Gas-fired power plants are the dominant source of generation setting marginal power prices across Europe. This has been clearly illustrated across the last year by the very high correlation between gas & power prices.

“This is a case of security of supply temporarily trumping emissions”

With gas plants producing marginal electrons, any incremental output from other types of generation acts to reduce gas demand. That is why the German government has just published draft legislation to allow 10.4 GW of reserved & retiring coal, lignite & oil capacity back into the market.

The Netherlands, Italy, Austria & France are also taking measures to allow increased coal output. From a decarbonisation perspective, this is a temporary case of security of supply trumping emissions until Europe’s gas supply situation stabilises.

Gazprom’s sudden reduction in Nord Stream 1 flows this month to 40% of normal levels is triggering emergency actions across Europe. All options are on the table to try and ensure continuity of energy supply.

In today’s article we look at gas & coal plant economics and the impact of higher coal output on European power markets.

Coal running ahead of gas across Europe

ARA coal prices for near term delivery are trading above 350 $/t. EUA carbon prices are ranging around 85 €/t. Under any normal conditions prices at these levels would drive coal plants deeply out of merit. Yet gas prices are even higher.

Acute gas market tightness has driven coal plant generation margins (clean dark spreads) to record levels this year. Gas prices are so high that CCGT variable costs are setting power prices at levels well above the variable cost of coal (& lignite) generation.

