Work on the much awaited new Bond film ‘No Time to Die’ began in 2016. After several delays and much suspense, it is due to be released later this year. The Nordstream 2 pipeline has followed an uncannily similar development timeline and after its own set of delays and suspense, is set to start flowing gas around the time we’ll be making for the cinema’s to find out what SPECTRE has in store for Bond.

“Gazprom has capacity to flow more gas into Europe but is choosing not do so, despite soaring prices.”

The Nord Stream 2 pipeline has become symbolic in a geo-political struggle between Europe, the US and Russia. Behind all the political drama are some undeniably simple facts:

- Europe is facing a tightening gas market & soaring prices, with Germany in particular aware of the security of supply benefits of Nord Stream 2.

- The pipeline is essentially completed, with the first of two strings about to be filled and pressure tested and the second to follow across the next few months.

The softening stance of the US against Nord Stream 2 has paved the way for its commissioning later this year. In today’s article we look at how Russia’s influence over the European gas market has returned in spades and why it is driving a big premium into gas prices.

The Russian flow situation

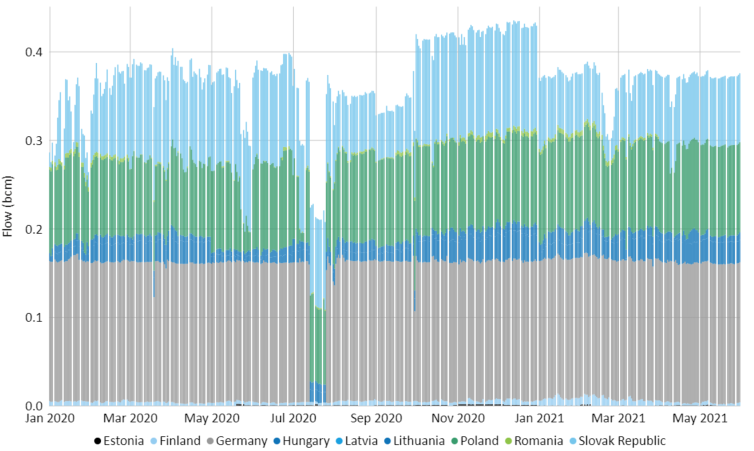

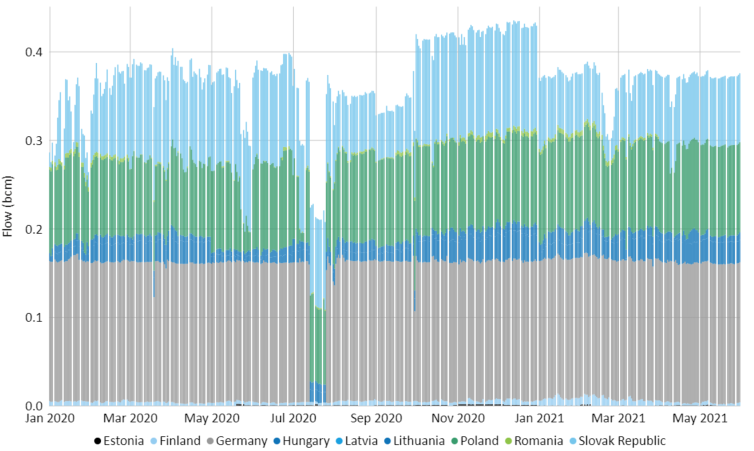

Chart 1 shows the evolution of Russian gas imports into Europe via the principle pipeline entry routes since the start of 2020.

Chart 1: Russian gas imports via primary routes

Source: Timera Energy, ENTSOG

The large stable grey volumes are Nordstream 1 imports (into Germany), Gazprom’s preferred route which is effectively flowing at max capacity.

The green volumes are the Yamal pipeline route via Belarus & Poland, also flowing at or near max capacity since the post Covid shock demand recovery.

The more variable light blue volumes are via the Ukraine/Slovakia route. Gazprom has a temporary transit agreement with Ukraine via this route with a 40 bcma equivalent ‘ship or pay’ volume. Flows via this route rose in Q4 2020 as gas hub prices recovered, but have conspicuously fallen back to minimum ‘ship or pay’ levels in 2021.

Despite a substantial increase in European hub prices in 2021 to above 28 €/MWh (10 $/mmbtu), Gazprom has shown no inclination to increase gas flows via Ukraine or place volumes on its ESP sales platform. This lack of supply response from Russia, against a backdrop of a tight LNG market and rising switching levels, is supporting price rises.

Russian strategic interests & gas price implications

In a tight gas market, Russia controls the marginal molecule of supply into Europe. Gazprom has capacity to flow more gas into Europe but is choosing not to do so, despite soaring prices.

There are strategic considerations in play, particularly around Nord Stream 2. Russia’s willingness to watch hub prices rise is putting pressure on Europe to clear the way for Nord Stream 2 commissioning.

