Investment momentum has been accelerating as the year progresses, and merchant business models have become the dominant focus.

Investment in Europe is being led by the UK and German power markets, with high renewables penetration and a more constructive policy environment supporting battery projects. Merchant investment is being fuelled by a combination of utilities (e.g. EDF, Uniper, Centrica), funds (e.g. Gresham House & Gore Street) and a range of renewables investors looking to pair batteries with solar, wind & other innovative strategies.

But battery investors all face a common challenge: building a viable margin stack that will underpin a return on capital. This is significantly more challenging for battery projects than for renewable or conventional thermal asset investments because of:

- Margin sensitivity to rapidly changing market & regulatory conditions (e.g. capacity mix changes & policy evolution)

- The complex nature of battery optimisation, across different markets and time horizons, to capture wholesale market margin

- A lack of historical data on achieved battery margin performance

One of Timera’s key focus areas this year has been working with battery investors on quantifying robust margin cases. In today’s article we outline our view on how to approach the analysis of a viable margin stack.

Breaking battery margin into buckets

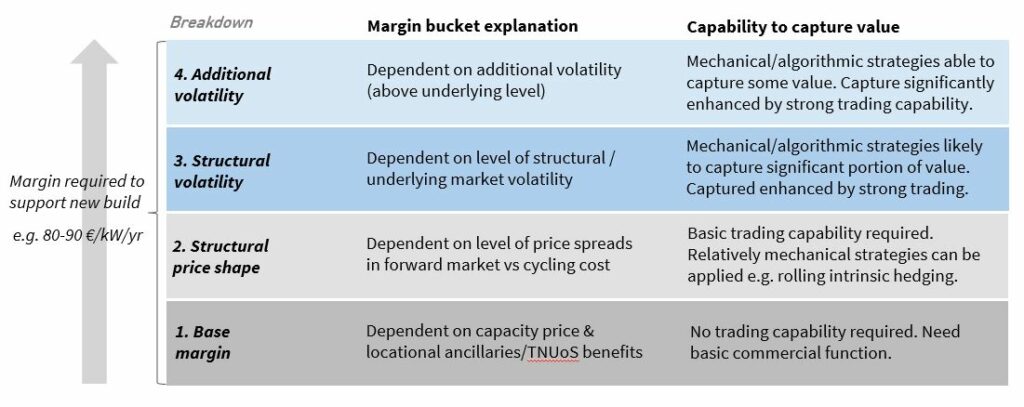

The complexity of battery margin capture means it is imperative to develop a way for investors to understand margin build up, without requiring a double PhD in maths & physics. In our view, the best way to achieve this is to break margin down into buckets as shown in Chart 1.

- Base margin: The merchant margin stack is underpinned by non-wholesale market margin streams. These include system services (e.g. frequency response, reactive power), capacity payments and project specific site/locational benefits. The advantage of these margin streams is that they are typically less risky than wholesale market margin and may even support some project debt.

- Structural price shape: Power markets have a structural intra-day price shape driven by the variable costs of different capacity types setting prices across the day. A lower bound for battery wholesale margin can be generated based on arbitrage of this structural intraday price shape e.g. via a simple rolling intrinsic strategy. Rising renewables penetration and retirements of coal / nuclear / CCGT plants is acting to increase price shape over time, supporting value in this bucket.

- Structural volatility: The very fast reaction speed of batteries in response to price volatility underpins battery wholesale margin capture. There is an inherent underlying level of prompt price volatility (or ‘price noise’) in power markets caused by fluctuations in load, wind and solar. This is increasing with renewables penetration. Value capture is riskier and more complex than for simple arbitrage strategies, but there are formulaic or algorithmic methods to ‘harvest’ value from this volatility without incurring high risk.

- Additional volatility: The final margin bucket is made up of riskier extrinsic value. This depends on how much additional price volatility occurs in the market above the inherent ‘price noise’ in bucket 3. Drivers include periods of market tightness and market events such as weather shocks & outages. The amount of value captured here has a stronger dependence on trading capability & commercial judgement.

Interpreting the margin buckets

The portion of value that sits in each of the four buckets varies significantly by commercial strategy, project configuration, location and market. The levels achievable in buckets 1 to 3, determine how much margin must be generated via the higher risk bucket 4, in order to meet required return on capital.

These buckets are very useful in building up a ‘digestible’ view of battery margin analysis. But they are not a way to side step what is a very complex analytical problem behind. The wholesale margin buckets 1 – 4 can be shown separately on a diagram, but are in practice co-dependent. Value is captured via an all-inclusive optimisation of battery flexibility across multiple time horizons. So what analytical tools are required to do this justice?

Quantifying margin bucket value

Firstly, it is important to specifically capture wind, solar & load uncertainty within the market modelling process. It is imperative that these factors are properly simulated (e.g. 500+ simulations) in order to understand their impact on market price volatility.

This means applying a stochastic power market modelling framework (follow the link for an explanation). Traditional ‘Base / High / Low’ scenario analysis of power prices is not appropriate for quantifying battery margins. This approach tends to underestimate both battery value capture and market risk.

Secondly, it is important to model battery margins using a robust stochastic battery optimisation model. This is a separate tool from the stochastic market model. It captures optimisation of battery dispatch against wholesale market prices, including the variable cost impact of battery cycling degradation and bid/offer spreads.

A robust market & margin modelling framework underpins an understanding of how batteries can practically create margin. More importantly it helps quantify the risk dynamics around projected margins.

3 new members join our growing Timera team

Jon Brown joins us from EDF, Steven Coppack from Total & Tommy Rowland from Smartest Energy. As with all of our team members, they have a strong practical background in commercial analytics from their industry roles. More details on Steven, Jon & Tommy on Our Team page.Timera Energy also move into new offices this week: L12, 30 Crown Place, London EC2A 4ES – details here. |