Italy has recently ratified a long-term contract support mechanism for storage that is set to unlock a wave of new investment.

The driving factor behind this new support mechanism is the scale of Italy’s solar deployment. Italy will be pushing the frontier of European solar penetration with 60-70 GW of installed capacity by 2030, driving intraday swings in solar output of up to 40GW by 2030. Substantial volumes of wind capacity are set to be developed in parallel exacerbating system balancing requirements.

Development of renewable capacity is focused in the South of Italy where there are already significant transmission constraint issues. These are set to cause large curtailment volumes given inadequate transmission capacity to flow solar output towards the largest demand hubs in Northern Italy.

Policy makers realise that substantial volumes of storage will be required to balance renewable swings and manage system stability. The new mechanism is specifically designed to address these issues.

In today’s article, our first in a series on Italian storage investment, we set out how the mechanism works, what volumes of storage are likely to be procured and what the implications are for BESS investors.

The mechanism in a nutshell

Under the new mechanism Terna (the system operator) will tender directly for large volumes of storage capacity under long term contracts (e.g. 12-14 year duration). Storage developers will bid for fixed price contracts partially indexed to inflation, ensuring long term revenue stability.

While all storage technologies are eligible, in practice the mechanism will strongly prioritise longer duration lithium batteries (BESS) e.g. 4-8 hr systems and some smaller volumes of pump hydro.

The game changer with this scheme versus those in other European markets is the extent of revenue support offered by the long-term contracts. The resulting reduction in merchant risk exposure means that BESS projects will fall comfortably within traditional infrastructure investment risk/return mandates.

This should attract large volumes of infrastructure & pension fund capital to back storage developers. It should also support substantial volumes of debt financing at relatively high loan to value ratios.

So how much storage are we talking about and where will it get developed?

System operator will drive BESS capacity volumes

Italy’s long term contract tender mechanism to support storage investment was ratified in June 2023 (ARERA resolution 247/2023/R/eel), after an initial proposal in 2022.

Ratification paves the way for a relatively quick implementation into 2024. We will come back to the implementation timelines below (1st tender likely in H2 2024), but let’s start with the scale of capacity to be developed under the mechanism.

The unique feature of the Italian mechanism is that Terna (as system operator) will directly:

- Determine system storage capacity requirements (GWh)

- Tender for that capacity via auctions for long term contracted revenue support.

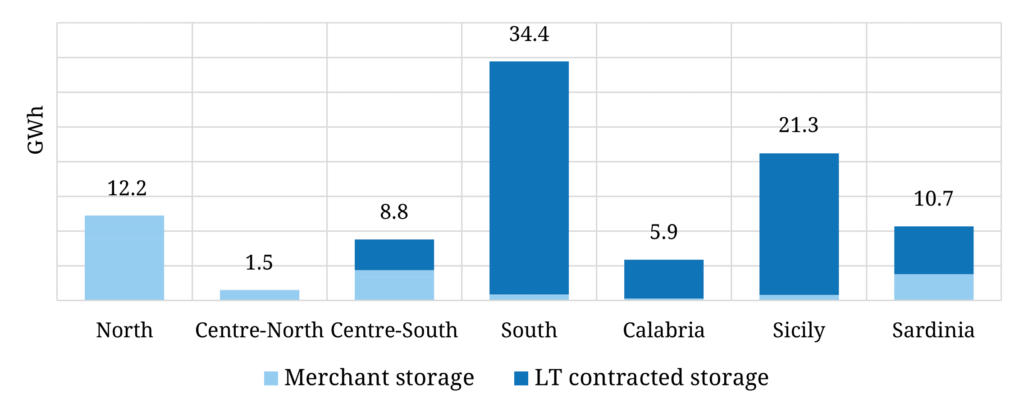

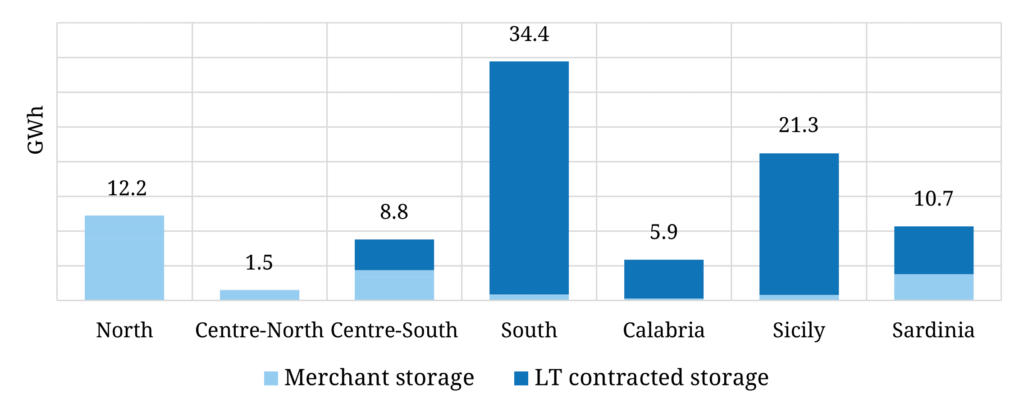

Terna published its analysis of 2030 requirements for storage in 2022. This forms a good first indication of Terna’s volume requirements for storage by 2030, summarised in Chart 1. Volume projections are split between merchant storage and storage to be delivered under the new scheme.

Chart 1: Terna’s view on storage capacity needs under Fit-for-55 scenario

Source: Timera Energy, Terna

Chart 1 highlights Terna’s view that most of Italy’s new storage projects being delivered under the tender mechanism going forward, particularly in Southern Italy and the Islands (where renewable deployment is expected to be highest).