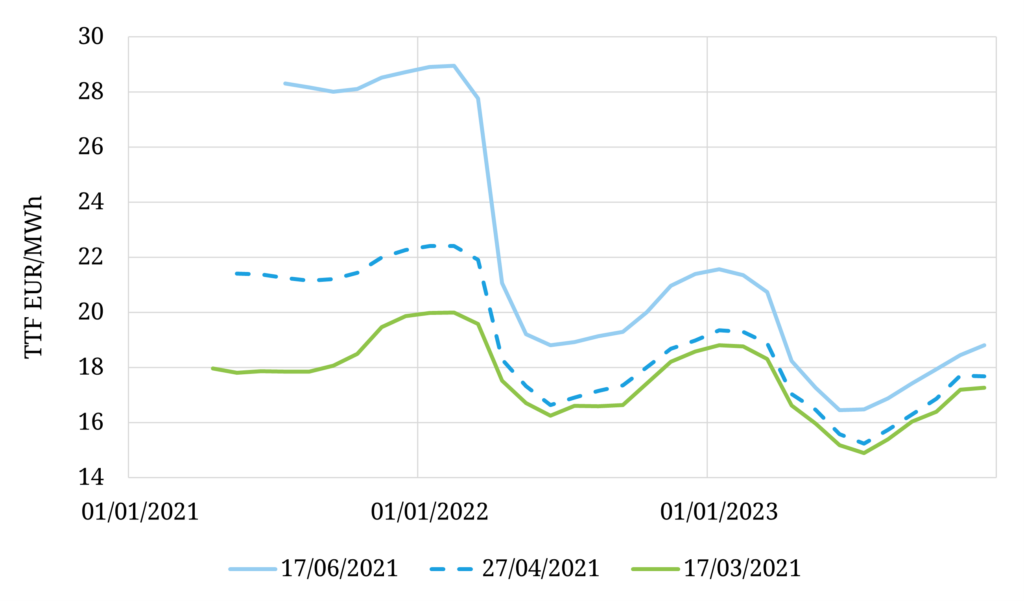

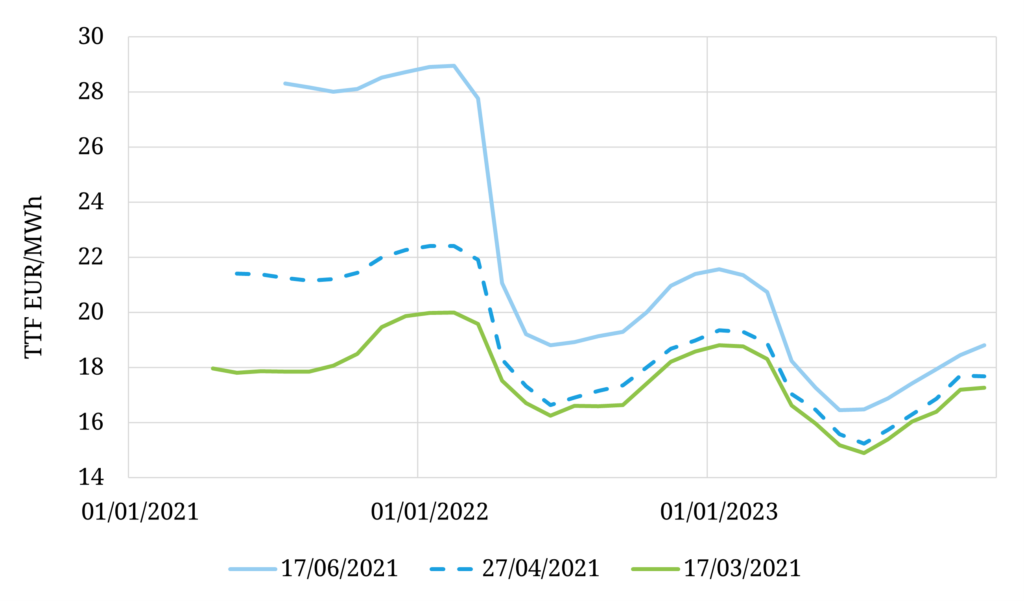

The implicit ‘reward’ for completion of this pipeline is additional flow volumes via Gazprom’s preferred Baltic route. Those volumes can have a substantial impact on market prices and a very steep backwardation in the TTF forward curve recognises this, as shown in Chart 2.

Chart 2: Evolution of TTF forward curve across last 3 months

Source: Timera Energy, CME

As the European gas market has tightened in 2021 and switching levels have soared with rising carbon & coal prices, the front of the TTF curve has surged. From 2022 onwards, price movements have been more subdued and the anticipation of incremental Russian imports via Nordstream 2 is an important driver.

The current gas market balance in 2021 means that an incremental molecule of gas demand must effectively be met by expensive switching of gas generation with coal or lignite. The TTF forward curve shape is consistent with incremental Russian imports in 2022 pushing hub prices back through key switching range levels to settle in a more balanced market state.

Whether the market obliges will depend on Russia’s flow strategy and the evolution of gas demand in both Europe and Asia.