The world came to terms with a new market dynamic last week in the form of negative WTI crude prices. The concept of negative prices is not new to anyone who has worked in power markets, where they are increasingly becoming an everyday occurrence. But oil is a lot easier to store than electricity and negative prices reflect an acute temporary demand shock associated with the global Covid-19 shut down.

“The cargo that pushes TTF prices through Henry Hub may have already been produced and liquified.”

The global gas market is also currently in a temporary state of pronounced oversupply, exacerbated by Covid-19. Today we look at the current state of play in the global gas market as well as the drivers that will determine whether gas prices can follow oil into negative territory.

Which gas price do we mean – TTF, JKM or Henry Hub? Well it doesn’t really matter at the moment. The three key regional gas price benchmarks have all essentially converged.

What just happened in the oil market?

With about half an hour of trading to go on Apr 20th, May delivery WTI crude futures went ‘no bid’ on the NYMEX exchange. At that moment, in one of the world’s most liquid commodity markets, there was no-one showing a bid for May WTI crude at any price.

No bid situations are rare in established markets. They reflect an extreme market imbalance typically accompanied by distressed selling. WTI prices immediately gapped lower and within several minutes traded as low as minus 40 $/bbl.

Crude oil market imbalance can be summarised with a couple of simple supply & demand metrics. The Covid-19 global demand shock is currently in the order of 20 million barrels per day. The Russians and Saudis are struggling to come to an agreement to cut production by half that volume (10 mbpd). The net imbalance is causing a huge increase in crude storage inventories.

The owners of WTI futures contracts on expiration must take physical delivery of crude oil in Cushing, Oklahoma. Most contract holders typically close out futures contracts and cash settle in advance of expiration, to avoid the obligation to take physical delivery. In fact many market participants do not have the capability to take delivery of crude at all.

Negative prices reflect constraints on the ability to store a commodity. In this case, uncommitted storage capacity at the landlocked Cushing delivery point is full (given the Covid-19 demand shock). As crude market participants stampeded for the exits (exacerbated by a VaR shock), they were prepared to pay a considerable amount to anyone who could take away their May contract oil exposure.

Next we turn to look at Covid-19 impact on the gas market, but we come back to an important linkage between gas and oil prices a bit later.

