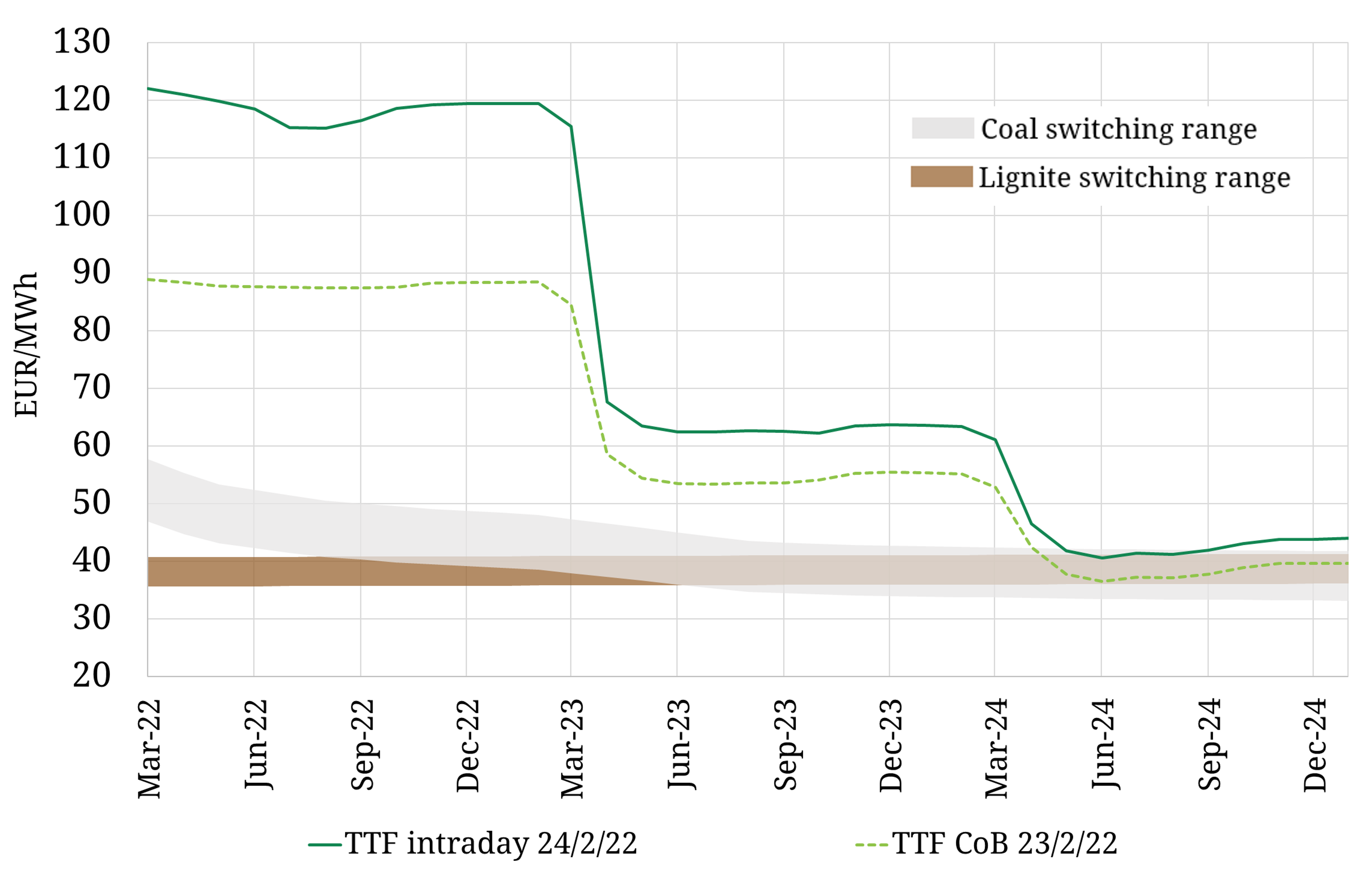

Over the past few weeks, attention in the European gas sphere has moved away from end of winter storage fears and more towards the heating of tensions between Russia and the West over Ukraine. While the far curve (e.g. Summer 2024) has remained anchored by the European power sector switching ranges (grey & brown shaded areas), the risk of low Russian flows through 2023 and a storage deficit to remain into next winter has seen Summer 2023 trading further above the coal & lignite switching range anchors.

The news of Russia launching an invasion into Ukraine this morning has brought this sharply into focus. The chart shows today’s TTF forward price curve (dark green line) & switching levels (post invasion) vs yesterday’s closing TTF prices (dashed green line). Despite Russian gas flows actually being higher than yesterday, massive future uncertainty has caused the front of the curve to rally by almost 40%. With NordStream 2 pushed off the table, Summer 2023 has moved even further above the switching ranges (now over 50% higher).

We will speak in more detail on impacts of the Russia-Ukraine situation in our feature article on Monday.