Europe’s parallel gas & power crisis has continued to ease into 2023. A mild winter & record LNG import levels have been a big help. There is also growing evidence of a structural reduction in gas demand taking place. Forward gas prices remain elevated (2 to 3 times historical averages), but are down 70-80% from the peak of last summer.

“Power sector switching is back in the driving seat”

In today’s article we focus on what happens next, particularly the re-emergence of power sector switching dynamics as a key driver of European energy markets.

Storage buffer calming markets

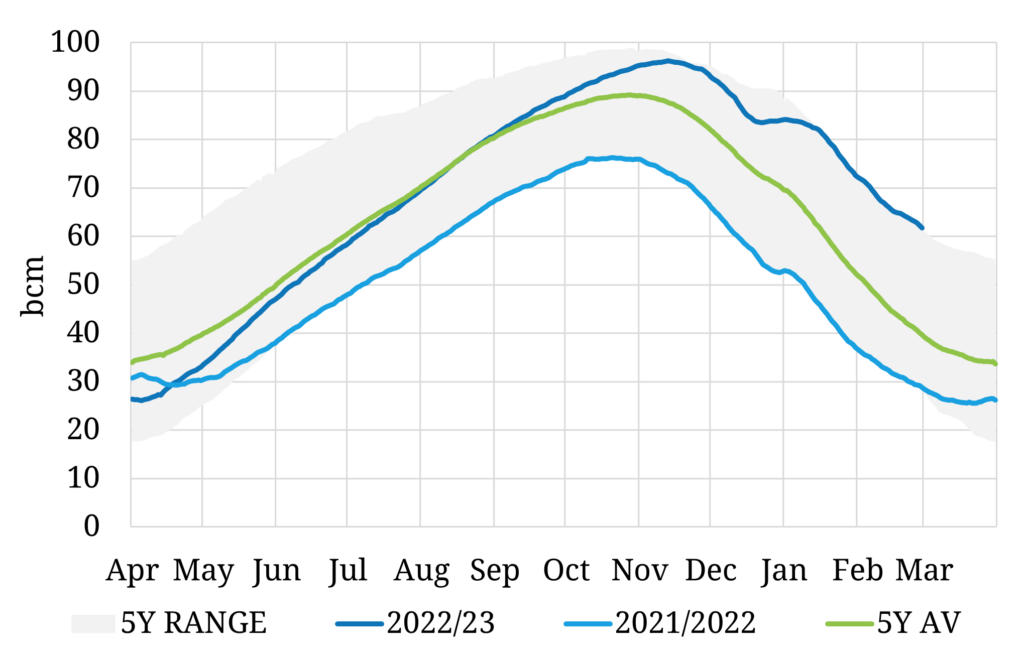

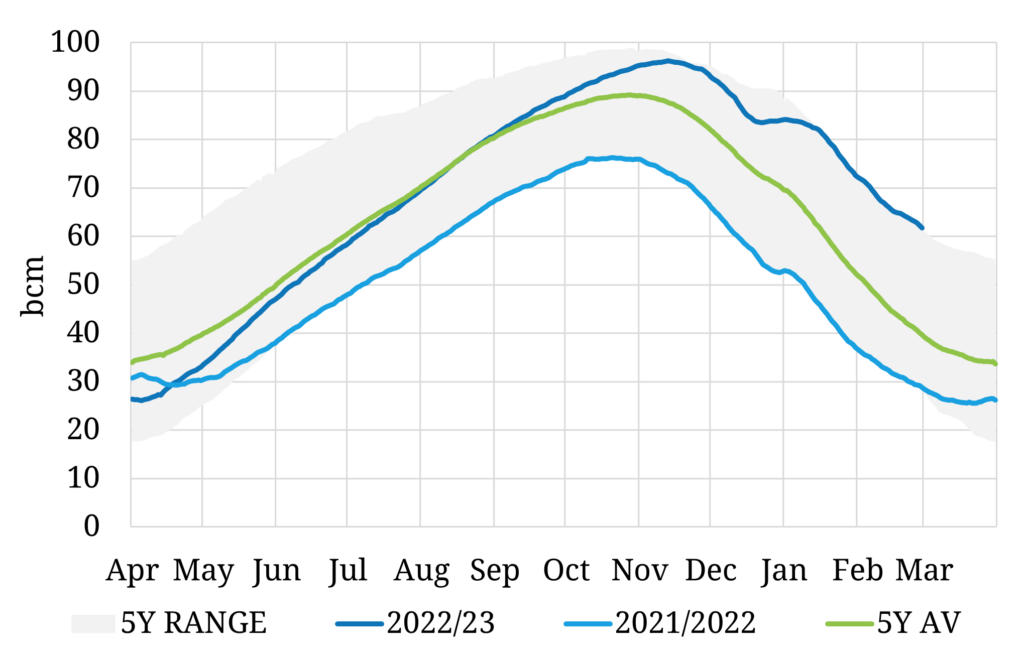

Europe entered this winter with record storage levels, helped by new government mandates. The continuation of a mild winter has seen European stock levels trending near record highs as shown in Chart 1.

