Cold weather across North West Europe sparked a surge in gas price volatility last week. The epicentre of system stress was the UK gas market. But the parallel spike in NBP and TTF prices reflected a UK and Dutch fight for gas across the interconnectors, with price shocks reverberating across the European gas hub network.

In today’s article we summarise the events that culminated in one of the sharpest bursts of gas price volatility this decade. We also touch on how this impacted other European hubs and the UK power market. But more importantly we consider the potential implications for policy, supply flex value and the re-pricing of portfolio risk.

Anatomy of a gas market shock

System stress built over the course of last week as temperatures plummeted across NW Europe. The impact of the arctic blast peaked on Thursday where the UK TSO (National Grid) forecast a 50 mcm shortage of gas for the day and issued its first ever gas deficit warning.

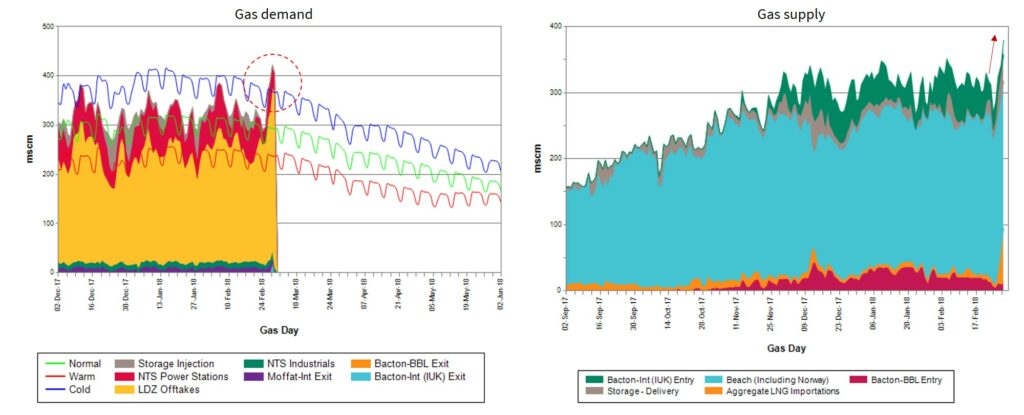

Demand reached its highest level since 2010 on Thursday (410 mcm). There were also significant weather related supply infrastructure outages (Kollsnes 16 mcm, SEGAL 18 mcm & a temporary halt on South Hook terminal send out). This saw the UK’s first real test of system deliverability in a post Rough environment.

Within-day prices were elevated across the day, peaking at an unprecedented 450 p/th on Thursday evening. Grid was actively buying back gas from large industrials at elevated prices to help balance the system.

Within-Day prices at the Dutch TTF hub also rose above 120 €/MWh as Europe’s two primary hubs battled for limited gas supply. Other hubs across Europe were caught in the price uplift, although most traded at a significant negative basis to NBP and TTF as we showed in our Snapshot column on Fri. The exception was PEG Nord with Northern France facing a shortage of gas driven by declining LNG send out and falling Norwegian deliveries.

Chart 1 illustrates how UK supply flex responded to the sharp jump in price signals. Storage withdrawals (~80 mcm) and LNG tank send out (~60-80 mcm) played a key role in plugging the gap. The ability for LNG terminal send out at this rate is typically restricted to a couple of days given limited inventories. Interestingly the IUK interconnector was importing at lower than normal rates as TTF price rises kept pace with NBP.

These short term fireworks had little impact on NBP and TTF forward curves beyond the horizon of the current cold spell. The fact that the impact of system stress was focused on prompt prices is a sign of a well functioning commodity market.

UK power market reaction

UK power prices leapt in sympathy with gas prices, but market stress was actually less acute. A liquid gas market ensures direct pass through of higher spot gas prices into power prices. Very high gas prices saw power prices jump above 100 £/MWh later last week, even in the context of a market that had capacity headroom to spare.

Stress in the power market was highest on Thursday morning when unusually cold weather impacted the ability of several large CCGTs and a nuclear plant to start. But elevated gas prices ensured that CCGTs were at a significant variable cost disadvantage to coal units. This saw 11GW of coal capacity running baseload which along with healthy wind output helped to cap system tightness.

The events of last week are a reminder of several evolving power market dynamics:

- Gas volatility: As the UK gas market becomes more import dependent, rising gas price volatility is set to translate into higher power price volatility, given the price setting dominance of gas-fired power plants.

- Coal closures: The replacement of 11GW of coal capacity with other flex is causing a major transition in price setting dynamics to the right of the supply stack (e.g. GTs and engines have much higher variable costs than coal).

- Outages: Flexible infrastructure outages tend to be correlated with market shocks (e.g. due to cold weather), particularly for ageing assets.

Policy implications of this market shock

The key takeaway from the events of last week is that markets worked as they should. Security of supply was maintained through a period of major system stress driven by a combination of very high demand and supply outages.

In the short term, gas supply is inelastic (unresponsive to price). This means temporary market shocks cause extreme short term price movements to ensure the balance of supply and demand. This price volatility is evidence of well functioning markets rather than system failure.

The UK gas market in particular needs investment in new deliverability flexibility after the closure of Rough storage (as we have written about previously). Spot volatility is the price signal required for investors to commit capital.

Expect a repricing of portfolio risk & supply flex

While recent gas market tightness does not constitute market failure, it is likely to trigger a re-pricing of ‘tail risk’. A low volatility environment has steadily eroded risk premiums over the last five years. But market shocks are set to increase in frequency and magnitude as import dependency increases. The extreme nature of recent price moves reinforces the portfolio insurance role of supply flexibility.

Energy supply is a high volume, low margin business that is vulnerable to irregular market shocks. A number of new entrant suppliers have already fallen victim to market price risk this winter. More may follow after last week. As the new entrant supplier model matures, demand for flexible insurance products (e.g. price caps) is set to rise significantly.

This dynamic is already being anticipated by larger gas portfolio players. A re-pricing of risk is reflected in a step change in demand for gas supply flexibility since the closure of Rough. Interest here is twofold: (i) to cover own portfolio risk and (ii) to enable the origination and sale of insurance products to new entrants and less sophisticated players.

The value of flexible gas supply infrastructure is in a cyclical trough. But increasing portfolio demand for gas supply flex points to recovering prices ahead for storage and regas assets.