What is LNG Bridge?

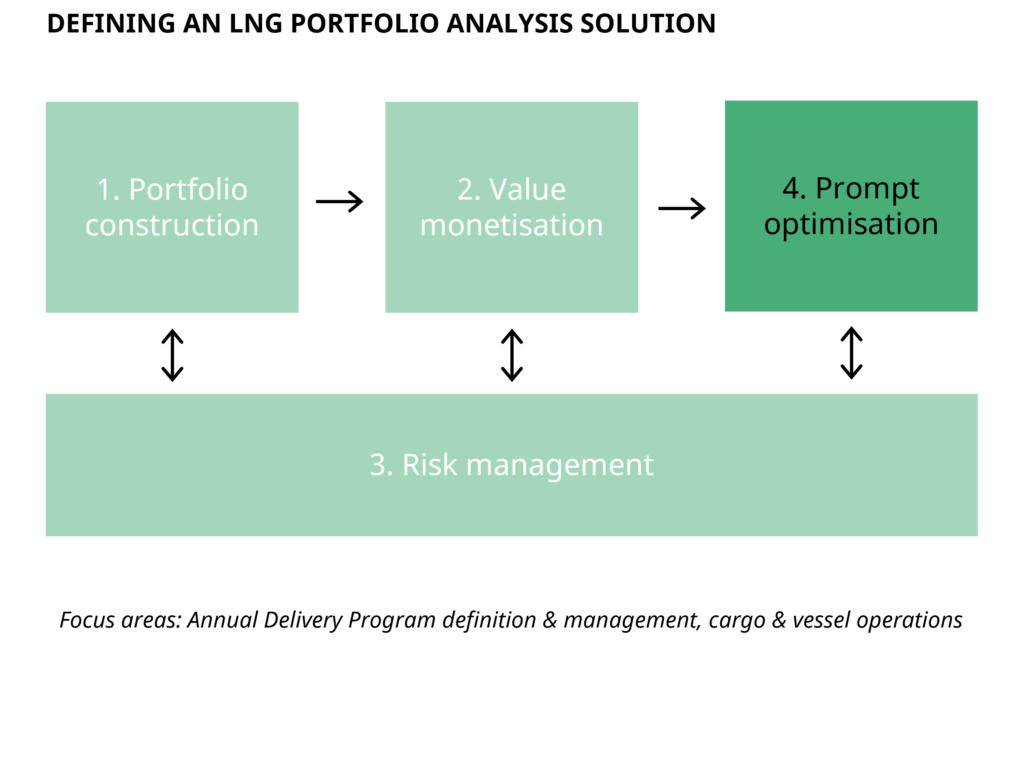

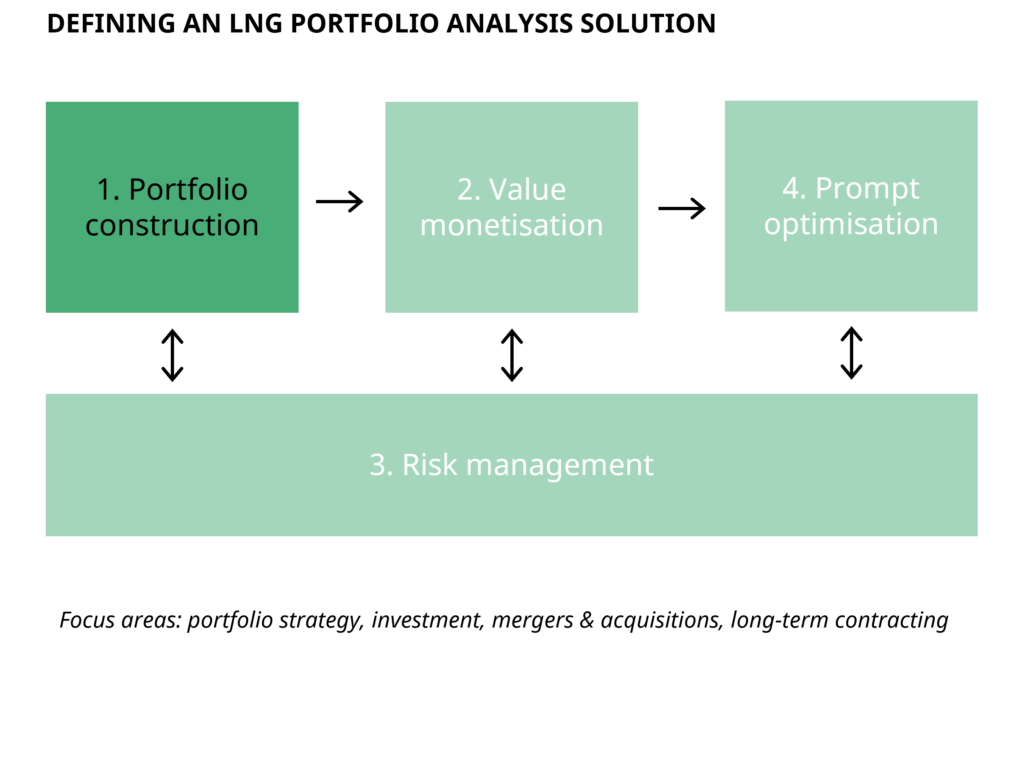

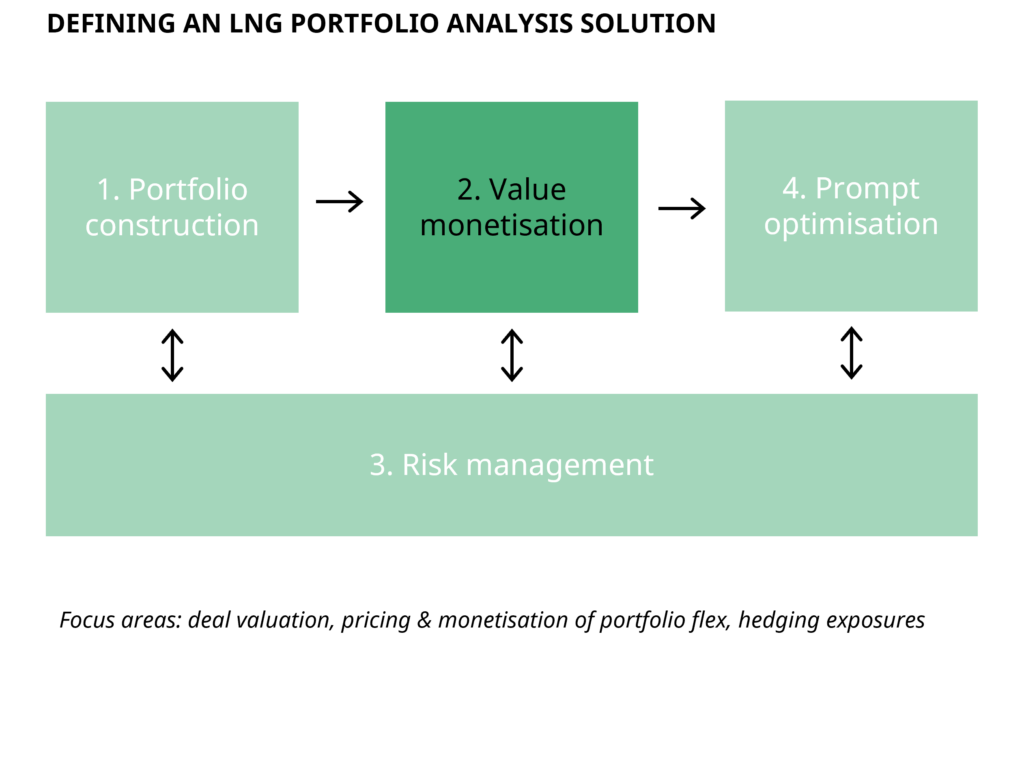

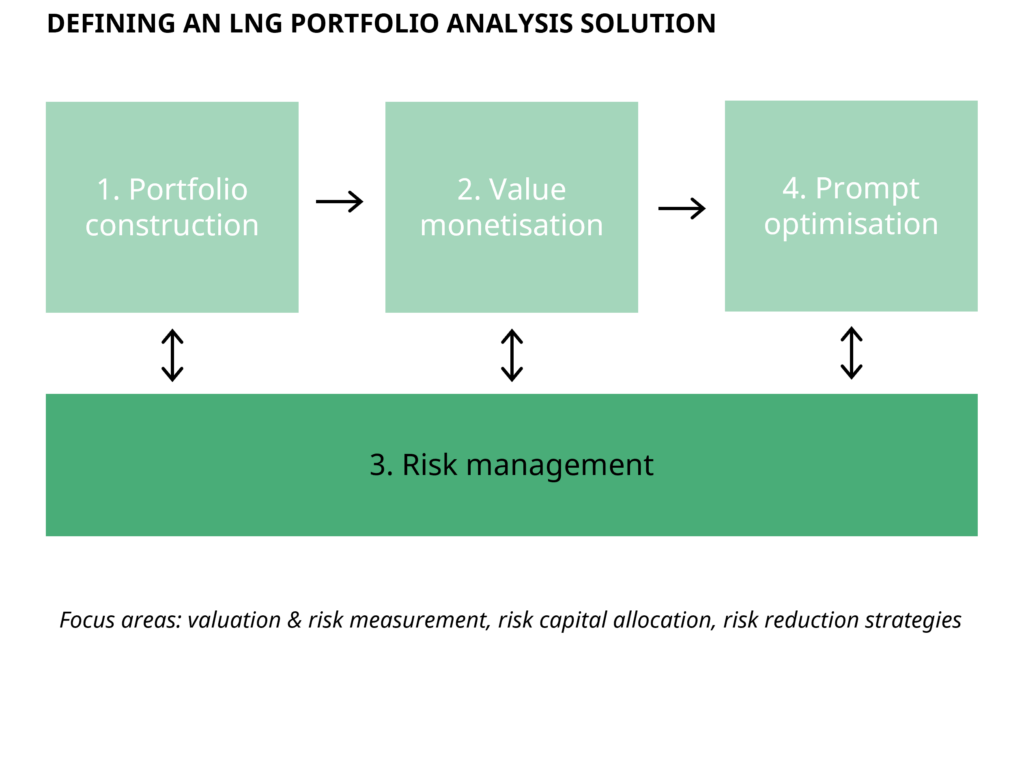

The construction & optimisation of LNG portfolios drives value creation. An effective portfolio model is the analytical ‘engine room’ behind portfolio value creation.

-

- LNG Bridge is an LNG deal and portfolio analysis model.

- LNG Bridge is a key model for our consulting work & used by many leading LNG companies for their own portfolio analysis.

- It allows companies to quantify and manage the interdependent value of LNG assets within a portfolio.

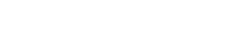

- LNG Bridge is underpinned by a sophisticated price simulation and portfolio optimisation engine.