Chart 1: European underground storage inventories

Source: Timera Energy, GIE

With a little under a month left of winter, the upside demand risk from a prolonged spell of cold weather is diminishing. Europe looks set to end winter with over 50% of gas in store even if March temperatures outturn below normal.

As such, the task of refilling storages through the coming summer now looks significantly less daunting, with injection demand set to fall at least 25 bcm year on year. This more than offsets the expected ~20 bcm year on year fall in Russian pipeline imports over the course of summer.

Weak storage injection demand is helping to push Summer 2023 prices lower, with the possibility that storage facilities could approach ‘tank tops’ before the end of summer.

LNG import volumes remain very high

European LNG imports have continued to trend near record levels so far in Q1 2023. This reflects the fact that overall Asian demand has remained relatively muted, against a pricing backdrop which remains high in historical terms.

There are however some early signs of a potential recovery in Asian LNG demand. Lower price levels are leading to a re-emergence of some buy side activity in price sensitive Asian markets (i.e. China, India, Bangladesh).

JKM prices have correspondingly moved back to a premium to DES NWE (at parity with TTF) over summer 2023 in a bid to incentivise flexible cargoes West of Suez to transit to more distant Asian markets. There are likely to be lagged effects before China’s post lockdown recovery & stimulus impacts LNG demand so this remains a key area to watch.

Together, high storage inventories and strong LNG imports have seen European gas prices continue to retreat in order to incentivise incremental demand. This has brought power sector switching firmly back into play.

Switching is again anchoring global gas markets

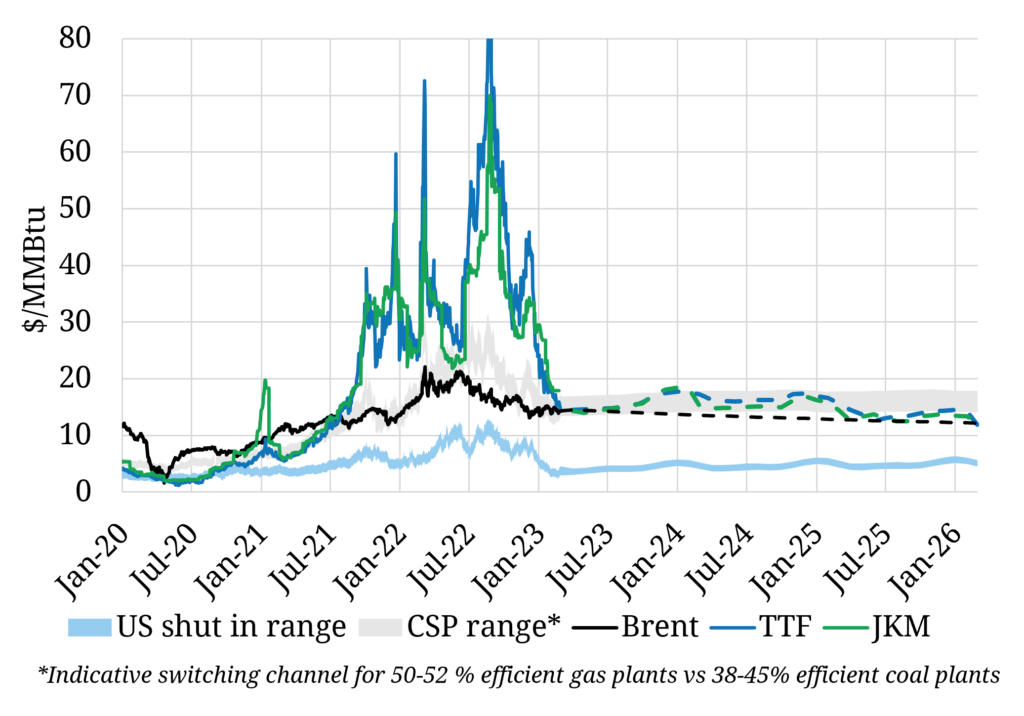

As the European gas market tightened across 2021-22, prices surged above coal to gas switching levels in the power sector as shown in Chart 2.

With a little under a month left of winter, the upside demand risk from a prolonged spell of cold weather is diminishing. Europe looks set to end winter with over 50% of gas in store even if March temperatures outturn below normal.

As such, the task of refilling storages through the coming summer now looks significantly less daunting, with injection demand set to fall at least 25 bcm year on year. This more than offsets the expected ~20 bcm year on year fall in Russian pipeline imports over the course of summer.

Weak storage injection demand is helping to push Summer 2023 prices lower, with the possibility that storage facilities could approach ‘tank tops’ before the end of summer.

LNG import volumes remain very high

European LNG imports have continued to trend near record levels so far in Q1 2023. This reflects the fact that overall Asian demand has remained relatively muted, against a pricing backdrop which remains high in historical terms.