Gas market state of play

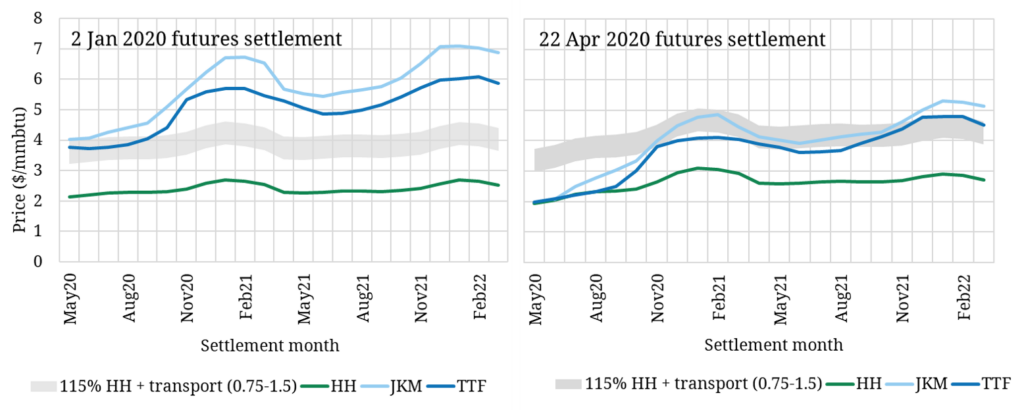

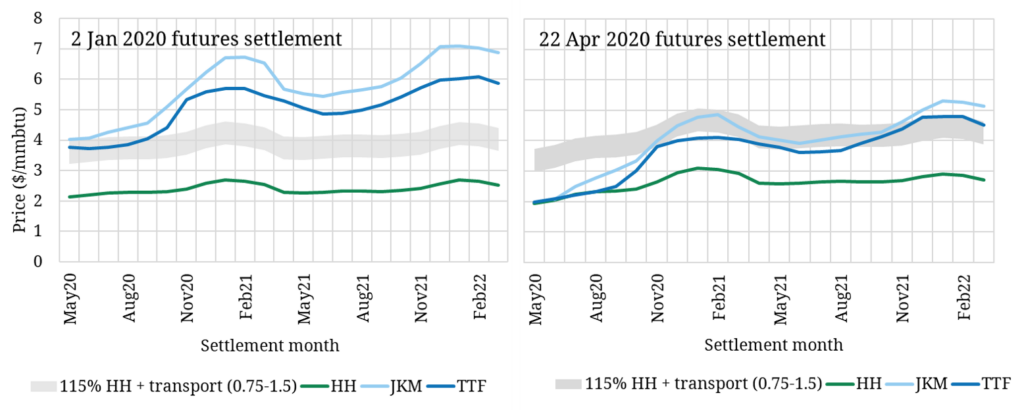

The June contract prices for the US (Henry Hub), European (TTF) and Asian (JKM) gas price benchmarks have now converged to within a range of around 0.05 $/mmbtu. For now there is effectively a single global spot gas price benchmark, at least for the next two or three months as shown in the right hand panel of Chart 1. The left hand panel shows the situation at the start of this year to illustrate how much prices have moved in just under 4 months.

Chart 1: 2nd Jan 2020 vs 22nd Apr 2020 forward gas curves & US shut in range

Source: CME, Timera Energy

Weak demand in Asia has seen large volumes of surplus LNG flowing into Europe (JKM pushed down onto TTF). With the more price sensitive coal to gas plant switching options in the power sector exhausted, TTF has now been pushed down onto Henry Hub.

TTF prices falling to Henry Hub levels points to the substantial shut in of US export volumes across summer 2020. The majority of Gulf Coast LNG liquefaction terminals source gas at or close to a Henry Hub cost basis. In order to avoid cash losses on US exports, TTF needs to cover the variable costs of getting gas to Europe (over and above the Henry Hub feedgas cost).

The grey shaded range on Chart 1 shows our estimate of the variable cost range of liquefying and transporting gas to sell at European hubs (0.75-1.50 $/mmbtu depending on sunk cost dynamics across different LNG portfolios). Forward TTF prices are now well below this range out until Q4 2020.

While there is a strong media focus on the current spot price fireworks, the rest of the forward curve is much more important from a price signal and investment perspective. And the TTF gas curve is in a very steep state of contango, with forward prices doubling from under 2 $/mmbtu currently to 4 $/mmbtu by Dec 2020. From that point the strong influence of the US shut in range exerts itself again as a ‘soft floor’ for TTF & JKM prices, as can be seen in the right hand panel of Chart 1.

Could negative gas prices be on the way?

Negative gas prices are already a reality in some part of the US gas market (e.g. prices in the Permian have ranged from minus 0.5-1.0 $/mmbtu). But these dynamics reflect specific constraints in getting gas out of high shale production zones. Could broader global gas price benchmarks also turn negative?

The answer to this question will be determined by the US gas market, given Henry Hub is driving global gas price dynamics across summer 2020.

There are several reasons why negative Henry Hub prices look unlikely:

- Demand: The rapid ~20% reduction in global crude demand has been driven by a near standstill in aviation demand combined with a large reduction in vehicle usage. US gas demand is not facing a similar demand shock, with consumption currently supported by heating usage, which will transition to demand for cooling across the summer.

- Supply: Henry Hub gas prices actually rallied as oil plunged last week, supported by an anticipated reduction in associated gas production as shale oil plays scale back given lower crude prices. This negative correlation between crude & gas prices in the US is something to watch closely.

- Storage: US storage levels are currently higher than average (about 20% above 5 year average for this time of year). But there is currently ample storage capacity given the injection season only started a couple of weeks ago.

A more plausible situation is that TTF trades at a negative basis to Henry Hub across the coming summer. That has already happened at the UK NBP this month as prices at the front of the forward curve fell below Henry Hub given large volumes of Qatari LNG imports into UK regas terminals.

There is strong structural price support for TTF (& JKM) from the shut in potential of US export capacity, up to 60 mtpa (82 bcma). But within a 4 to 6 week logistics window this relationship can breakdown. Within this horizon, marginal cargoes may be locked into delivering to Europe, even if doing so pushes prices below Henry Hub. The cargo that pushes TTF prices through Henry Hub may have already been produced and liquified.

Despite all of the current excitement around low and negative gas prices, we still expect the global gas market to form a multi-year low this summer. And that is the case even if there is a more prolonged Covid-19 induced recession. The key reasons: structural demand growth in Asia, declining domestic production in Europe and a huge reduction in new LNG supply from 2020 (48 mtpa) to 2022 (4 mtpa).