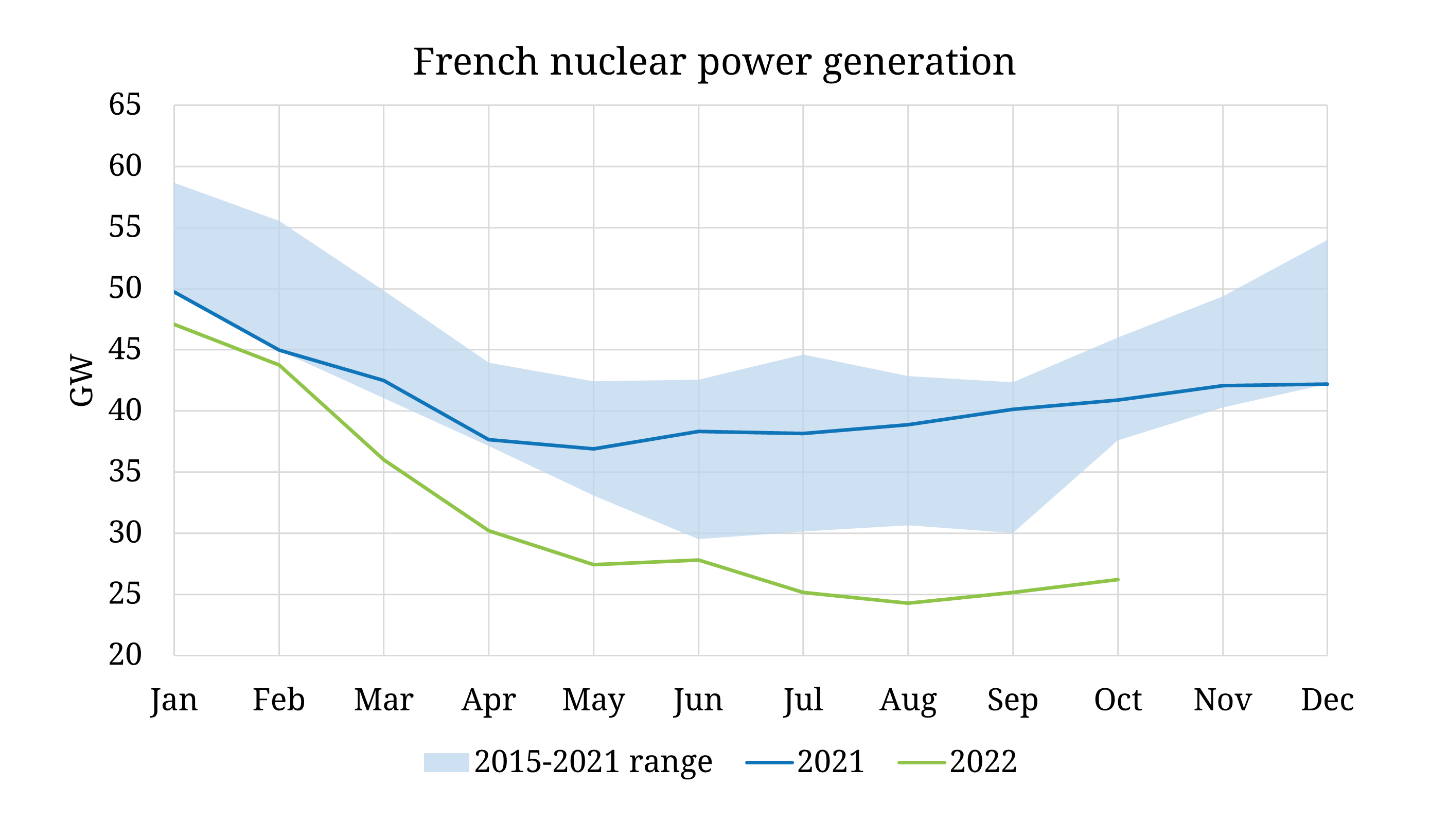

Europe is currently in the midst of a parallel power and gas crisis. Low French nuclear output this year has been a key contributor. Overdue maintenance and corrosion issues have hampered availability and led to multi-year monthly lows since the start of the year. Year to date generation of ~215 TWh is set against a reduced yearly target of 280 – 300 TWh. The dearth of nuclear generation has led to a seismic shift in French interconnector dynamics. From 2015-2021 France averaged 1.3 GW export to the UK, but during 2022 this role has reversed with France importing 1.1 GW on average from the UK.

French power prices have jumped to huge premiums over neighbouring markets to incentivise these imports. While the French government (currently nationalising EDF) are targeting 50 GW of availability by mid winter (from 30 GW now, and average 25 GW in September), this has not been sufficient to materially reduce these forward location spreads. Q1-23 French baseload power prices are above 1000 €/MWh, a more than 500 €/MWh premium to Germany, and a 100 €/MWh premium over the UK.

Output estimates of 2023 (300-330 TWh) and 2024 (315-345 TWh) show improvement. As 2022 has shown however, maintaining the plants to run at levels necessary to mitigate the European power crisis is no easy feat.