USER INTERFACE

Data entry screens & results dashboards

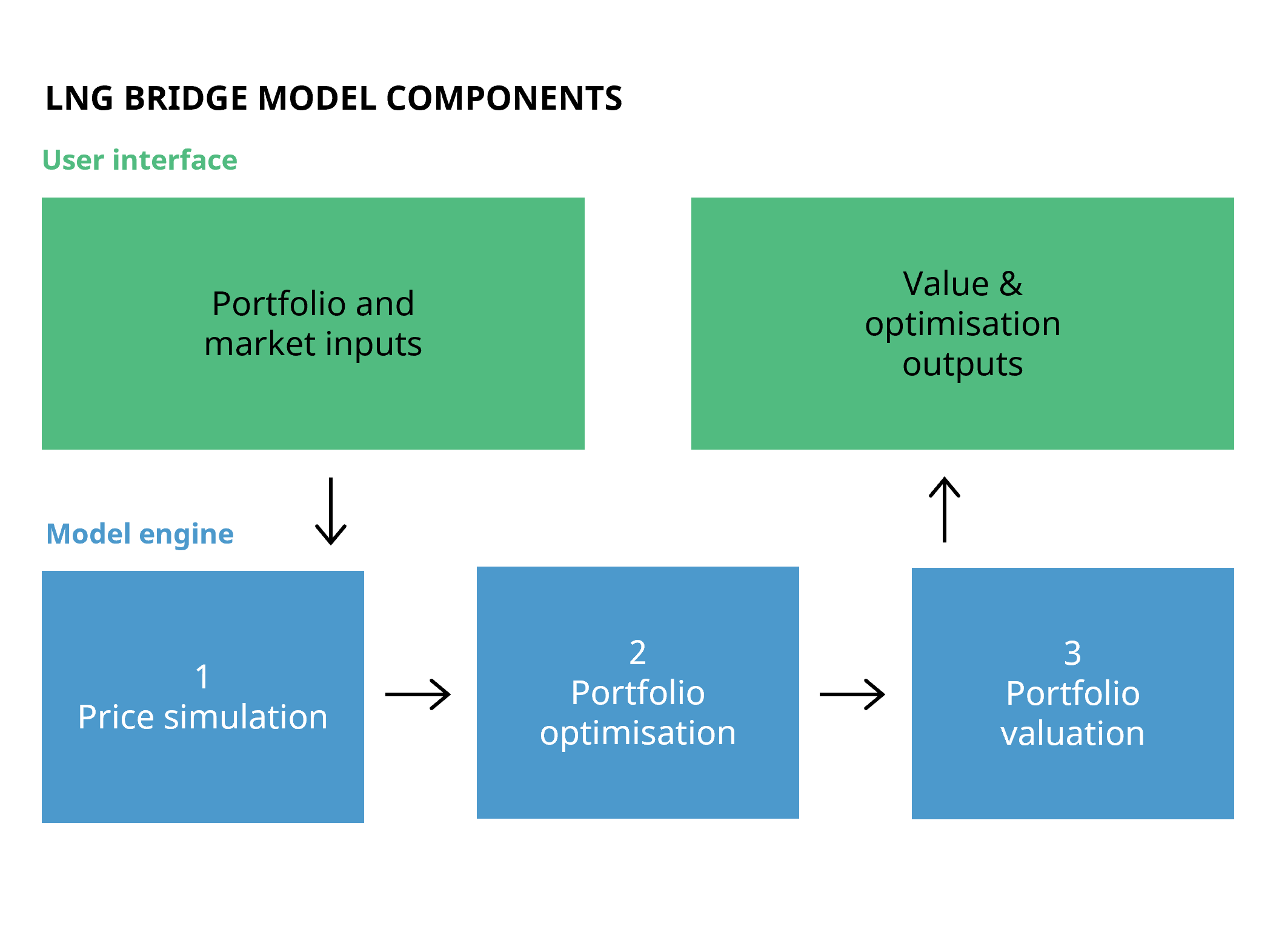

A key benefit of LNG Bridge is its ability to capture a broad range of contract structures, supply chain assets & logistical constraints. It is also highly configurable, supporting rigorous deconstruction of complex portfolio exposures & flexibility.

The user-friendly dashboard provides a transparent summary of analysis of portfolio components, optimised flows & margin capture.

