Europe’s path out of the current energy crisis depends on it sustaining high levels of LNG imports. Europe has lost about 130 bcma of Russian supply since the crisis began, with limited ability to replace this via other pipeline imports.

“There is substantial value in play in the current regas contracting frenzy”

Reductions in gas demand are helping, but Europe still needs a substantial increase in LNG imports to balance its gas market. European gas market balance is also directly driving power markets given the role of gas as the dominant source of marginal generation.

The price Europe needs to pay to attract incremental LNG is one challenge. This depends strongly on Asian LNG demand given global LNG supply constraints until new projects comes online post 2025.

Another key challenge Europe faces is regas capacity constraints. This was illustrated in 2022 where structural constraints in regas access to the NW European gas market drove large locational price differences (e.g. TTF vs NBP vs NW European DES prices).

In today’s article we look at the impact of the current surge in regas capacity expansion in response to the crisis. We also look at the market & commercial value drivers which influence the decision to buy European regas capacity from an LNG portfolio perspective.

The race to build regas

European policy makers understand the importance of new regas capacity for European security of supply in both gas & power markets. This has seen a very supportive policy framework for the rapid construction of new regas capacity. Capacity expansions are underway both in the form of temporary solutions (FSRU based) and permanent terminals (mix of FSRUs & onshore capacity expansions).

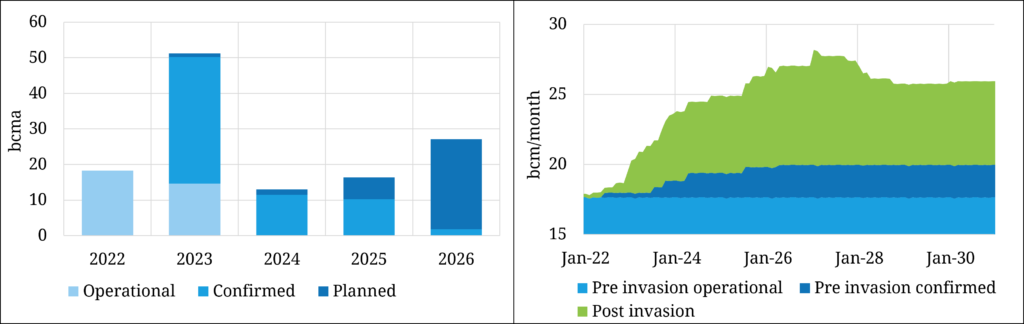

Chart 1 summarises the ramp up in new European regas capacity.

Europe had 211 bcm of operational regas capacity pre-invasion, although working capacity was in practice somewhat lower due to:

- import constraints into ‘island’ markets e.g. UK & Spain in low demand months

- maintenance activities.

We project 123 bcm of confirmed new regas capacity. 100 bcm of this is classified as ‘post invasion’ expansion with the remaining 23bcm confirmed ‘pre-invasion’. The right-hand panel of chart shows the impact of this pretty breath-taking increase in regas capacity volume.

It is not just the volume of new capacity that is important but the profile of the capacity through time. For example some FSRUs have been initially chartered for only 5 years (e.g. the Dutch Eemshaven may be replaced with fixed capacity) or 10 years (in the case of 2 German FSRUs).

Location of regas capacity within Europe is also important given a greater requirement to backfill Russian supply for certain countries (e.g. Germany). Regas expansions will also determine how quickly some of the locational price spreads are ironed out across European hubs via helping to alleviate transmission bottlenecks.

Growth is driving a regas contracting frenzy

Most new supply coming online across 2022-23 is in the form of FSRUs or expansions at existing terminals. This is the low hanging fruit. Over 30 bcm of new FSRU capacity is expected to come online in Germany by end of 2023, with additions also in Italy, Netherlands, and France.

In 2022 three new FSRUs were commissioned in Eemshaven (2 x 4 bcm) and Wilhelmshaven (5 bcm). In addition, there was a further 4 bcm of interruptible capacity at Gate (Netherlands) and smaller additions at Adriatic LNG (1 bcm) and Krk (0.3 bcm).

The scale & pace of these capacity additions is driving strong regas contracting activity. Long term bookings are required to support FID of some projects (e.g. onshore German projects). Other projects have taken FID before selling capacity but with the help of state support. Either way there are substantial volumes of long term regas capacity contracts coming to market.

Buyer interest is also being spurred by a lack of available primary capacity across existing regas terminals, with long term contracts only starting to expire from 2026 onwards.

There is a substantial amount of value in play in this regas contracting frenzy. And regas capacity is not a straightforward asset to quantify from a risk / return perspective.

Market drivers of regas capacity value

The value of regas capacity is driven by (i) demand for LNG imports into Europe (ii) regas capacity availability constraints. Depending on these two key drivers there have been periods like 2021-22 when regas capacity is very valuable. There have also been periods of very low utilisation when you can’t give away European regas capacity (e.g. in the mid-2010s post Fukushima).

Understanding the market drivers of regas capacity value in turn depends on robust analysis of the role of LNG in the European supply mix and how European & Asian gas demand evolves.

We summarise key market drivers & risks with respect to European regas utilisation in table 1.

Table 1: Key market drivers of European regas capacity value & risk

Commercial considerations in valuing regas capacity

It is one thing to understand the drivers of regas utilisation. It is another to work out how to value regas capacity access. The latter is impacted by some key commercial & portfolio considerations we summarise in Table 2.

Table 2: Commercial considerations driving regas capacity value

It is also important to note that regas capacity has valuable optionality but that this comes at a cost. The fixed capacity payments associated with regas caused capacity owners considerable financial pain across the periods of low utilisation in the 2010s. For some portfolios it can make a lot more sense to buy secondary capacity than to compete in a bidding war for long term contracts.

Battle to control European market access

The development & contracting of this new wave of regas capacity is shaping who will control LNG supply access into European hubs. There are major strategic & competitive forces in play.

Unique portfolio drivers are a big factor determining the price individual companies will pay for regas capacity. For example:

- A European utility may place value on regas as securing flexible access to physical supply into a portfolio of customers & power plants

- An Asian utility may value regas as a key portfolio risk management tool, with physical TTF access allowing exposure management of US tolling capacity

- A commodity trader may value regas as physical optionality that enhances midstream optimisation flexibility and downstream market access

- A large producer (e.g. Qatar) may value regas capacity as a put option allowing access to liquidity to monetise surplus physical cargo volumes.

The common theme across all these cases is the dependence of regas capacity value on its interaction with other portfolio components. It is the portfolio structure of key market players that will shape the battle for who controls regas access to Europe.

We are supporting clients on both the buy & sell side of regas deals, by modelling regas capacity value within portfolios and advising on strategic contracting decisions. Feel free to reach out to our Director of LNG & Gas david.duncan@timera-energy.com or Managing Director olly.spinks@timera-energy.com if you are interested in more details.