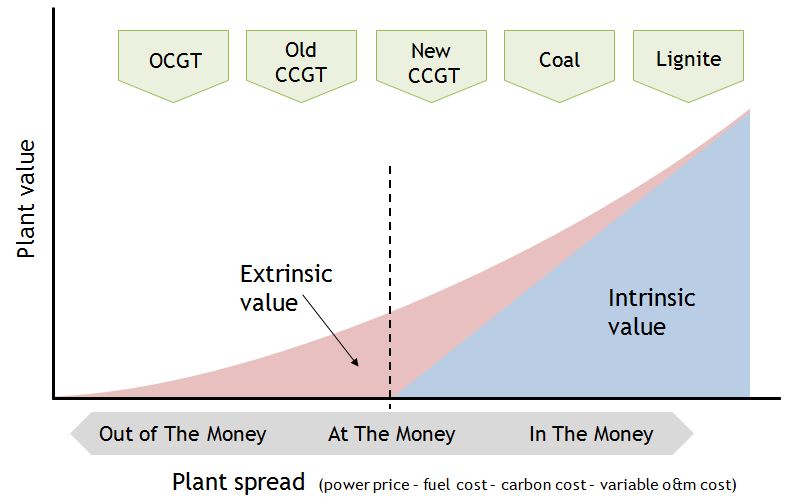

CCGT power plant valuation has traditionally focused on intrinsic value, the value of dispatching the plant against prices observed in the forward market. Any mention of the extrinsic (or flexibility) value of CCGT assets, resulted in nervous glances around the table. Extrinsic value was considered to be icing on the cake. Nice if you could get some, but unreliable and unbankable.

With the rapid decline in CCGT generation margins since 2010, Europe is now a different place. Support for intermittent renewable capacity has driven down power prices and cheap coal has displaced gas plant from the merit order. CCGT asset values have been written down as a result. But the value of CCGT assets has evolved not disappeared.

Intermittency is causing a structural increase in the requirement for system flexibility, in the form of responsive but lower load factor generation. CCGT assets are well placed to service this requirement. But the extrinsic value from plant flexibility now plays a central role in defining CCGT asset value. The owner of a newer CCGT may still have the ability to hedge some intrinsic value over peak periods, but an increasing portion of asset value is now extrinsic. For older CCGTs, 100% of value is extrinsic.

Deconstructing CCGT asset value

CCGT value is driven by the clean (or carbon adjusted) spark spread achieved by the plant. This spread is simply the difference between the market power price and the variable cost of operating the plant, calculated in any given period as:

clean spark spread = power price[€/MWh] – gas price[€/MWh] / plant efficiency[%] – carbon price[€/t] × plant carbon intensity[t/MWh]

Note: the formula above is for a European gas plant. Conversions (energy and currency) and the consideration of the Carbon Price Floor are required when calculating the clean spark spread for a gas plant in the UK.

A CCGT asset is essentially a strip of options on the spark spread. These options can be exercised on a very granular basis over a short time horizon ahead of plant dispatch, e.g. against hourly or half hourly price granularity in the spot market or even finer granularity in balancing markets. But monetising plant value based on short term optimisation alone, usually results in unpalatably high earnings volatility.

So where possible, asset owners will typically hedge plant exposures in the forward market. Exposures can be hedged on a forward basis by grouping the strips of plant options into a granularity that matches available forward contracts in the power, gas and carbon market. These forward hedge positions can then be adjusted in response to changes in market prices.

Extrinsic value of European power plant

The intrinsic value of a CCGT can be monetised with low risk, by hedging generation margin in the forward market and then dispatching the asset to fulfil the hedge. So hedging intrinsic value sets a floor for plant returns (ignoring plant outage risk for the moment). But the plant can also be ramped up to respond to periods where spark spreads move higher and ramped down during periods of zero or negative spreads. Extrinsic value is generated from the flexibility of the power plant to respond to changes in market prices.

European CCGTs currently have relatively little intrinsic value at current forward market prices. Sparkspreads range from slightly positive values in the UK, to pronounced negative values in markets like Germany and the Netherlands that are currently suffering from significant overcapacity. In other words the strip of CCGT plant spark spread options is only slightly ‘in the money’ in the UK and well ‘out of the money’ across much of Continental Europe as illustrated in Chart 1.