Europe’s dependence on Russian gas is vying for pole position as ‘policy concern of 2022’. What is the direction of policy response? Accelerating the energy transition and electrifying gas demand.

“Power demand is projected to be 25% – 50% higher by 2035… and may need to more than double by 2050”

The electrification of demand from other sectors (e.g. transport, heat & industry) is set to have a profound impact on the evolution of electricity demand across European power markets. Demand is projected to rise 25-50% from current levels by 2035. It may need to more than double to achieve net zero by 2050.

5 years ago, projections of future power demand growth were largely theoretical. Demand has been steadily declining in most European markets across the last decade due to technology evolution and efficiency measures. But tangible sources of demand growth are now falling into place e.g. the rapid electrification of passenger vehicles & deployment of electrolysers.

Demand growth of the scale required to transition to net zero is unprecedented in modern history. In today’s article we look at the factors driving annual and peak demand growth, which in turn will determine the levels of investment required in renewables, flexible capacity and network infrastructure.

How much demand growth are we talking about?

We use a UK market case study across the article to quantify the impact of energy transition on demand. The drivers of demand growth in the UK are just as relevant for other Western European markets.

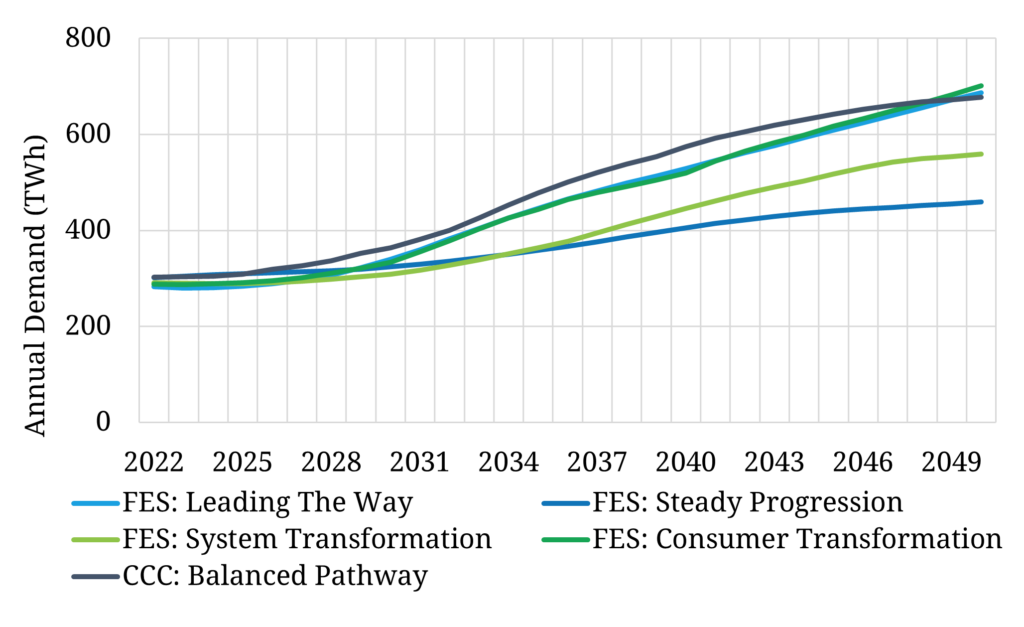

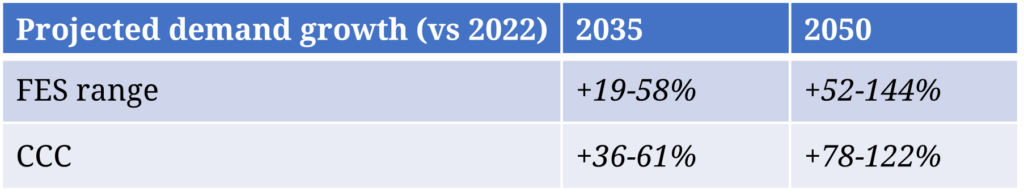

Chart 1 illustrates the scale of potential UK annual power demand growth. It shows the latest 4 Future Energy Scenarios (FES) published by National Grid (used for system planning purposes) as well as the Climate Change Committee (CCC) ‘Balanced Pathway’ to net zero by 2050.

