France’s 63GW nuclear fleet underpins the orderly operation of European power markets. These plants alone have historically generated around 15% of the European Union’s total annual electricity output. The importance of French nukes is magnified in North West Europe, given the accelerating closure of ageing thermal plants and rapid increase in intermittent wind & solar output.

“Many of the issues impacting this winter are more structural in nature…

…consistent with power markets that need more flexibility”

The core role of French nuclear capacity means availability problems can send shockwaves across European power markets. The winter of 2016-17 was a memorable case study, where safety related outages caused a sharp tightening in the European power market balane, driving a surge in power prices and volatility.

The impact of Covid has seen record low levels of French nuclear output in 2020. EDF has flagged ongoing nuclear availability issues across the coming winter, and reduced output guidance until at least 2023.

In today’s article we look at how power forward markets are pricing in a step up in winter risk premium. We also consider the impact of ongoing nuclear availability issues on the value of flexible power assets, such as CCGTs, peakers, interconnectors and batteries.

What is going on with French nuclear?

French annual nuclear output has historically been in the 390-400 TWh range. Output fell to 380 TWh in 2019 as EDF’s fleet was impacted by maintenance and safety related issues. But in Q1 2020, as the world confronted the onset of Covid, EDF’s guidance range for 2020 output remained a relatively robust 375-390 TWh. The reality has been a very different story.

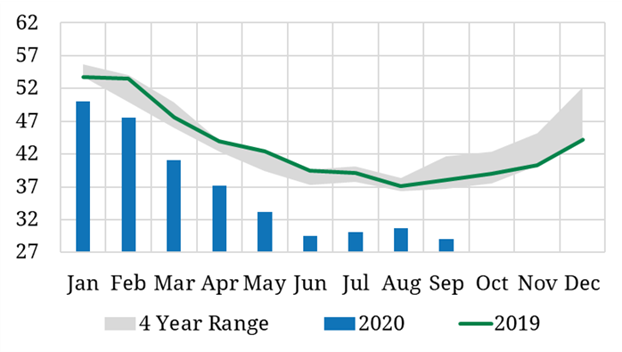

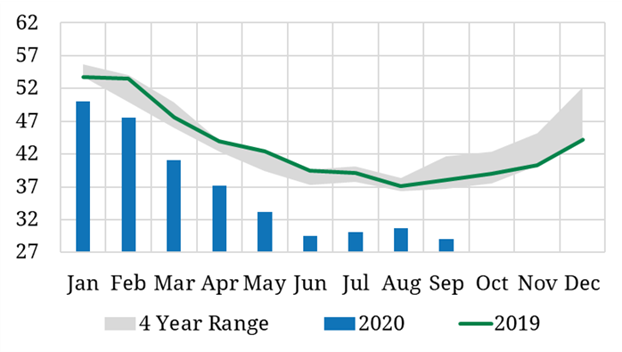

Chart 1 illustrates the substantial drop in average French nuclear output in 2020 compared to recent years. We have shown output in average GW terms (vs TWh) to give a sense of how low fleet capacity utilisation has been.

Chart 1: 2020 French nuclear output compared to 2019 and the previous 4 year range

Source: Timera Energy, ENTSOE

EDF shocked the market in Apr 2020 by slashing its output guidance by more than 20% to 300 TWh. We’ll come back to the market impact of that announcement in the section below, but it reflected the impact of Covid related issues on what was already a heavy 2020 maintenance program. Output guidance was revised up slightly in Jul 2020 to the current 315 – 325 TWh level (still a steep discount to normal).

Six French nuclear plants have major 10 year overhauls that need to be undertaken in 2020, in addition to planned maintenance & refuelling outages across other plants. Covid lockdowns delayed maintenance schedules with knock on impacts across the fleet. But there has also been a more enduring impact of new Covid-compliant maintenance processes at plants, contributing to EDF reducing output guidance to 330-360 TWh across 2021-23. EDF has announced up to 10 day increases in planned outage windows across the next two years.

The issues that have come up this year highlight several considerations going forward:

- Availability issues with France’s ageing nuclear fleet appear to be steadily rising

- Very strict safety regulations mean outage timing can often be sudden, inflexible & extended

- Covid related delays and process issues are not helping, i.e. availability uncertainty has increased significantly this year

- EDF does not have a good track record of clear & transparent communication of output guidance to the market, reinforcing market uncertainty.

