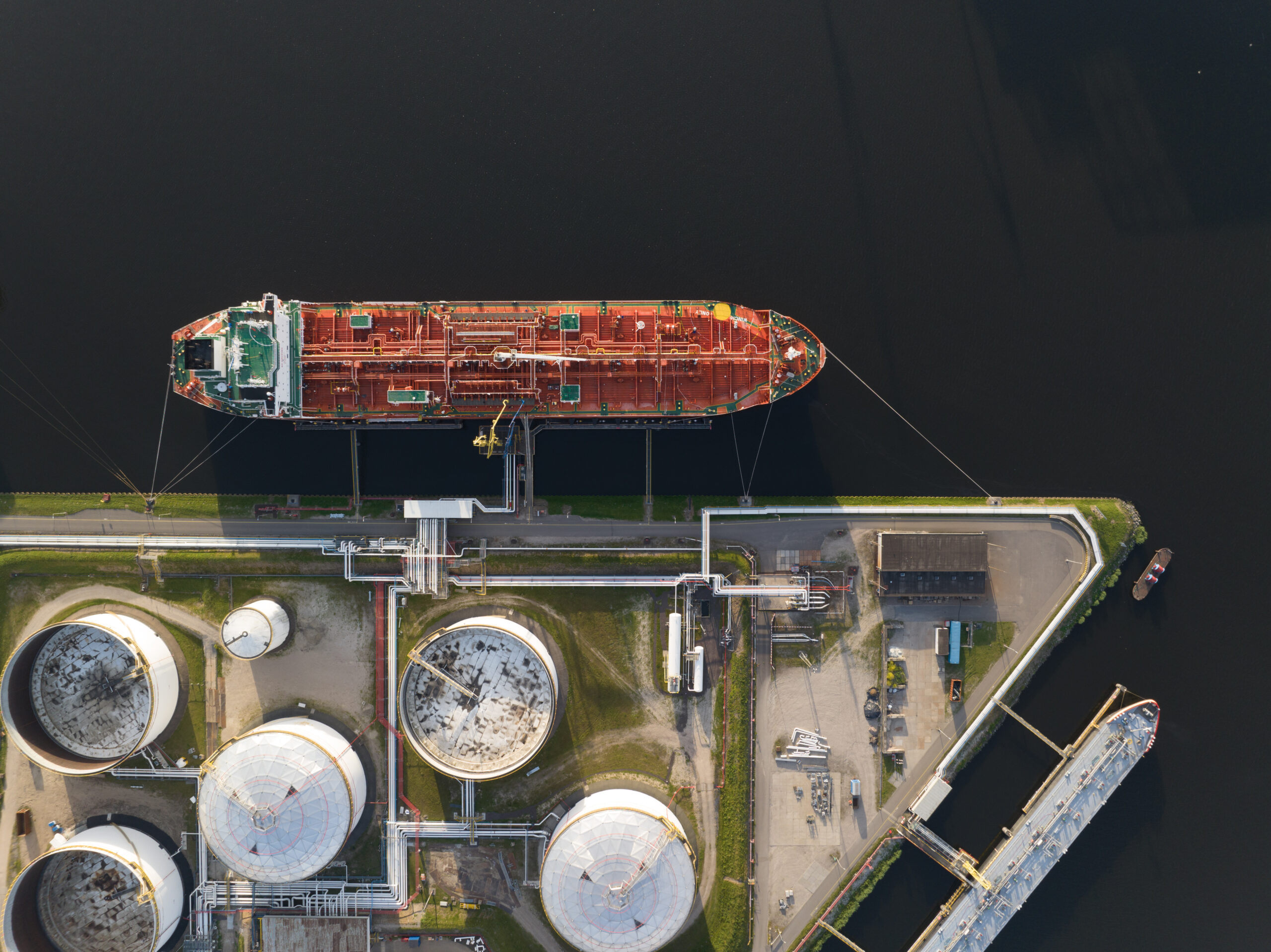

Large LNG producer

We were engaged to support our client bid for a large LNG portfolio with Pacific / Atlantic basin footprint.

View our challenge, solution and results

Client Challenge

As commercial advisor we supported our client with analysis of LNG market evolution & valuation of portfolio contracts & assets.

Our Solution

We modelled our client's existing & target portfolio in our LNG Bridge portfolio model under a range of scenarios. We analysed both standalone portfolio value & synergy value from acquisition.

Result

Our analysis supported both the non-binding & binding bids as well as identifying key value drivers and risks.