The table illustrates ranges of projected demand growth by 2035 and 2050. Even based on conservative estimates, demand is projected to be at least 25% higher by 2035. Demand may need to more than double by 2050 to achieve net zero targets.

3 big drivers of demand growth

Rapidly evolving policy frameworks and maturing technologies are helping to clarify the way forward for power demand. There are three clear sources of demand growth that can be used to underpin sensible projections of demand. We summarise these below and show a simple UK case study that illustrates the scale of demand growth.

1.Transport

It is increasingly clear from a policy, technology & cost perspective that EVs will dominate road transport. It is now a question of ‘how fast’ not ‘if’.

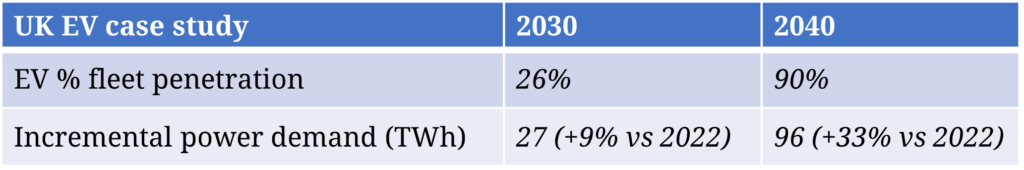

Car manufacturers are transitioning production lines & supply chains to lock in the path to electrification of passenger vehicles. Within the next couple of years EVs are set to gain a cost advantage over conventional ICE vehicles, particularly if oil prices remain high. This will accelerate adoption. The UK case study below illustrates the demand impact of passenger vehicle fleet transition to EVs.

2.Electrolysers

The EU published its Hydrogen Strategy in 2020 targeting at least 40GW of electrolysers by 2030 (6GW by 2024). National hydrogen strategies & targets have since been published by most Western European countries.

Specific policy support mechanisms are under development and set to be launched across the next 1-2 years. Hydrogen production via electrolysis is set to be very expensive, but policy backing only appears to have been enhanced by concerns on Russian gas dependence. Electrolysers represent a substantial new source of power demand as illustrated in the UK case study below.

3.Heat

Decarbonising heat is complicated. The clearest current means of material emissions reduction is via installation of heat pumps. This relies on a minimum standard of building insulation. In countries with existing gas boiler infrastructure (e.g. UK and Germany) there is also a significant cost hurdle. But meaningful policy targets are taking shape that are set to increase heat pump penetration substantially across Europe.

In the UK there is now a policy of no gas boilers in new homes by 2025 and no new gas boilers by 2035. The table below shows the impact of heat pump penetration on power demand based on FES projections.

Evolution of peak demand

System security of supply depends on being able to meet maximum instantaneous peak demand (GW) as well as total annual demand (TWh).

Peak demand growth is likely to slow relative to annual demand into the 2030’s due to increased flexibility of demand sources. Currently most demand sources are relatively inflexible and price insensitive.

Demand flexibility is set to increase over time with smart appliance technology, smart EV charging, improved software and more effective tariff structures. But significant uncertainty remains as to how much flexibility will be provided and how long it will take.

Increasing flexibility will help shift some demand away from peak periods. Studies show peak demand reductions in the range of 20-40% may be possible by 2050 but with a strong dependency on the evolution of smart technology and software as well as substantial investment in distribution network infrastructure.

This still leaves the majority of demand constrained by more rigid retail & business consumption patterns. The combination of substantial demand growth and limitations on demand flexibility underpin the requirement for enormous investment in low carbon flexible capacity to decarbonise the power sector while maintaining security of supply.

We’ll come back soon in a second article on demand to look at evolution of intraday demand shape and its impact on pricing dynamics.