LNG Bridge analysis case study

Anatomy on an oil indexed SPA

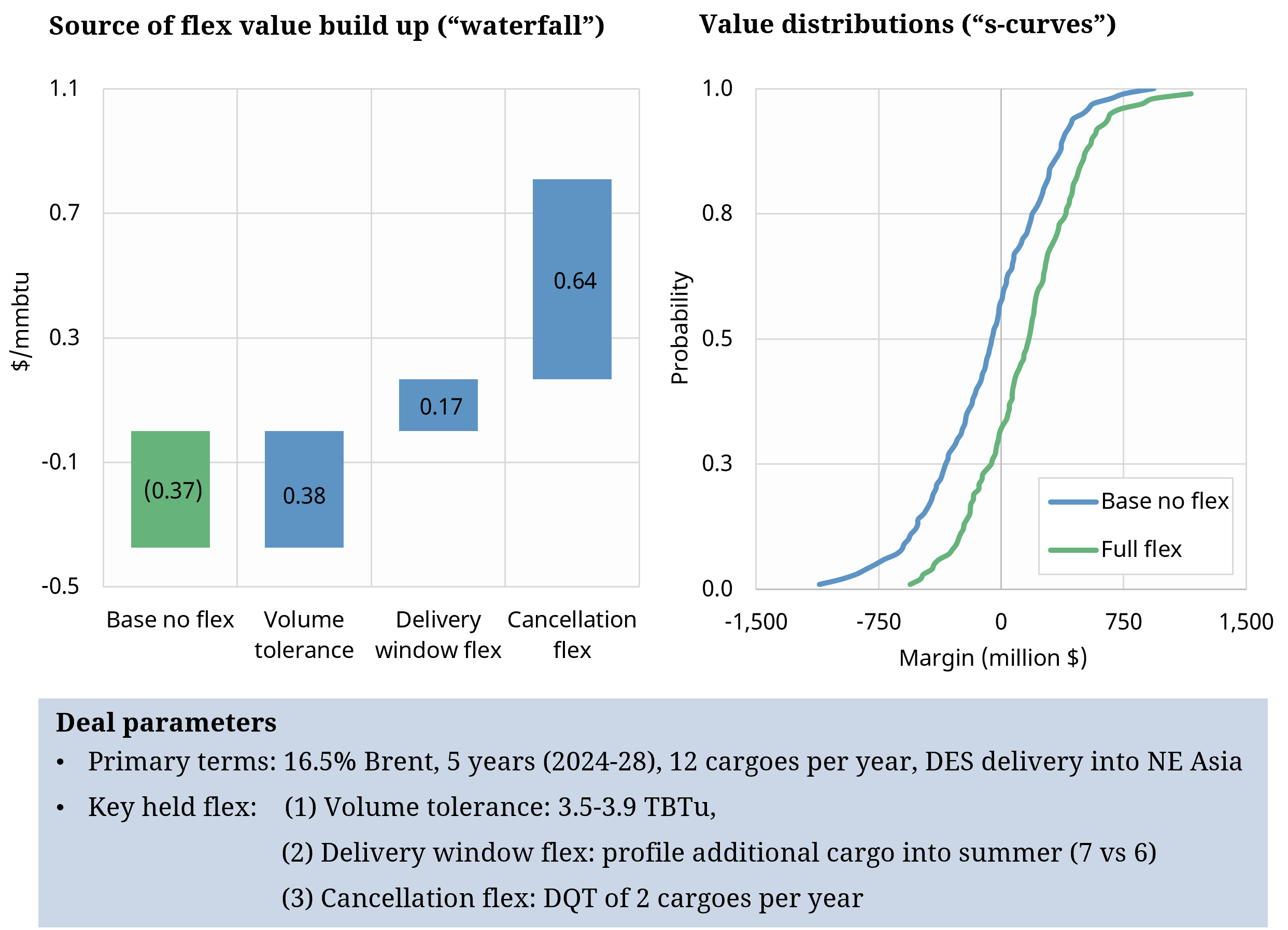

Bridge allows our clients to quantify the value distribution of different sources of flexibility. This can provide powerful insights that support contract pricing, negotiation & value management. The Bridge result charts illustrate how complex gas vs oil price relationships (e.g. correlations) underpin significant risk in oil indexed SPAs, which can be partially mitigated via contract flexibility (e.g. DQT).

