Dynamic Containment (DC) has just celebrated its 1 year anniversary. This ultra fast frequency response ancillary service product has underpinned a UK battery revenue party since its inception in Oct 2020. But it is past midnight at the DC party and the drinks supply is starting to run dry. There is still some fun to be had, but the end is in sight.

“It is past midnight at the DC party and the drinks are running dry”

DC moves to EFA block procurement

DC revenues have underpinned very strong margins for UK batteries across the last 12 months. The DC market has been structurally short capacity (i.e. DC demand exceeds available battery supply), resulting in prices clearing at a soft cap of 17 £/MW/h.

That is the equivalent of around 150 £/kW/year of revenue for batteries, approximately double the levels required to cover the Long Run Marginal Cost of investment.

Up until last month, National Grid had procured the DC service in daily blocks on a ‘paid as bid’ basis. But from 15 Sep 2021, Grid moved to procuring DC on a four hourly EFA block ‘paid as cleared’ basis.

Grid has also split DC requirements into two product types; the main DC-L (low frequency) product and an incremental DC-H (high frequency) product to be introduced in Nov 2021.

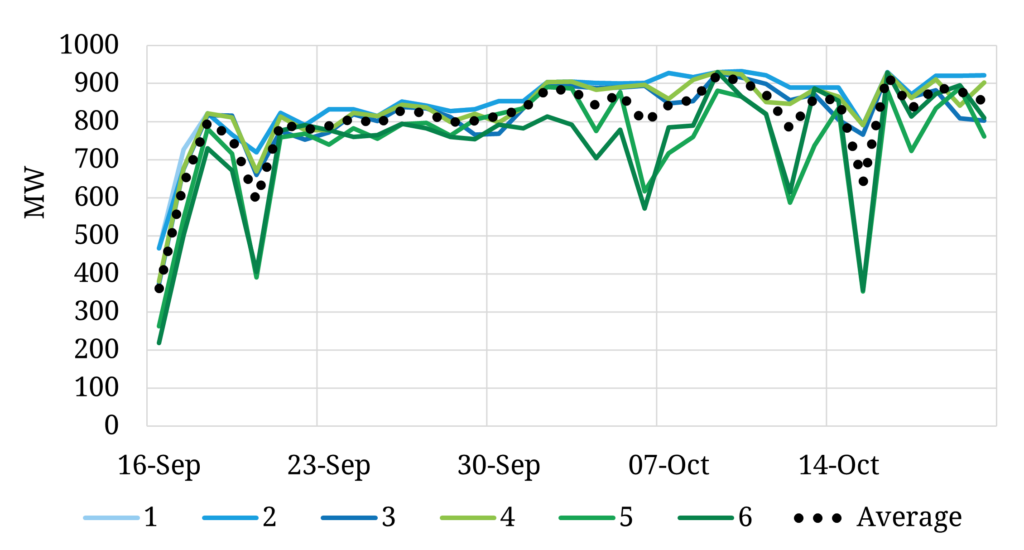

Chart 1 shows cleared DC auction volumes across the 6 EFA block periods since the changes were introduced. Overall cleared volumes for DC remain healthy (around 800MW on average). But DC volumes in the evening blocks 5 & 6 have started to drop off, with batteries optimising more dynamically across DC and energy markets.

Looking forward there is a clear drop off in Grid demand for DC services. Grid’s DC-L volume requirements for Nov 2021 and Summer 2022 have surprised to the downside. For example in Nov 21, zero volume is required 93% of the time in block 5 and 37% of the time across all blocks.

The music is still playing at the DC party but the fridge is emptying fast.

DC saturation is approaching

The changes we set out above, represent Grid taking a more targeted approach to procuring DC services. There is another more important factor that will impact DC revenues.

A significant volume of new battery capacity is set to come online across the next 12 months, with total UK installed capacity is likely to approach 2GW in 2022. Grid demand for DC services is likely to stabilise around 1GW, with a further ~0.5GW of demand for FFR (Grid’s other key frequency response service).

The situation we have seen across the last 12 months of a structurally short DC market is coming to an end. As the supply of batteries exceeds Grid’s demand for frequency response services, prices are set to fall.

How much? Ancillary revenues are likely to be anchored by the risk adjusted opportunity cost of expected returns in the wholesale & balancing market (or even lower given the overheads costs of monetising merchant battery value). We have a precedent for this logic from FFR market saturation and are already seeing the dynamic switching between ancillary services and energy arbitrage across volatile periods.

The approaching normalisation of DC returns is by no means the death of battery investment. An increasingly tight and volatile energy market is providing record energy market returns this winter and there are strong tailwinds supporting battery returns going forward. But battery investment cases will be underpinned by wholesale & balancing revenues, not ancillary services.

Timera is recruiting We are actively looking for new people to join the Timera team across a range of roles. Two specific ones we are currently targeting:

- Senior Analyst (Power) – strong practical knowledge of European power markets and value drivers of flexible assets, particularly storage & batteries.

- Senior Analyst (LNG) – strong experience of LNG portfolio commercial & value drivers / risk / analytics.

We offer very competitive packages as well as the ability to directly participate in company value upside. We offer significantly more flexibility & autonomy than other companies, covering e.g. location, work hours & remuneration structure.

Timera has an open, innovative & entrepreneurial environment and we work on a variety of stimulating analytical challenges across the rapidly evolving energy industry.

See here for more details timera.sobold.dev/careers or email us at recruitment@timera-energy.com