The combination of these factors is driving a French nuclear related risk premium into forward market price signals.

What is the forward market telling us about French nuclear risk?

In theory, this winter should be OK. French nuclear output is scheduled to recover strongly in Q4 2020 as plants return from maintenance. European power demand remains at lower than normal levels, although the shortfall is declining steadily and now looks to have reduced to less than 5%. And hydro storage levels coming into the winter are relatively healthy.

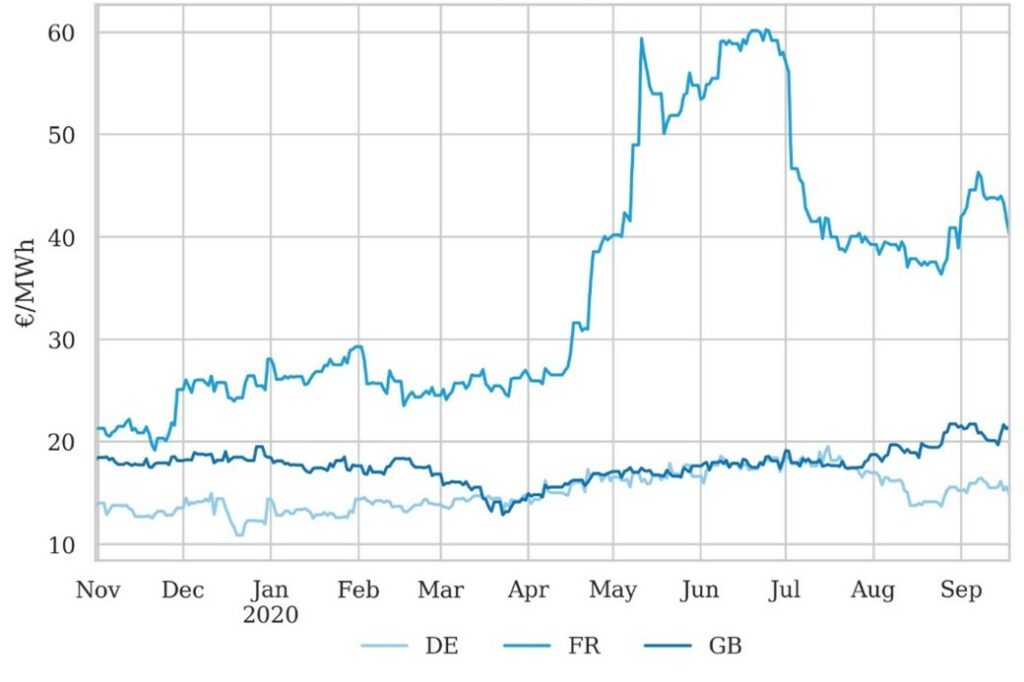

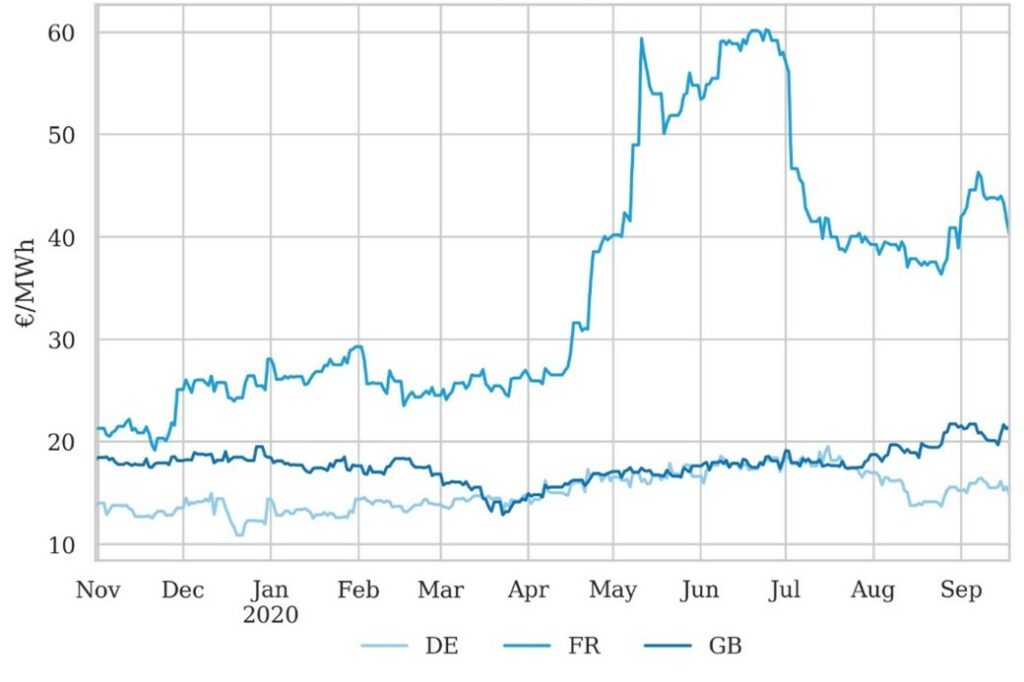

But Europe’s forward power markets are not so sure. Chart 2 shows the evolution of Winter 2020-21 forward Peak Clean Spark Spreads (CSS) across the last 12 months in France, Germany and the UK. These effectively show the forward generation margin of CCGT plants. As such they reflect the market price signal for gas-fired generation flexibility.

Chart 2: French, UK & German Winter 2020-21 Peak Clean Spark Spreads

Source: Timera Energy, ICE

The impact of EDF’s 300 TWh nuclear output guidance reduction in Apr 2020 is pretty clear, with French Peak CSS exploding higher across April & May (doubling over the space of 4 weeks). EDF’s upward guidance revision (315 – 325 TWh) at the start of July calmed the market somewhat (Peak CSS fell).

But a substantial forward price impact remains as we enter winter, reflecting a market risk premium around nuclear output uncertainty.

What about the impact on the UK & German markets?

The movements in French CSS in Chart 2 appear to somewhat dwarf those in the UK and Germany. But this is deceptive.

One of the drivers of the jump in forward peak French power prices and CSS is the requirement for France to significantly reduce net exports across the winter to compensate for lower nuclear output. This requires a price signal to incentivise gas-fired plants in key neighbouring markets such as the UK (with its carbon price floor) and Italy (with higher PSV gas prices) to run more.

UK Winter Peak CSS has risen around 50% since EDF slashed nuke output guidance in April. That is a big move in historical terms and peak CSS (at around 20 £/MWh) is well above average levels of recent winters.

But the rise in UK spark spreads is not just about French nuclear risk. Spark spreads have steadily risen across the last six months, reflecting several important drivers:

