The UK capacity market auction process normally takes two days of bidding rounds before a result. This year’s auction for 2026-27 capacity was over almost before it started.

“This auction result has much broader investment implications across Europe”

The auction cleared at a record 63 £/kW/yr, around 3 times the average clearing price of previous T-4 auctions. Successful new build projects were dominated by batteries, engines, DSR, a CCGT & an interconnector. These will benefit from a substantial portion of required revenue being underwritten by multi-year fixed price capacity agreements (15 years in most cases).

Let’s take a look at what caused this surge in capacity prices and what its implications are for flexible asset investment, both in the UK and more broadly across Europe.

Auction deconstruction

Note: if you don’t care about the UK auction but want to understand its implications for capacity prices & asset investment across other European markets… jump to the next section.

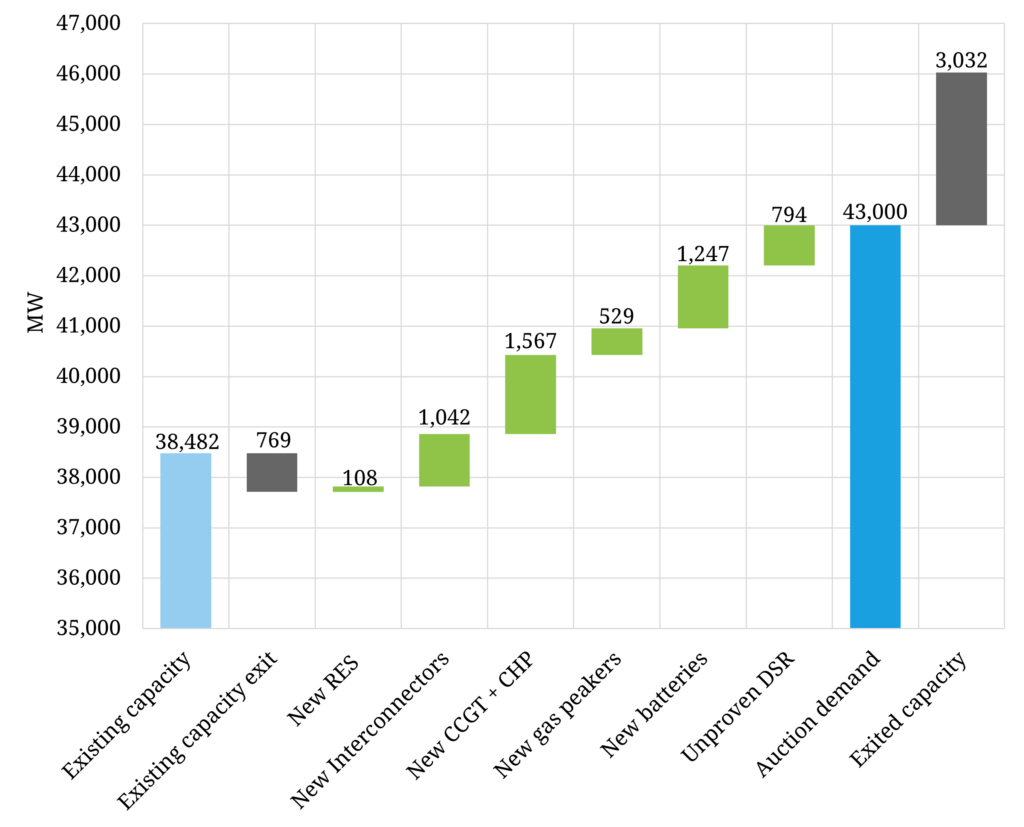

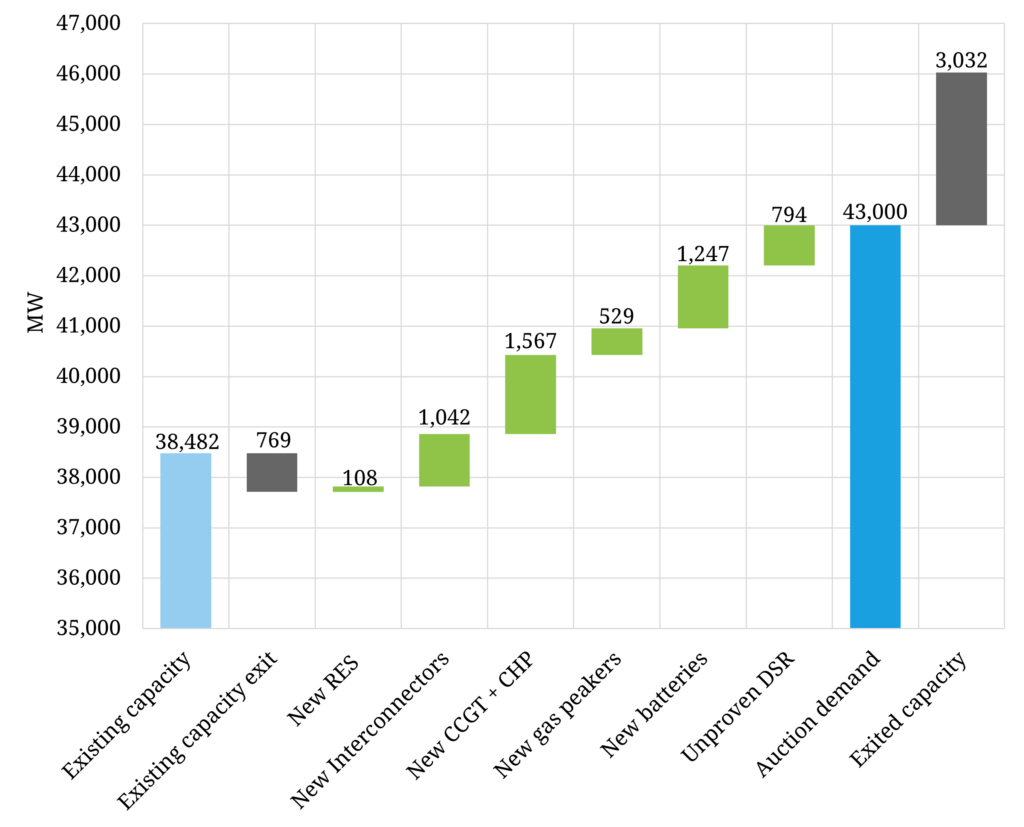

It was clear before the event that this was going to be a tight auction. There was a structural deficit of existing capacity (38.48 GW) vs the government set auction demand target (43.00 GW at the clearing price). This was exacerbated by an older CCGT (0.75 GW) exiting the auction early (South Humber 1).

Chart 1 shows a breakdown of how the demand target was achieved as well as volumes of exited capacity.

Chart 1: Deconstruction of 2026-27 T-4 capacity auction result

Source: Timera Energy, EMR Delivery Body

Successful new capacity was dominated by a new CCGT (EPH’s Eggborough 1.55 GW project), batteries (1.25 GW derated), the Viking Interconnector (1.04 GW), DSR (0.79 GW) and gas engines (0.51 GW). The high auction price saw 352 MW of 4-hour duration batteries successful, which have less penal derating factors than shorter duration BESS.

Much tougher battery derating factors also contributed to the capacity deficit in this auction. For example 2-hour BESS projects were derated at 23.63% (vs 39.73% in last year’s auction). Tougher derating factors saw 5.0 GW of nominal BESS capacity contribute only 1.2GW of derated capacity. BESS derating factors are likely to decline further in future as the marginal capacity contribution of batteries erodes with scaling.

The big surprise in the auction was how high offer price levels were for new build capacity. Historically there has been a strong overhang of new build gas engine & CCGT projects above 30 £/kW/yr that have acted as strong price resistance. The increase in cost structure of this thermal capacity is playing an important role in pulling up capacity prices.

5 factors driving the capacity price surge

At the simplest level, the reasons for a high clearing price were:

- A relatively aggressive government demand target

- An increase in the cost structure of new build capacity to meet that target.

