Commercial evolution of the LNG market has accelerated over the last three years. This is the result of new and more flexible sources of supply. But it also reflects new market players, rising liquidity and a transition to shorter & more flexible contracting. As the LNG market grows and matures, substantial value creation opportunities are emerging.

These opportunities are reflected in the evolution of LNG market players. Big producers (e.g. Shell, BP, Total) are expanding their value chain presence. Trading focused intermediaries (e.g. Vitol, Gunvor, Trafigura) are driving liquidity growth and evolution of the traded market. Large buyers (e.g. JERA, Kogas, Pavilion) are expanding their portfolio footprints and developing commercial capabilities or JVs to support this growth.

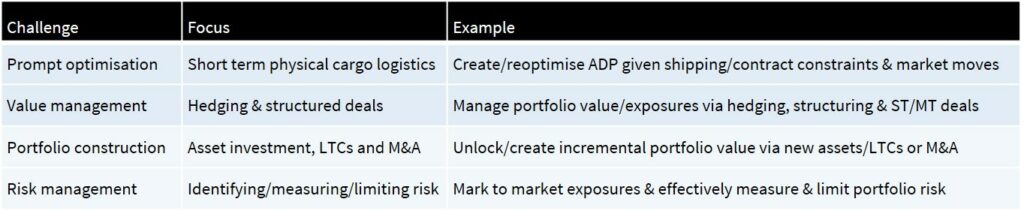

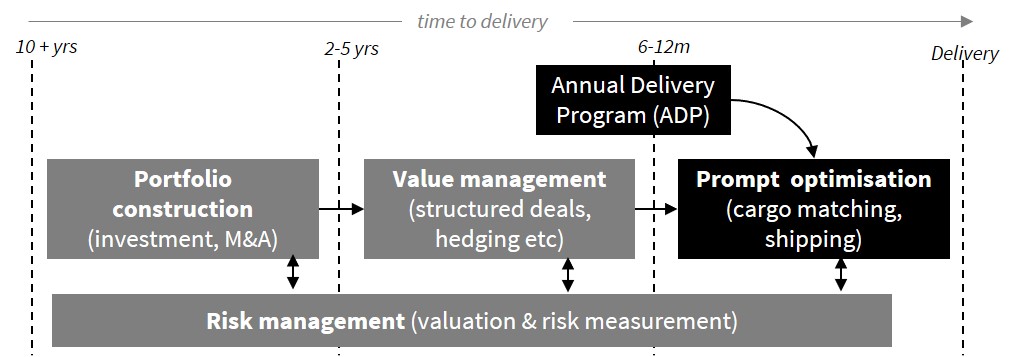

One of the foundations of successful value creation is a robust commercial analysis framework, to tackle:

- Shorter term optimisation of portfolio flexibility, constraints & logistics

- Management of portfolio value via hedging & structured deals

- Creation of incremental portfolio value via new assets/LTCs or M&A

- Risk management of portfolio exposures

A successful analytical framework plays a key role in gaining a competitive edge when building and optimising an LNG portfolio. In today’s article we set key challenges and success factors in developing a solution. This draws on our first hand practical experience working with some of the largest players in the market to develop their in-house solutions.

5 key challenges of LNG portfolio analysis

Building an effective LNG portfolio analysis framework means confronting several key challenges.

1.Value chain interdependence

In many markets, liquid prices mean that portfolios can be valued and managed at an individual asset level. This is not the case with LNG portfolios. The value of LNG assets within a portfolio is interdependent, given the physical & contractual complexity of the LNG supply chain. As a result, valuation & optimisation needs to be tackled on a portfolio basis, recognising asset interactions & constraints.

2.Bespoke business models

Each LNG business model & portfolio has bespoke analytical requirements. These relate to the specific exposures, constraints & logistics of portfolio components. Requirements are also driven by the business model of the portfolio owner e.g. ‘trader’ focus on building portfolio optionality, ‘buyer’ focus on managing physical supply. The bespoke nature of the problem undermines the effectiveness of ‘off the shelf’ analytical solutions.