There are however some early signs of a potential recovery in Asian LNG demand. Lower price levels are leading to a re-emergence of some buy side activity in price sensitive Asian markets (i.e. China, India, Bangladesh).

JKM prices have correspondingly moved back to a premium to DES NWE (at parity with TTF) over summer 2023 in a bid to incentivise flexible cargoes West of Suez to transit to more distant Asian markets. There are likely to be lagged effects before China’s post lockdown recovery & stimulus impacts LNG demand so this remains a key area to watch.

Together, high storage inventories and strong LNG imports have seen European gas prices continue to retreat in order to incentivise incremental demand. This has brought power sector switching firmly back into play.

Switching is again anchoring global gas markets

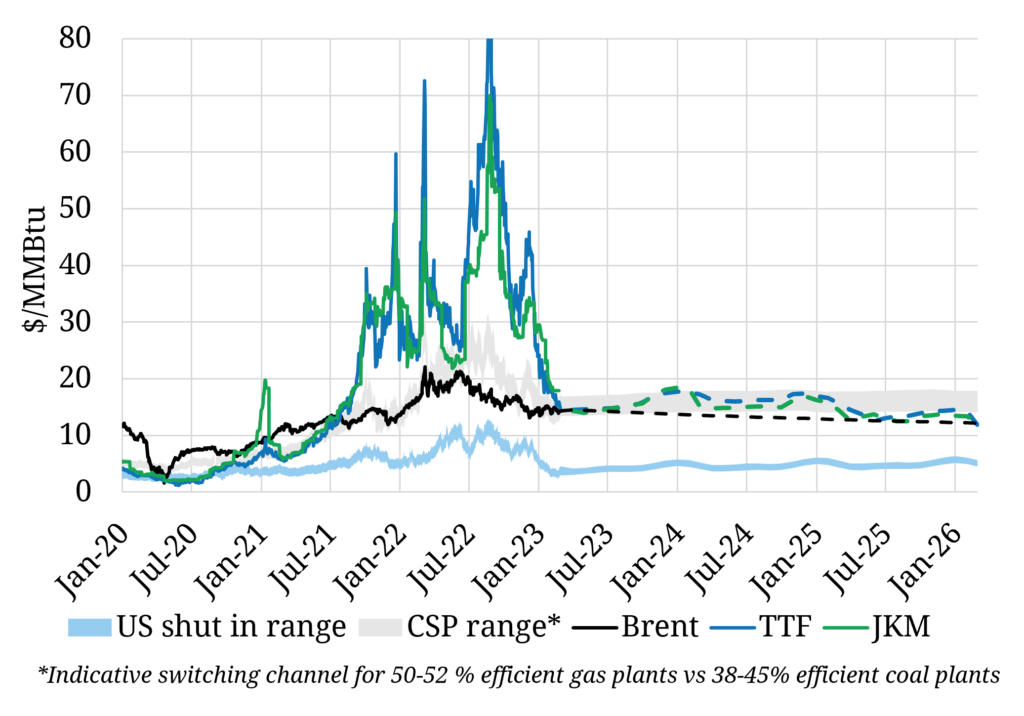

As the European gas market tightened across 2021-22, prices surged above coal to gas switching levels in the power sector as shown in Chart 2.

Chart 2: Key global gas price benchmarks

Source: Timera Energy, ICE, CME

The chart illustrates how the TTF forward curve across 2023-25 has now fallen right back into the switching range (grey shaded area), where coal plant load factors decline in favour of CCGTs, stimulating incremental gas demand.

This Coal Switching Price (CSP) range represents strong support for European hub prices, given the large volumes of gas fired generation that can be incentivised to ramp up by relatively small additional price declines.

The level of this CSP range is directly driven by coal & carbon prices (which determine the cost competitiveness of coal vs gas plants). Both coal & carbon prices remain higher than pre-crisis levels, particularly the EU ETS price which has been testing 100 €/t this year. The strength of these two commodities is an important driver of structurally higher forward European gas prices vs historical levels.

Hub prices are also touching Brent parity equivalent (the black line in Chart 2). This may incentivise oil to gas switching in the industrial (i.e. refinery feedstock optimisation) and upstream production (i.e. NCS) segments, adding to gas price support.

The risk of higher prices & volatility remains

European switching provides strong price support moderating further downside risks, but there is no equivalent form of price resistance to the upside. If European & Asian gas markets tighten again from here we are quickly back to a world of inelastic demand response setting prices.

Against this backdrop, relatively small changes (e.g. further pullback in Russian flows, LNG supply side outages, recovering Chinese demand growth) can result in large price moves and a resurgence of volatility.

This risk will once again be exaggerated next winter when temperature driven demand adds further risk to market balances. The threat of price spikes remains until there is a material ramp up in new global LNG supply (from 2025).

In summary, gas & power markets are stabilising at price levels driven by power sector switching. These represent strong support but don’t underestimate the potential for some more fireworks across the next 2 years.