Gas reciprocating engines are emerging as a key source of peaking capacity in European power markets. They are cheaper & more flexible than CCGTs and have very low start costs. This makes engines much better suited to providing flexibility to back up swings in wind & solar output.

“The key investment case hurdle is the cost for sourcing clean hydrogen”

Engines also have a greater potential viability for hydrogen firing than CCGTs. The costs & practicalities of hydrogen firing is currently an important focus for infrastructure and renewable investors. The reason: ESG driven investment mandates.

For many investors, capital deployment in gas-fired power assets can now only be undertaken if there is a credible path to decarbonising asset footprints in the 2030s.

In today’s article we look at investment value drivers for hydrogen fuelled engines.

Hydrogen generation viability depends on cost

Hydrogen can be burnt in what is essentially an upgraded version of a standard reciprocating engine, e.g. to deal with higher combustion temperatures. The conversion process does not require any substantial technological evolution i.e. it can be done now.

The key hurdle preventing deployment of hydrogen fired engines is the very high cost of low carbon hydrogen production. Any viable future for hydrogen firing of peakers requires substantial reductions in fuel cost & improvements in fuel access.

The current cost of producing green hydrogen in Europe is above 15 €/kg. The key driver is the feed cost of power for electrolysers. Surging energy prices across Europe have driven up the costs of both green & blue hydrogen.

Even if energy prices return to pre-crisis levels the cost of green hydrogen production remains prohibitively expensive for use as a fuel for power generation (at least 6-8 €/kg for European produced green hydrogen).

How much do costs need to fall?

The EU has set a 2030 target for reducing the cost of green hydrogen to below 2 €/kg. It is an understatement to say that this is an ambitious target.

Reduction of hydrogen production costs is constrained by the laws of thermodynamics which determine energy losses from the electrolysis process. Achieving the EU target effectively relies on sourcing extremely cheap power (in the order of 10 €/MWh average feed power prices or less). That in turn relies on large volumes of surplus renewable energy.

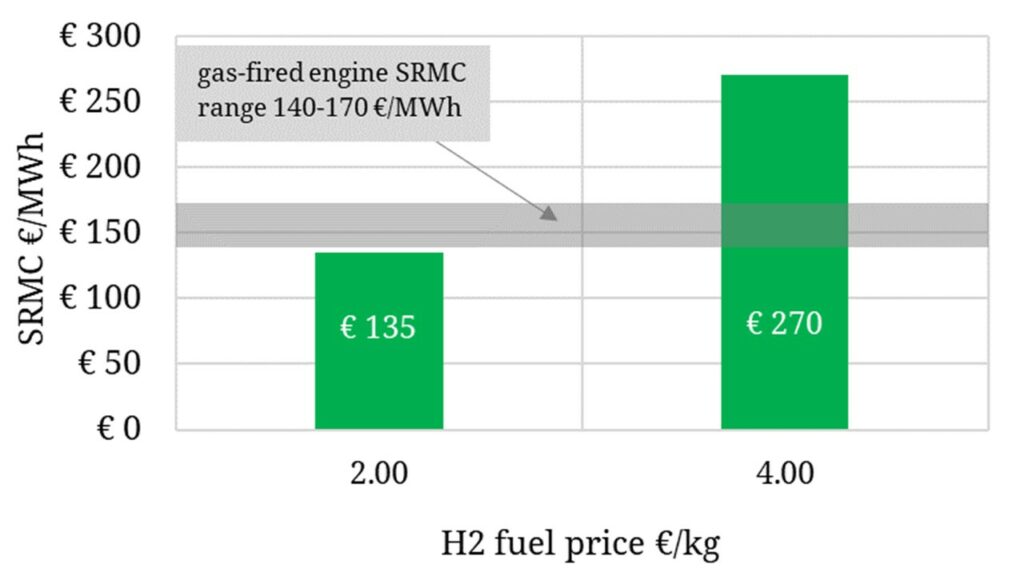

Chart 1 quantifies the scale of the fuel cost challenge for hydrogen peakers. It shows the potential Short Run Marginal Cost (SRMC) competitiveness of hydrogen vs gas fuelled engines at different potential hydrogen costs (2 vs 4 €/kg) in the mid 2030s.