3.Illiquid markets

Despite rapid growth, the LNG market remains relatively illiquid & has complex physical & contractual logistical constraints (e.g. shipping, ports, canals, pricing & volume flex). This creates challenges in valuing & hedging complex (e.g. non linear) exposures. But these liquidity constraints also lie at the core of value creation opportunities. A transparent but robust deconstruction, optimisation & valuation of complex exposures underpins an effective analytical solution.

4.LNG price behaviour

LNG prices are not normally distributed! Standard pricing models do not capture complex relationships across LNG price markers. For example, the levels of price spreads, volatility & correlation depend on the prevailing ‘regime’ of the market. Pricing dynamics in a well supplied market tend to reflect convergence, high correlations and low volatility. In a tight market, prices temporarily diverge with correlations falling and volatility rising. Getting price analysis right can generate big competitive advantage.

5.Lack of standardised methodologies

Because of the 4 issues we set out above, there is a lack of standardised methodology for LNG portfolio analysis. As a result, companies are developing bespoke solutions. But a consistent approach is evolving across a number of the key analytical building blocks required (e.g. formulation of constraint problems, valuation approach for specific types of optionality). This is breaking down the barriers to developing an effective solution.

If those are the 5 key challenges, what are the success factors underpin a solution?

Creating & analysing LNG portfolio value

How is value created?

The most accurate answer is probably… in a pub over a ‘five o’clock’ beer.

But behind the deals that underpin a portfolio, value is created via the interaction between:

- Constraints & stress points in the LNG supply chain

- Changes in market dynamics.

Value is captured via constructing & optimising an appropriate combination of portfolio components & optionality. Understanding the way that portfolio value is practically created and monetised is the most important success factor in building an effective analytical solution. There is some important theory behind this, but theory on its own is useless.

How is this represented analytically?

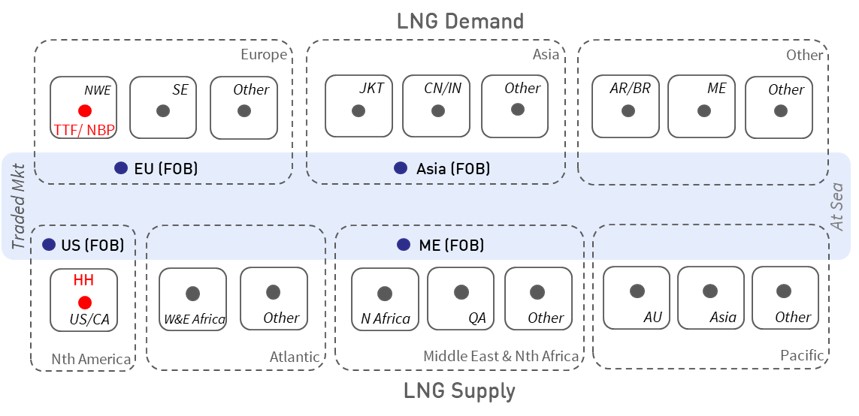

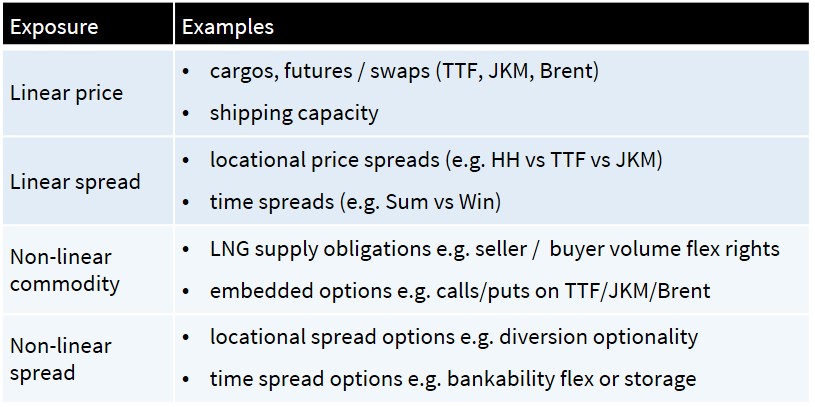

LNG portfolios can be simplified using market price ‘nodes’ and asset ‘exposures’. Market prices act on exposures to drive portfolio value. Diagram 1 shows a simple illustration of key LNG market price nodes. Diagram 2 summarises some key LNG portfolio exposures.