The EU is better known for considered diplomacy than picking fights. But it has come out swinging punches with its approach to a carbon border tax.

“This is a bold attempt by the EU to export a carbon price signal globally…

..and it has major implications for European energy markets”

EU assertiveness in laying out a Carbon Border Adjustment Mechanism (CBAM) is driven to a large extent by political and economic necessity.

The ‘Fit for 55’ and ‘net zero’ policy targets mean Europe needs to start decarbonising its industrial sector fast. A clear implication of this is ‘carbon leakage’. Imposing decarbonisation costs on European industries will erode competitiveness and drive a shift in production away from the EU.

The potential economic & political implications of carbon leakage provide a big incentive for the EU to protect industry. Several factors are contributing to an urgency for action:

- A policy realisation that new targets require rapid action to address the industrial sector (as well as heat & transport)

- An aim to set out the CBAM ahead of the COP26 summit in Nov, with the tailwinds of a climate constructive US administration and Congress in what will likely be a major confrontation with trader partners (e.g. China, Russia & India).

- A surge in EU carbon prices in 2021 which is already imposing significant incremental cost on industries. Free allowances provide some buffer, although not from carbon cost pass through into higher power prices.

The EU faces a huge challenge in implementing an effective CBAM. The recent announcement is only an opening shot in what is likely to be a long and drawn out battle.

The result may look quite different to this initial proposal. But there is now enough information to allow us to start to grapple with the important implications that a CBAM may have for energy markets.

In today’s article we focus on a brief summary of the proposed CBAM and some of its potential impacts.

How the proposed CBAM works

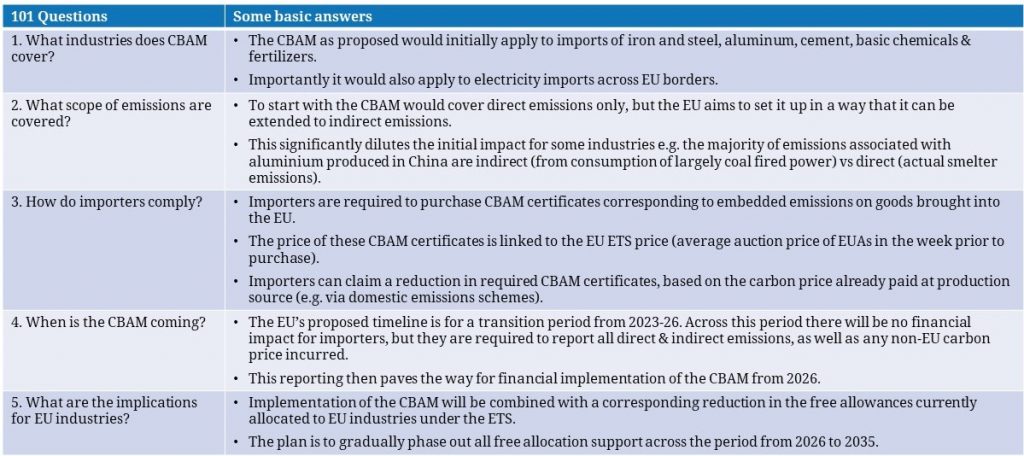

The EU CBAM proposal contains a door-stopping 291 pages of details. We attempt to distil this down to a few key takeaways in the table below.

The key countries that the CBAM will impact can be grouped into 3 broad categories:

- Closely aligned ‘friends’: Switzerland, Norway and the UK who have climate policy goals that are largely aligned and / or integrated with the EU

- Direct neighbours: Russia, Ukraine & Turkey, important from both and industrial and an electricity import perspective.

- Major trading partners: China, India, Sth Korea and the US, likely representing the biggest challenge from an implementation perspective.

It will take some inspired EU diplomacy to negotiate a path through this landscape while avoiding a trade war and falling afoul of the World Trade Organisation (WTO).

That said, this is a bold attempt by the EU to export a carbon price signal globally. And clearer carbon pricing is exactly what is required to allow companies and investors to get on with effectively reducing emissions.

5 potential impacts of the CBAM

Given uncertainty around how the CBAM will actually be implemented, it makes sense to be pragmatic in interpreting its impact at this stage.

So we finish with 5 broad observations on the potential impact of the CBAM on European energy markets:

- Higher carbon prices: demand for EUAs from EU based industries should rise, with the CBAM increasing competitive advantage vs importers.

- Higher power demand: industrial power demand should also be supported for a similar reason (& gas demand, although noting the requirement to decarbonise).

- Lower power imports: costs of importing power from neighbouring countries with a lower carbon price will rise, reducing flows.

- Lower power price spreads: following this logic, power price spreads to neighbouring countries should also decline (e.g. reducing interconnector returns).

- Limited ‘close’ border impact: The impact across Swiss, Norwegian and UK borders is likely to be limited by policy alignment and converged carbon price signals. Not so e.g. for Russia & Turkey.

An ‘all else being equal’ caveat applies to these points.

Another important potential implication of CBAM implementation is that it strongly incentivises inaccurate reporting of emissions or outright fraud by importers or producers outside the EU. The EU faces a huge challenge in ensuring consistent & accurate reporting across a range of countries, companies & complex supply chains. It may also need to deal with governments that try and introduce ineffective carbon taxes in an attempt to protect industry.

For all the challenges ahead, the CBAM has huge implications for decarbonisation & energy markets. It is worth keeping a close eye on the CBAM into the COP26 summit in Glasgow in November. It will be particularly interesting to see how constructive the US is in supporting the EU’s push for what could be a transformational implementation of carbon border pricing.