The success of Europe’s decarbonisation strategy depends on very large amounts of private infrastructure capital being efficiently deployed into flexible power assets. This is achievable. It is happening already with the surge in wind & solar investment, supported by feed in tariffs and CfDs that transfer market price risk to consumers.

“The big challenge for flex asset investors is an inherent asymmetry of information and commercial expertise between investor and offtaker.”

Policy support for renewables has de-risked asset investment cases, reducing required return on capital and increasing the ability to leverage projects. But policy mechanisms underpinning flexible asset investment (required to support the rapid roll out in renewables), is at an earlier stage of evolution.

This has pushed the challenge of managing market risk onto infrastructure investors. But most infrastructure investors are not interested in developing the trading & commercial capability required to monetise flexible assets. So they have turned to established third party trading entities for offtake contracts to underpin investments, optimise assets and provide market access.

The structure of contracts between investors and offtakers is evolving rapidly. But it remains one of the key hurdles for investors in assets such as batteries, gas peakers and demand response. In today’s article we look at how offtake contracts are evolving to support flex asset investment.

The two parties to an offtake contract

Offtake contracts can address three main issues faced by investors in flexible assets:

- Downside protection: limiting the left hand tail of asset return distributions e.g. via a margin floor

- Market access: providing a trading execution capability to access power, ancillaries and balancing markets

- Trading & optimisation: optimising dispatch and hedging of asset flexibility to capture & monetise value

These capabilities require specialist commercial expertise, systems, analytics, credit lines, data & communications access. Importantly the offtaker also requires risk capital to support asset monetisation. So offtakers (e.g. Centrica, EDF, Statkraft, Orsted) need to recover costs and overheads from providing these services as well as making a return on risk capital.

Offtake contract structures

Flexible asset contracting structures are evolving very quickly. But most of the underlying elements of offtake contracts have been around for more than 20 years, developed to support thermal power plant investments.

At the core of any offtake structure negotiation is the challenge of how asset risk & return is shared between the two parties. Investors are prepared to give away a portion of asset value upside, to secure adequate downside risk protection. Offtakers are looking to cover their costs, gain access to asset flex value and ensure they can adequately manage the downside risk they take on (e.g. through their portfolio or via hedging).

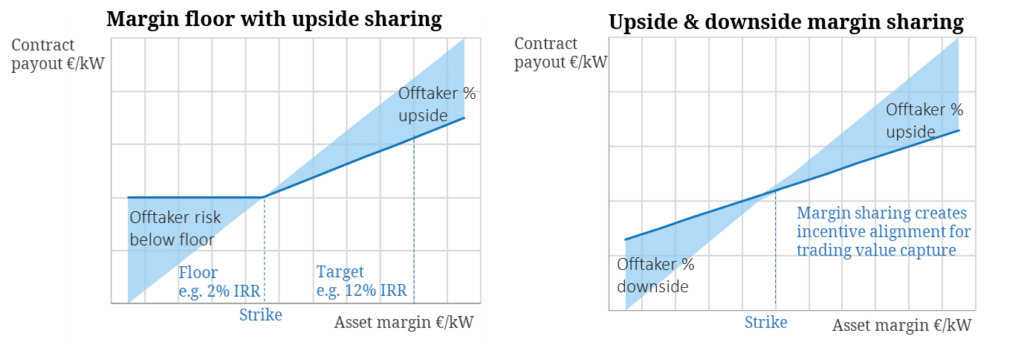

Chart 1 provides a simple illustration of two relatively common mechanisms to achieve these goals.

In the left hand panel, the offtaker is providing a margin floor to limit the investor’s downside market risk. The floor (essentially a put option) is typically significantly out of the money, but can provide an infrastructure investor with important protection in terms of underpinning return of capital. The cost of that floor usually consists of a fixed fee structure (e.g. monthly) and an upside sharing incentivisation mechanism, where the offtaker takes a defined percentage of realised returns.

The structure in the right hand panel is involves a similar principle but without the cost of a margin floor. Here the structure ‘dampens’ the investors downside risk below a defined margin level, for the price of allowing the offtaker a percentage of value generated above that level. There is often a trade off between fixed fees and the defined percentage of upside share.

There are many other structures within an offtake agreement that can be used to allocate risk and return.

Terms moving in investor favour but watch for pitfalls

The good news is that offtake contract terms have moved significantly in favour of investors over the last 12 months. Investment in battery storage, co-located storage and PV and gas engines is helping to drive momentum. Improving terms reflect:

- Increasing competition to provide offtake structures amongst trading entities

- Policy & market tailwinds that are improving flex asset value upside expectations and reducing risks (allowing offtakers to offer more attractive terms)

- Structure innovation where elements of successful offtake contracts are being recycled & refined, increasing standardisation of terms and efficiency in tailoring solutions

The big challenge for flex asset investors in negotiating offtake agreements is an inherent asymmetry of information and commercial expertise between investor and offtaker.

Flex asset offtake contracts are substantially more complex than renewable PPAs & offtake agreements. This is because of the importance of trading & optimisation in monetising flex asset value.

Offtakers (trading desks), live and breathe trading & optimisation. They have specialist commercial expertise, sophisticated analytics and a strong understanding of how flex assets interact with markets to create value. That is not a capability that is easily acquired by an infrastructure investor entering into an offtake contract negotiation.

There is a long history of offtakers using this asymmetry to their advantage at the expense of asset owner value over the term of a contract. Classic issues that can arise include:

- Inability for the investor to objectively benchmark, audit & incentivise trading performance

- Offtaker conflict between maximising value of the investor’s assets versus other asset in the offtaker’s portfolio

- Allocation of offtaker’s ‘losing trades’ to the investor’s assets

- ‘Hidden terms’ that allow offtakers to claw back value e.g. through execution fees or acquiring embedded options

- Value leakage through the incentive mechanism, where equity value bleeds to the offtaker over time

- Concealed risk pushed back onto the investor e.g. from asset outage or availability risk

Time invested in getting an offtake contract right at the structuring and negotiation stage can pay big dividends over the lifetime of the agreement.