Europe is aiming to deploy hydrogen as a major new front in the push to decarbonise. The extent to which this will succeed will primarily be determined by cost.

Electrolyser capex cost reductions are a popular topic in focus. Could we see capex declines of 50%, 75% even 90% by the mid-2030s?

Time will tell, but what is perhaps more important is the influence of commodity prices on hydrogen economics (e.g. carbon, gas & power prices). That is the focus of our article today.

“Hydrogen economics do not stand still… energy prices have a major impact on both relative & absolute economics”

How do commodity prices drive hydrogen economics?

Hydrogen economics do not stand still. Capex costs may decline over time with scaling, but production costs vary on a day to day basis with energy markets.

Let’s consider the 3 main types of hydrogen production:

- Grey hydrogen: unabated production using Steam Methane Reform (SMR); the dominant form of existing hydrogen supply to industry

- Blue hydrogen: SMR production with carbon capture, transport & storage (CCS), capturing 90-95% of onsite carbon emissions

- Green hydrogen: production using electrolysers driven by some form of renewable power supply.

There have been some big moves in European energy market prices across the last 12 months. European power and carbon prices have more than doubled since last summer. Gas hub prices have more than tripled.

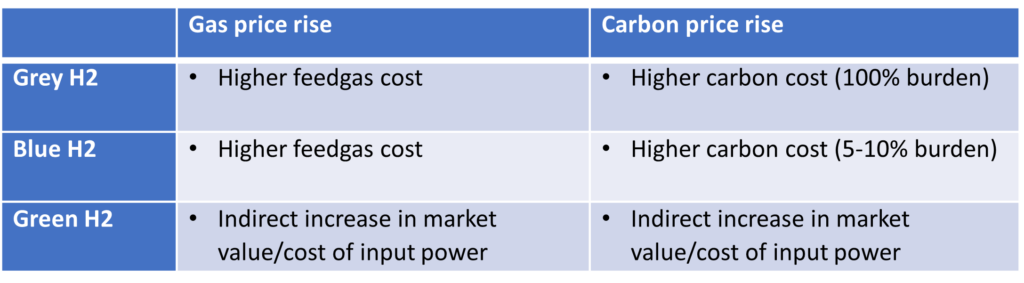

Hydrogen production involves converting one form of energy (gas or power) into another (hydrogen). As a result energy price moves have a major impact on both the relative and absolute long run economics of the 3 major types of hydrogen production as summarised in Table 1.

Table 1: Impact of market price rises on hydrogen production economics

The impact of gas and carbon prices on green hydrogen economics is indirect, via increasing the variable costs of gas-fired power plants. Although the load factors of gas-fired power plants will decline as renewable generation rises, gas is set to remain the dominant technology setting power prices across European power markets into the 2030s.

So unless the electrolyser and any collocated renewable generation is completely isolated from power market connection, gas & carbon costs are an important factor impacting green hydrogen investment economics via their impact on power price levels.

