The European gas market has driven global LNG market pricing across most of the last decade. This is a direct result of Europe’s role in providing price responsive volume flexibility, allowing the global LNG market supply & demand balance to clear.

“European flexibility has acted as both an LNG market ‘sink’ and a ‘tap’… but it is becoming structurally inhibited”

The three factors that enable European gas market flexibility provision to the LNG market are:

- Switching between gas & coal plant across European power markets

- Large volumes of underground gas storage (vs relatively low capacity in Asia)

- Significant annual & daily flexibility in Russian supply contracts (ACQ / DCQ).

These sources of flexibility have been important drivers of marginal pricing at TTF, which in turn has anchored LNG market pricing e.g. at Asia’s benchmark JKM price marker.

This flexibility has allowed Europe to act as both:

- A ‘sink’ during times of surplus LNG in Asia, via higher import volumes (e.g. Q4 2018 – Q2 2020)

- A ‘tap’ during periods of strong Asian LNG demand, via cargo diversion flexibility (e.g. Q1-Q3 2018; Q2-Q4 2020).

We are entering a new LNG market regime where Europe’s ability to provide flexibility is becoming structurally inhibited.

European flex provision currently inhibited

Two of the three major sources of European flex we list above are currently inhibited.

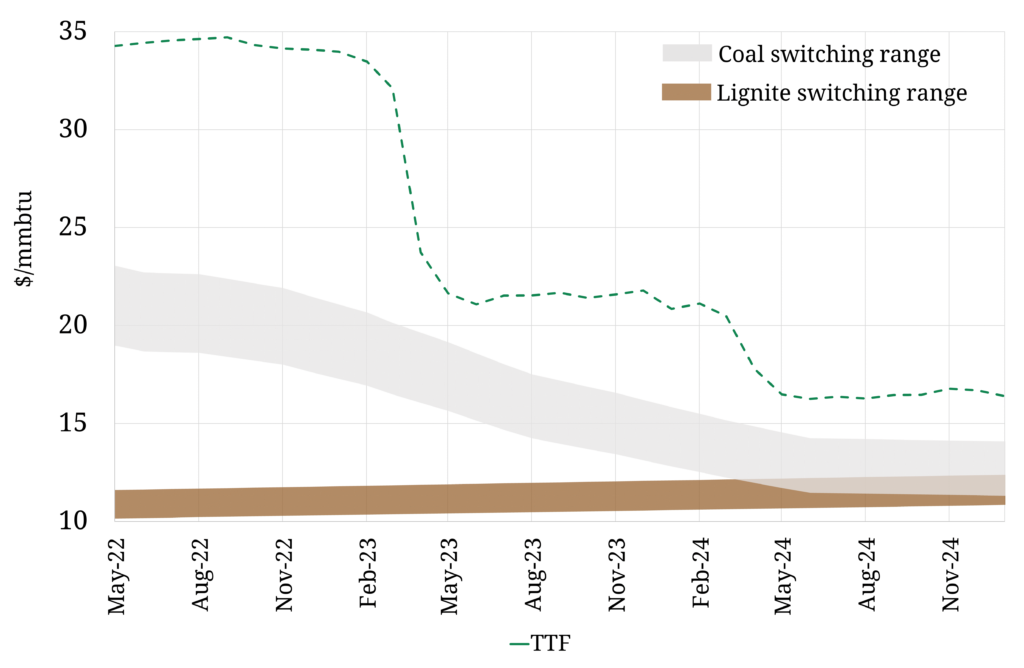

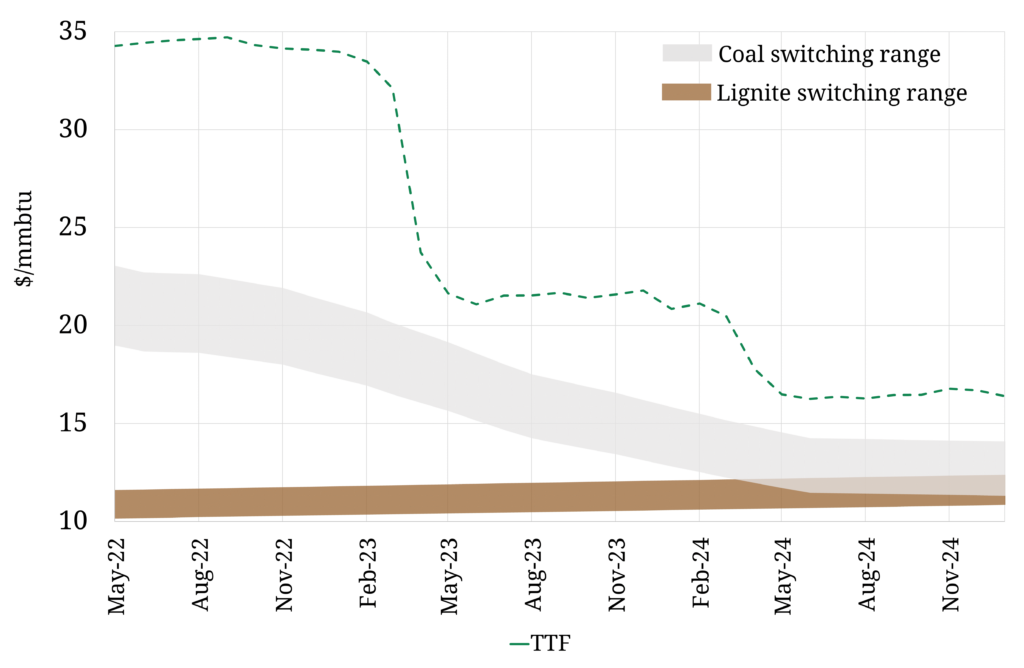

Power sector switching, the first and most important source of flex, has been inhibited by market pricing dynamics. Very high gas prices mean Europe’s power sector is effectively fully switched (i.e. coal plants are running at maximum output). This is illustrated in Chart 1 with the TTF forward curve (green dashed line) well above coal & lignite switching ranges until at least 2024.

Chart 1: Switched out - European gas prices vs switching ranges.

Source: Timera Energy, TTF

The second source of inhibited flex is gas storage. New government storage volume mandates across Europe are reducing the commercial flexibility of storage sites to respond to market price signals. This is also unlikely to change across the next few years, until there is a substantial reduction in Europe’s dependence on Russian gas.

Somewhat ironically, Russian long term contracts are the only major source of supply flexibility that have not so far been significantly inhibited. This of course could change if any Russian flow interruptions occur due to the current conflict.

Structural erosion of European flex