The volume projections under the tender mechanism may be refined to reflect the Italian Ministry’s view that there is somewhat more potential for solar deployment in the north (given smaller scale and rooftop capacity development). But the direction of travel is clear:

- Terna is set to tender for large volumes of storage across the next few years (up to 71 GWh by 2030), focusing on 4-8 hour duration BESS

- The new tender mechanism is likely to replace the Italian capacity market (the main support mechanism to date) as the primary source of BESS support

- Investment in merchant BESS capacity is set to be more focused in the north of Italy or as merchant tranches of projects covered under long term contracts in the South and Islands.

Now let’s consider how the long term will work.

Long term contracts reduce risk for BESS investors

The Italian tender mechanism for long term storage contracts is so far unique in Europe. It is much closer to support mechanisms implemented for wind & solar. The objective of the support mechanism is to provide revenue visibility to battery and pump hydro storage projects to reduce market risk borne by investors and drive down cost of capital.

Importantly the current draft of the mechanism appears to be structured in way that storage developers can split a project into a long term contracted and a merchant tranche. This enables both downside revenue protection and access to merchant value upside. We come back to this in the last section of the article on BESS investor implications.

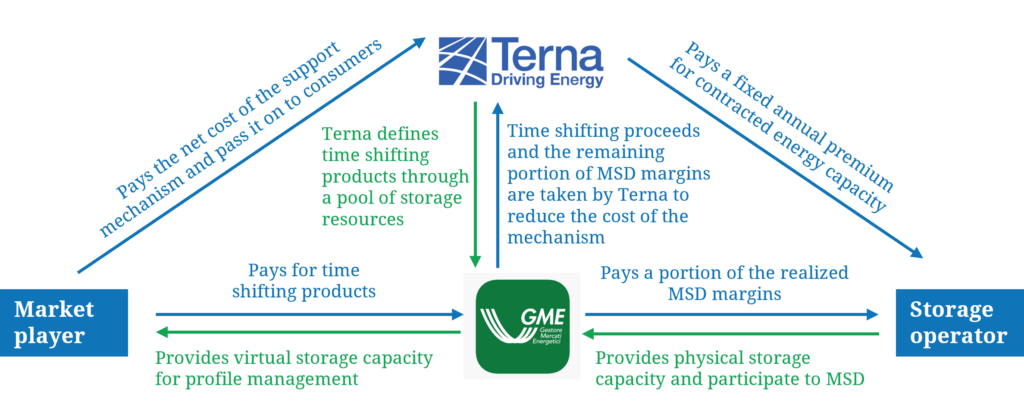

The key elements of the support mechanism are summarised in Diagram 1

Diagram 1: Mechanism design and payment flows

Terna (as system operator) sits at the centre of the new scheme in tendering for storage capacity via long term fixed price contracts from battery developers. Battery developers are then effectively obliged to provide physical storage asset flexibility to Terna to manage.

Terna utilises contracted storage flexibility in two main ways:

- It defines volumes & profiles of virtual flex (time-shifting) products that are traded via the Italian power market exchange (GME) e.g. to traders, utilities, RES operators

- It obliges storage operators to provide real time dispatch of storage flex into the MSD (ancillary services and balancing) market, with capped and floored price premium relatively to Day-Ahead prices.

Terna then recovers costs for the long-term contract support via sale of the virtual flex products (via GME) and by collecting the majority of MSD revenues (95%) achieved by the storage operators.

Flexibility provided via the market sales of virtual flex products has important implications for (i) the evolution of the merchant BESS revenue stack and (ii) renewable asset owners who are likely to be increasingly obliged to bear the burden of RES asset balancing.

Large volumes of storage to be tendered across the next 3 years

The timelines for implementation of the new storage tender mechanism are summarised in Diagram 2.

Diagram 2: Implementation timeline

After ratification of the policy in June, a consultation window has recently opened on more specific implementation details. This involves consultation both with industry participants and the EU.

Assuming no major hurdles emerge during this consultation period (e.g. EU State Aid issues), then publication & final approval of the mechanism is likely in early 2024. This would set up the potential for initial auctions in the second half of 2024 to deliver capacity from 2026-27.

Italian policy makers have a strong incentive to make this happen. A shortage of flexible capacity in the South of Italy is set to quickly become a security of supply issue as solar penetration ramps up across the next few years.

Implications for BESS investors

The first takeaway for investors is that Terna’s 2030 volume requirement indication of 71GWh represents a large volume of storage. Delivering this would require capacity development in the order of 13-16 GW of capacity (depending on duration) across the next 5 years.

The initial tenders are likely to see strong participation of developers with existing permitted project sites that are relatively advanced with planning & connection approvals. But most of these developers will need to raise large amounts of debt & equity capital to proceed.

We have had a strong focus across the last 2 years supporting investors deploy capital into Italian battery assets (via both development & acquisition). Our modelling of Italian market evolution & BESS revenue stack projections feeds into 5 challenges for BESS investors to consider in framing an initial strategy, summarised in Table 1.

Table 1: 5 key considerations to frame Italian BESS investment strategy

We will be returning in our next article in this series to address these considerations in more detail.

If you are after further details on Italian BESS investment in the meantime, feel free to contact Steven Coppack (Power Director) steven.coppack@timera-energy.com.

Join our upcoming webinar

Title: “The next frontier” – The drivers behind a surge in German battery investment

Date: Tues 28th Nov 09:00 GMT (10:00 CET, 16:00 SGT)

Registration link here, free to attend

Focus:

- Fundamental value drivers (e.g. RES growth, thermal retirements)

- DE BESS revenue stack breakdown & backtest

- How the within-day market is driving value capture

- Financing & offtake structures

- Key policy & investment risks