- Lower expected net imports of power across UK interconnectors (with FR, NL & BE)

- A higher risk premium for potential shocks e.g. French nuclear issues or cold weather that could reverse interconnector flows as in Winter 2016/17

- UK plant availability issues e.g. Hunterston nuclear outage, mothballing of the Calon CCGT portfolio & anticipated reduced short term flex response from older coal units

- Rising balancing related network charges (BSUoS) in 2020 that are being passed through into power prices by marginal generators.

The story in Germany is somewhat different. Since EDF’s revised July guidance on nuclear output, a clear divergence can be seen between UK and German Peak CSS in Chart 2. The fall in German spark spreads reflects a stronger availability of alternative flexibility, from the German coal fleet, hydro storage and an additional 2.5 GW of CCGTs returning from mothball (across DE & NL).

In contrast to Germany, UK spark spreads have continued their upward trend since July. This is consistent with the fact that the UK is becoming inherently more exposed to external shocks as the market loses thermal capacity and replaces it with intermittent renewable capacity and interconnectors.

This is not a one winter issue for flex asset value

It is easy to get excited about a unique set of risks for a given winter. But many of the issues that we describe above impacting this winter are more structural in nature. For example:

- Nuclear availability issues

- Accelerating closures of coal, nuclear and older gas plants

- Increasing swings in wind & solar output

- Rising levels of interconnection that transmit the impact of shocks across markets.

This is consistent with the rapidly increasing flexibility deficit across European power markets that we set out earlier this year.

Despite the Covid related demand slump, there have been a number of market price signals flagging a requirement for greater flexibility across 2020. As well as rising clean spark spreads (Chart 2), there has been an increase in prompt & balancing price volatility, rising intraday price shape and an increase in some ancillary services revenues.

These price signals impact gas-fired plants, batteries, demand flex and interconnectors in different ways. But the pricing dynamics of 2020 are consistent with power markets that need more flexibility.