Blue vs grey hydrogen dynamics

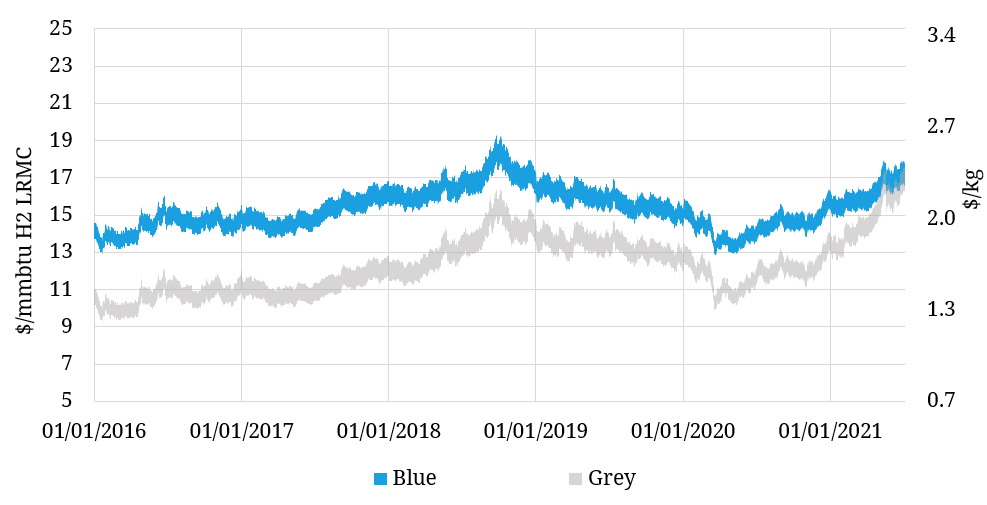

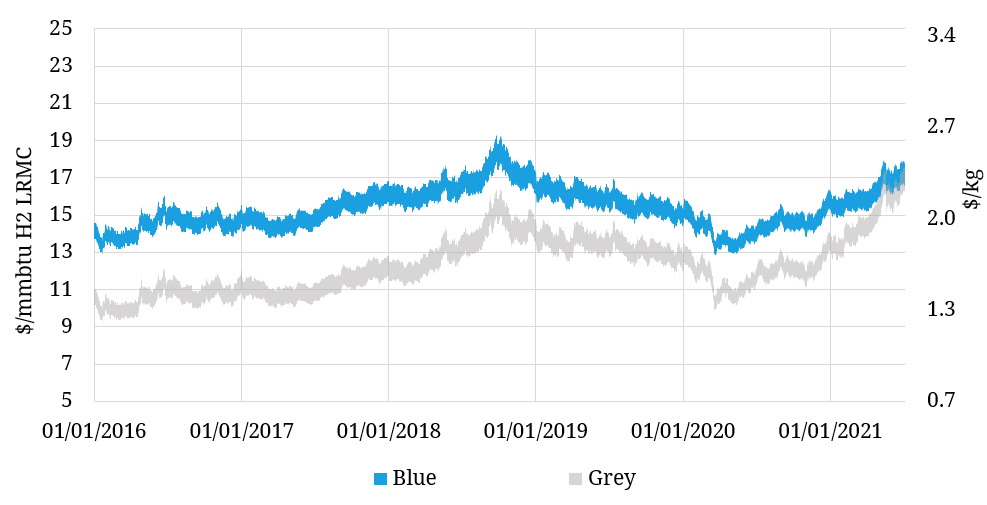

Let’s start with blue & grey hydrogen economics which are a bit simpler than green. Chart 1 illustrates how the Long Run Marginal Cost (LRMC) of production for grey and blue hydrogen has been impacted by fluctuations in gas and carbon prices across the last 5 years. We measure LRMC in $/mmbtu on the left axis (to compare to gas prices) and in $/kg on the right axis (the standard unit of hydrogen pricing).

Chart 1: Grey vs blue hydrogen production cost fluctuations

Source: Timera Energy, ICE, IEA

In order to calculate the blue and grey lines in the chart, we use a Year + 2 TTF forward gas price and the prevailing market EUA price as a proxy for long run expectations of gas & carbon price levels.

Three key observations:

- The LRMC of both blue & grey hydrogen has risen substantially since Q2 last year as gas prices have surged.

- A big rise in carbon prices this year has effectively removed the incremental cost of blue hydrogen over grey, i.e. they are near cost parity at current EUA prices, reflecting ~50 €/t cost estimates to capture, transport and store carbon.

- Hydrogen is a significantly more expensive fuel than natural gas, roughly double the cost on a long run basis.

Hydrogen is by nature an expensive fuel because of the efficiency losses of conversion from other energy sources (i.e. power or gas). As a result, it is reasonable to assume hydrogen will be a premium fuel, e.g. for super peak energy requirements and areas of industry & transport that are very expensive to decarbonise by other means. Talk of hydrogen fuelled CCGTs and heat pumps appears to be pretty speculative.

Overlaying green hydrogen dynamics

Now let’s consider green hydrogen. The current cost of green hydrogen production is literally off the chart (somewhere in a 3.5 – 5.0 $/kg range). This is a well-known fact and the challenge for green hydrogen is not cost levels today, but where these could fall to by 2030-35.