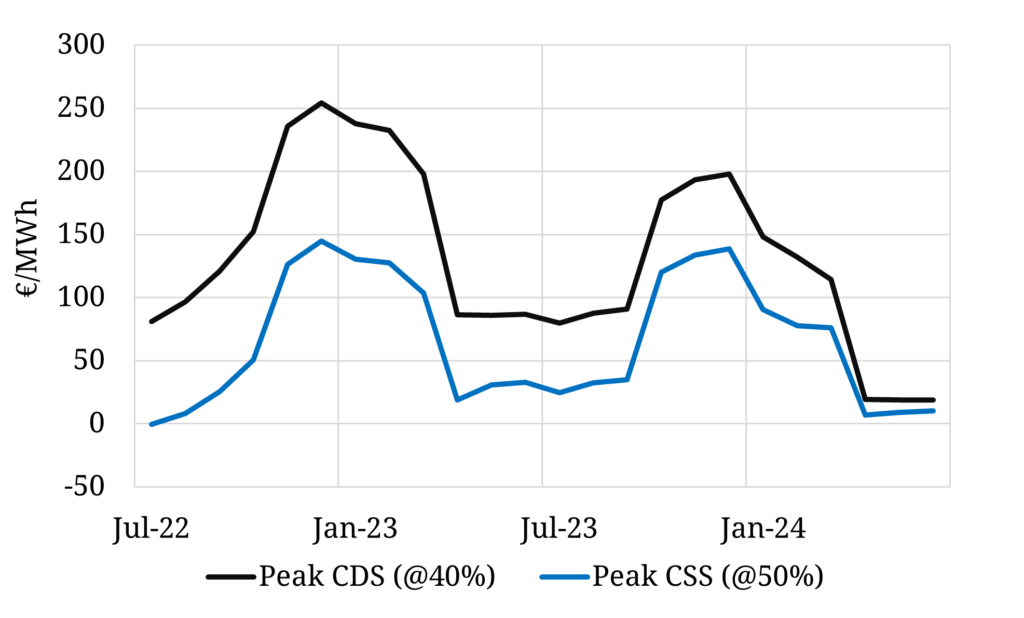

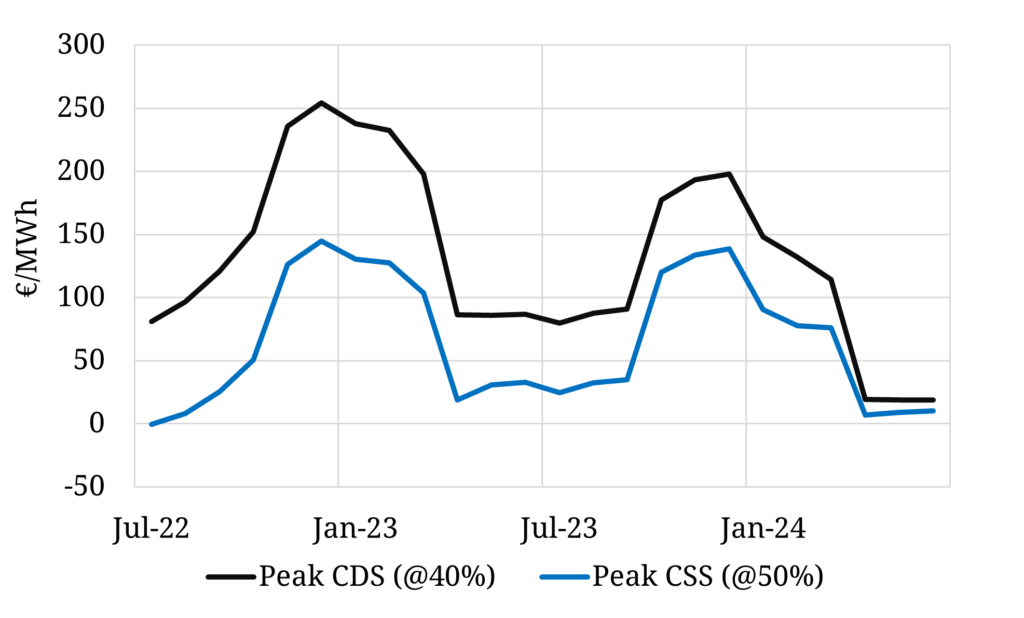

Chart 1 shows the comparison between:

- Peak forward Clean Dark Spreads (CDS) a benchmark for hard coal plant generation margins across peak periods (black line)

- Peak forward Clean Spark Spreads (CSS) a benchmark for CCGT generation margins across peak periods (blue line).

Chart 1: Peak German forward CSS vs CDS

Source: Timera Energy, ICE, CME

There is a simple takeaway from the chart: at current commodity prices, coal plants have a substantial merit order advantage over gas plants.

This means that if coal output is increased, it will erode CCGT run hours and reduce gas demand.

Gas crisis triggering return of large volumes of capacity

The German power market sits at the core of Europe’s interconnected network of power markets. Allowing 10.4GW of coal, oil & lignite capacity back into the market have significant knock-on effects across Europe.

Where does Germany’s 10.4GW of additional capacity come from:

- 6.9GW hard coal: 2.6GW closure auction dates waived (due to close 2022-23) & 4.3GW currently in reserve & granted option to return

- 1.6GW of oil fired peaking capacity currently in reserve & granted option to return

- 1.9GW lignite currently in reserve, to be moved to a higher state of readiness (to be called if required in emergency).

It is important to note that the return to market is optional. Chart 1 shows that there is a strong price signal for coal plants to generate. But plants coming out of reserve may face maintenance & availability issues in returning to operation.

The measures also only apply until Mar 2024 and are subject to final legislation being passed in July.

In addition there are several GWs of coal capacity likely to come back online across Italy, Austria, Netherlands & France, via plants being returned to service or generation caps being lifted.

5 impacts to consider from returning coal

We finish with a brief summary of 5 implications of returning coal capacity:

- Gas plants: Reduced CCGT run hours & margins as coal plants run ahead of gas in merit orders

- Gas demand & storage: Reduced power sector gas demand, easing prices on the margin and allowing faster storage injection to meet mandated volume targets

- Power prices: Marginal easing in power prices and market tightness, going some way to offset availability issues with French nuclear fleet (recognising this still remains a key risk factor)

- Carbon: Significantly higher power sector emissions, supporting EUA prices

- Coal: Support for Atlantic coal prices in what is already a tight market (reinforced by Russian supply ban requiring high quality grade imports e.g. from South Africa).

Despite the return of coal across the next two years, the German government reconfirmed its commitment last week to close all coal and lignite capacity by 2030. Current market dynamics show that if this is going to be achieved Germany will require very substantial investment in new flexible capacity.