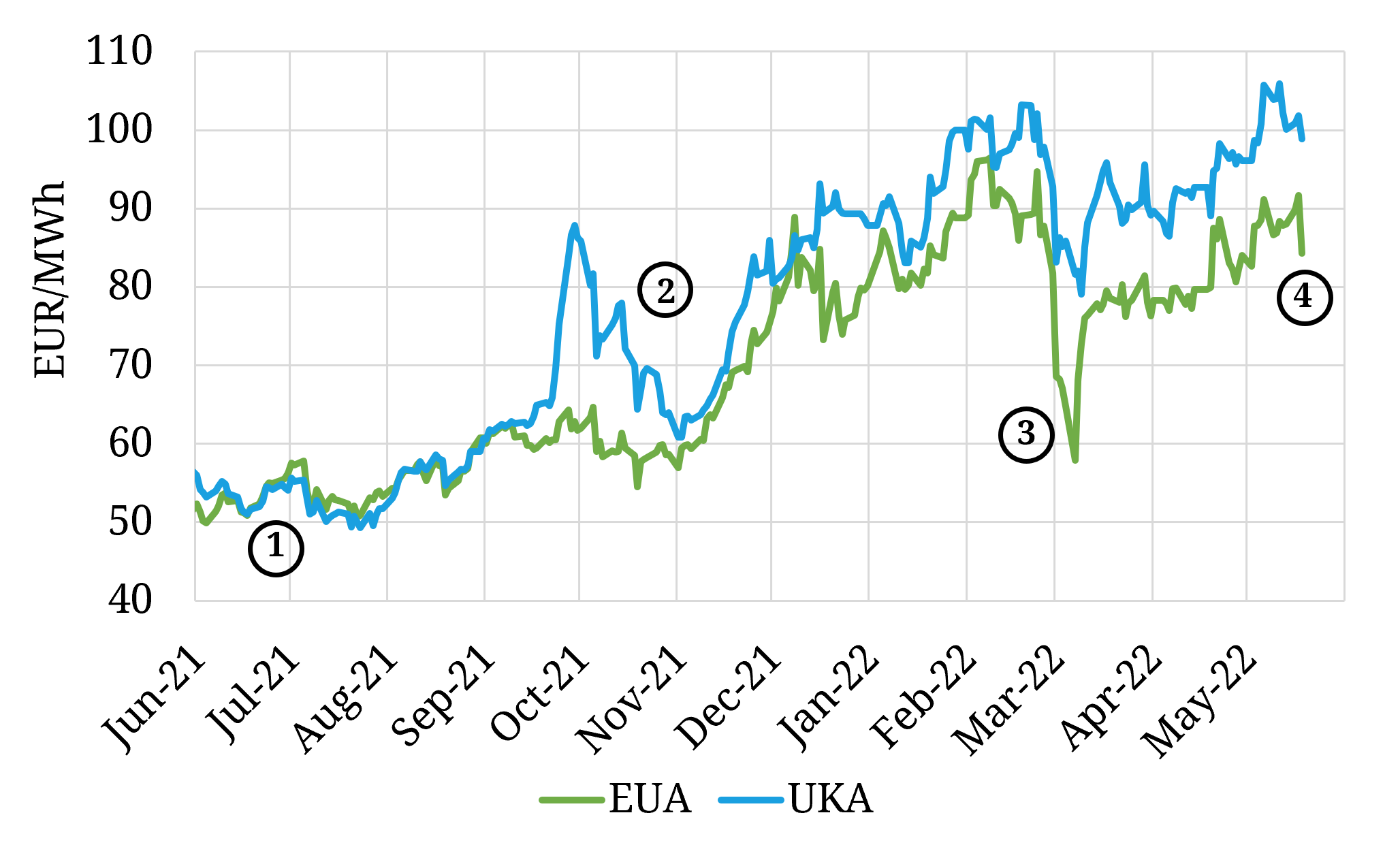

European carbon market (EUA) prices over the past year have generally been on a steep trajectory, driven by an accelerating policy momentum behind decarbonisation. There have been several notable highlights along the way:

- The introduction of the UK carbon allowance (UKA) market scheme in May 2021 following Brexit

- The start of the price dislocation between UKAs and EUAs, driven by a structurally tighter UK market design and rehedging from EUAs to UKAs

- High European fuel & power prices following the Russian invasion of Ukraine led to high margin call & collateral requirements. In order to cover these requirements there was an outflow of capital from the carbon markets, causing an almost 40% drop in EUA prices

- European carbon prices have since recovered to over 90 EUR/t as the capital returns, but the Russia-Ukraine impact has reared its head again. The planned EC intervention to raise 2bnEUR by selling 250m allowances from the MSR to go towards reform & investment towards the 2050 target of climate neutrality (which has been accelerated by recent events) has caused an over 10% drop in prices

While the carbon market is delivering a price signal consistent with the drive towards decarbonisation, the EC may be feeling the pressure as it comes alongside the high gas & power price and inflationary environment.