Two key factors can drive green hydrogen cost reductions:

- Electrolyser capex reductions (e.g. projected to fall from a 800-1000 $/kW range today to 250-450 $/kW range by 2030)

- Reduction in the cost of power supply, e.g. due to rising renewable penetration pushing down power prices.

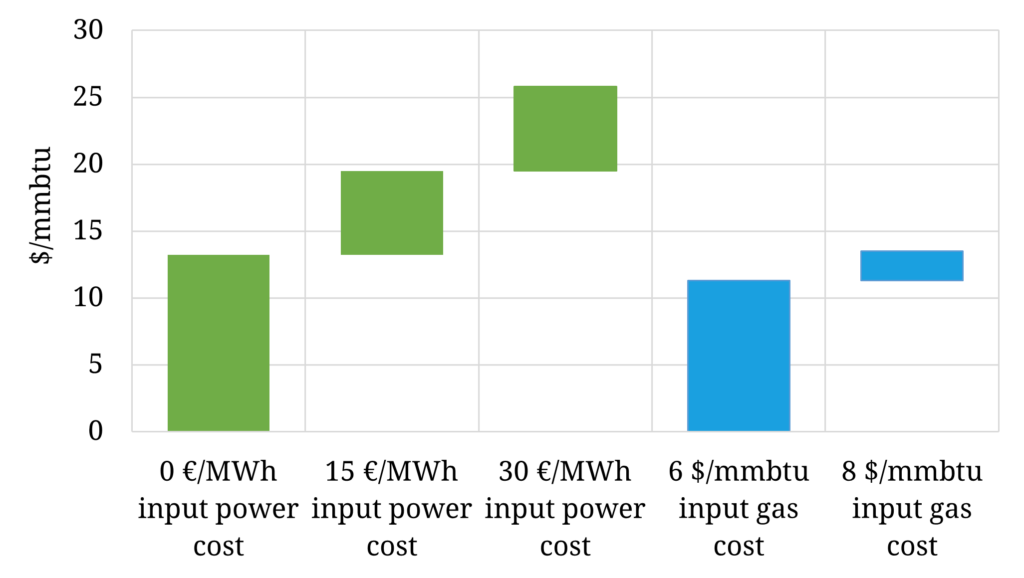

Chart 2 shows some benchmarks for 2030 LRMCs for green hydrogen.

Chart 2: 2030 green vs blue hydrogen LRMC benchmarks

The chart assumes 375 $/kW electrolyser capex (~60% reduction from current levels), 40% utilisation factor and 3 benchmarks for input power costs (0, 15 and 30 €/MWh). Two 2030 LRMC estimates for blue hydrogen are also included (assuming 6 and 8 $/mmbtu gas prices and 100 €/t carbon prices).

Chart 2 highlights how important input energy costs are for hydrogen economics, particularly power input costs for green hydrogen.

A substantial majority of electrolysers are likely to be grid connected, as well as being colocated with a renewable generation source in many cases. The logic for this is that the grid connection provides valuable optionality from sourcing low cost power as well as enabling additional revenue streams from providing network flex services (e.g. balancing, ancillaries).

Grid connection means that market power prices are a key driver of electrolyser production costs. Even though the majority of power may be sourced from a colocated solar or wind farm (to avoid grid charges), the value of this power is driven by market prices.

Blue vs green relative costs

Chart 2 shows how it will be challenging for green hydrogen to reach cost parity with blue hydrogen by 2030, even assuming a 60% decline in electrolyser capex, 100 €/t carbon prices and very low power costs.

Of course the future is uncertain. Electrolyser capex costs could fall by more, efficiencies could rise, other revenue streams may develop to support green hydrogen. All of these factors are in fact likely to play out over time (e.g. by the mid 2030s), to support green hydrogen as the enduring solution.

However as things stand it is too early to write off the role of blue hydrogen. SMR based hydrogen production should pay full market prices for any residual carbon that is emitted (including tackling fugitive emissions). But closing off blue hydrogen for ideological reasons risks removing an option that can support much more rapid scaling of hydrogen as a premium fuel to enable decarbonisation.