WHO USES LNG BRIDGE AND WHY

LNG Bridge is an industry leading solution, used by producers, utilities and commodity traders.

LNG Bridge user base portfolios cover an equivalent of almost 20% of the global physical market. LNG Bridge has been developed and our work with clients is underpinned by our first hand commercial expertise of LNG portfolios & markets.

Example LNG Bridge analysis use cases

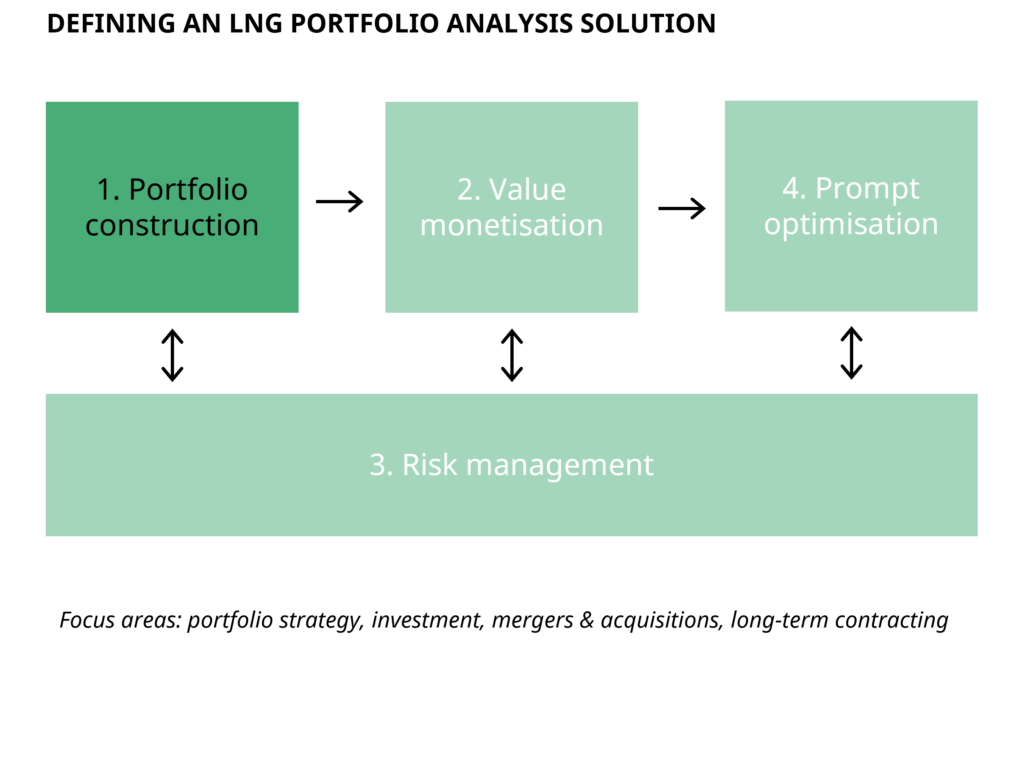

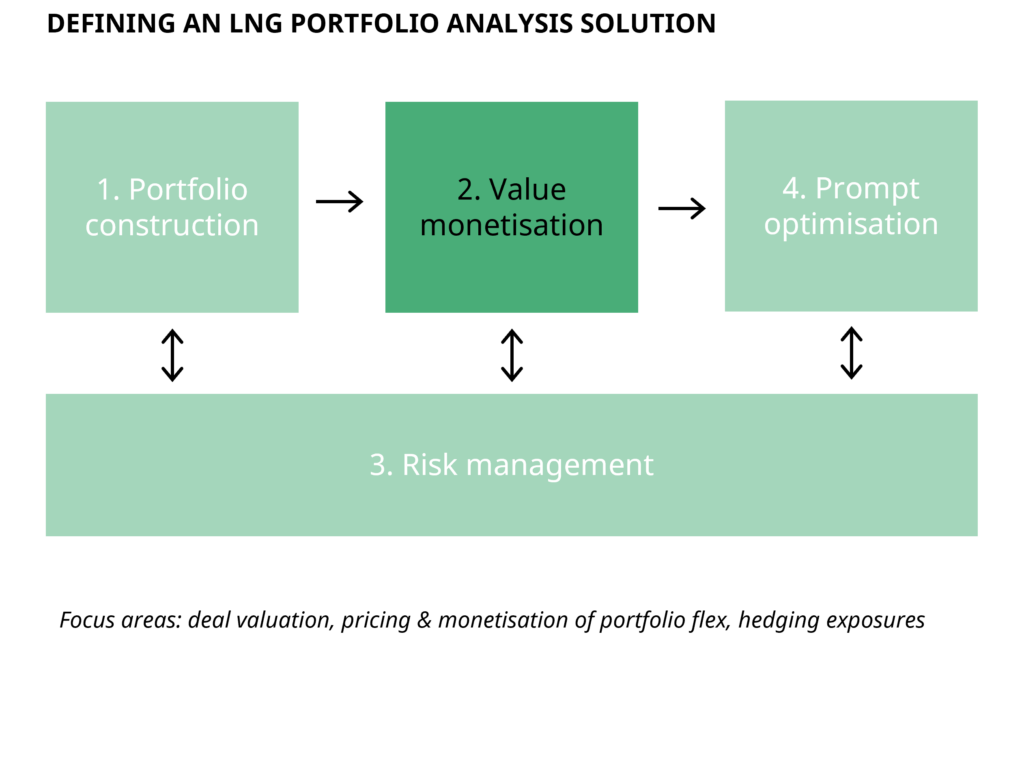

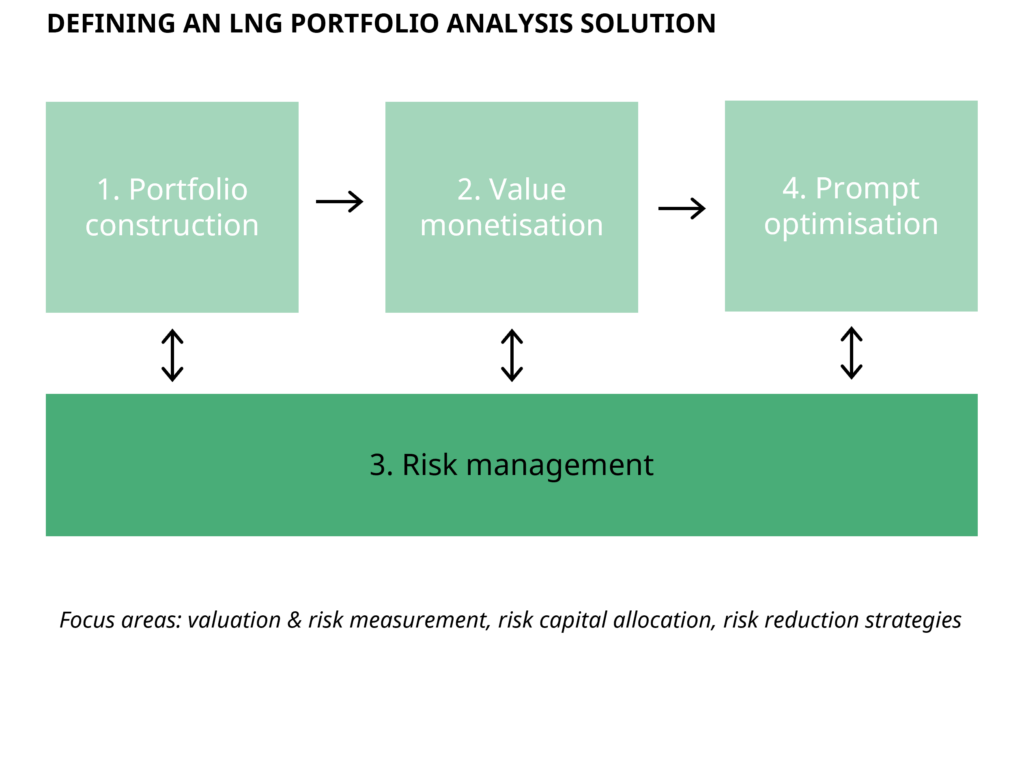

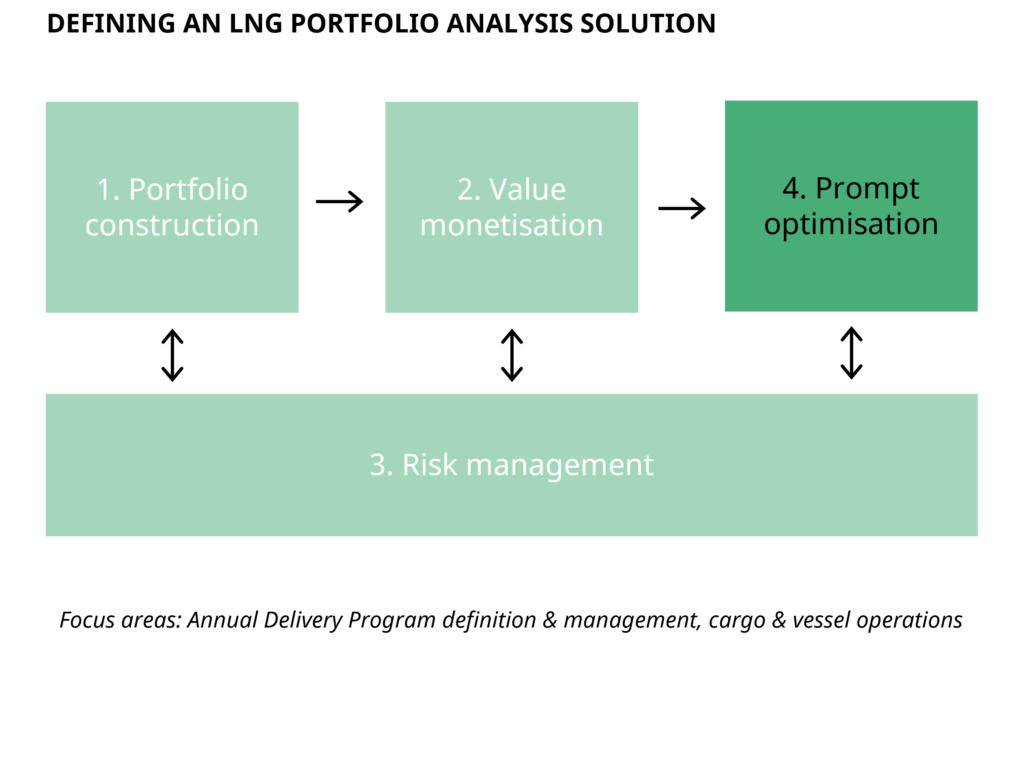

Portfolio construction

What is the value of adding an asset or contract to my portfolio?

How do I size my long-term shipping fleet given my supply and sales positions?

Value monetisation

Deal pricing – What is the standalone and portfolio value of a live opportunity?

How much should I be prepared to pay for additional diversion or cancelation flexibility?

Risk management

What is my LNG portfolio earnings at risk?

How can I reduce my portfolio risk through hedging or sales indexation choices?

Prompt optimisation

How do I identify the highest value optimisation trades?

What is the impact of an outage on my existing ADP schedule?

LNG clients include