Digging a level deeper reveals a set of drivers that are relevant for capacity prices & flexible asset investment across all power markets in Europe.

For example the impact of the current energy crisis is likely to see governments providing more proactive capacity payment support to reduce the risk of extreme market tightness as experienced across 2022 (note this will likely weigh on wholesale power prices). A strong policy push towards decarbonisation is also acting to drive up the cost of the marginal sources of flexible thermal capacity.

In Table 1 we set out 5 factors driving up UK capacity prices, all of which are to some extent relevant across other European markets.

Table 1: 5 factors driving higher capacity prices

Implications for investors

Should investors triple the capacity price assumption in their asset models? In a word no, not even double them.

This auction result is likely to be an outlier. Expect major price response in next year’s auction e.g. from gas engines which are H2 enabled, and even longer duration storage. But there are some important structural forces in play that may drive up average clearing prices going forward.

The factors increasing the cost structure of thermal assets are in part structural. Investors need to account for a decarbonisation solution in a 2035 time horizon i.e. within the first 10 years of operation. However, greater policy clarity could materially reduce the risk premium associated with thermal asset decarbonisation.

Capacity Market (CM) reform is also a key driver. A UK government consultation window is about to end which considers a range of CM changes. One of the focus areas is the potential for differentiated price levels & more targeted support e.g. for longer duration capacity.

This year’s capacity auction is signalling a shortage of longer duration flexibility, traditionally provided by gas assets. Long duration low carbon solutions are currently expensive. But the higher marginal cost of these projects does not necessarily need to drive up the clearing price across all capacity participating.

The challenge to incentivise longer duration flexible capacity is much broader than the UK capacity market. It is the key missing link in Europe’s push to decarbonise its power markets. Policy makers are realising this and it spells a big investment opportunity.

We are publishing our latest GB BESS subscription service Storage Report this week. The 70 slide pack covers:

- EU investment landscape: how BESS investment focus is evolving from GB to Europe & which markets are attractive

- GB BESS competitive landscape: key players, pipelines & impact of 2023 T-4 auction

- Offtake & financing: how GB BESS asset financing & offtake deals are evolving fast

- REMA: implications of market design changes on BESS investors

- Backtest & projections: analysis quantifying 1, 2 & 4 hr BESS asset revenue stack back-test & revenue projections to 2050

For more details feel free to contact our Power Director steven.coppack@timera-energy.com or Managing Director david.stokes@timera-energy.com.