Could European price responsive flexibility return if the impacts of the Russian conflict ease? In our view, current events are just accelerating what is a structural decline in traditional sources of flexibility. For example:

- The European coal fleet is set to be largely closed (or at least allocated to capacity reserves) by 2030, substantially reducing power switching potential

- Europe is aiming to reduce Russian import volumes as quickly as possible; supply flex will decline accordingly

- Stricter storage mandates may remain in place for years given security of supply concerns.

From an LNG market pricing perspective, the closure of Europe’s coal fleet is the most important of these factors. Switching ranges have anchored TTF and in turn LNG spot markers (e.g. JKM) across most of the last 7-8 years.

As gas market flexibility erodes under this new market regime, Europe is transitioning from a more passive role as a swing market, to directly compete with other markets in Asia & Latin America for available LNG.

What drives LNG market flexibility & pricing going forward?

The gradual erosion of European gas market flexibility, particularly from power sector switching, is set to increase the importance of other price responsive demand sources across the LNG market. This includes:

- gas intensive industry in Europe (e.g. ammonia production)

- power sector switching & industry in Asia.

Marginal price setting via these demand sources is not going to be as smooth as European power sector switching. Switching is both (i) price responsive – given liquid price signals and (ii) granular – given switching across hundreds of gas & coal plants.

Industrial demand response & Asian power switching is much less responsive & granular e.g.

- It can take weeks to months for Asian power switching respond in scale

- Industrial response is lumpy, limited in flexibility and can have significant lead times.

We recently set out the case for a regime shift in the LNG market as Europe pivots away from Russian gas to compete directly with Asia & Latin America for available LNG. This new regime is not just about higher prices. It is also set to be characterised by higher price volatility and changing correlations between TTF, JKM & Brent.

Under the new regime, the erosion of Europe’s ability to provide LNG market flexibility structurally underpins higher price volatility, as less responsive demand sources set marginal prices. That drives up the value of LNG portfolio flexibility across the supply chain.

As usual we don’t publish a feature article on Easter Monday but we’ll be back the following week.