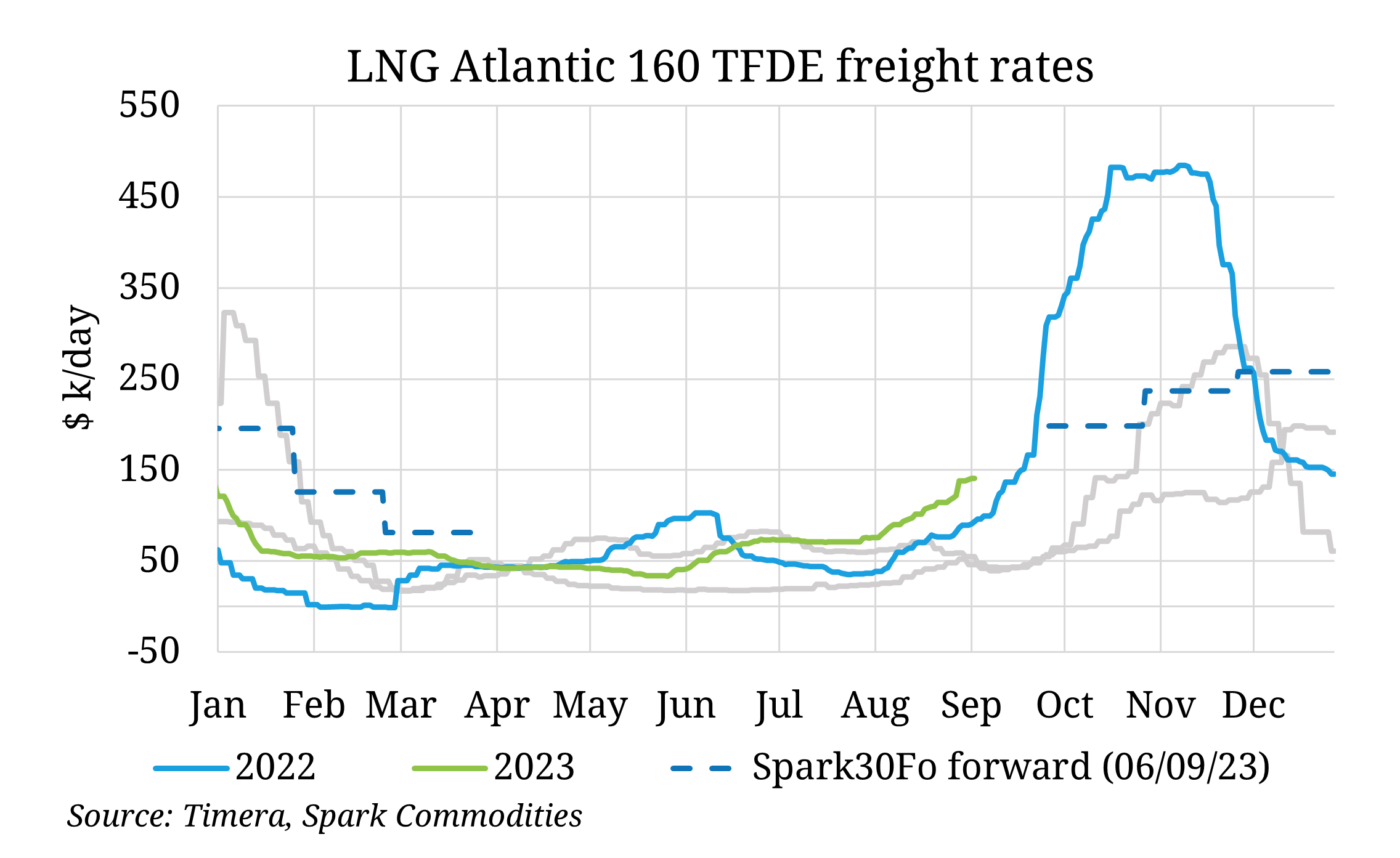

As discussed in our recent gas market ‘state of play’ article, record-high European seasonal storage inventories have led to a significant contango on the TTF curve into winter. This has made alternative, more expensive storage options profitable. One such option involves floating loaded LNG cargoes to later dated winter contracts. The shift is clearly reflected in LNG freight rates, with the Spark Atlantic spot freight assessment (30S, 160 TFDE) rising $66 k/day (+ 87%) since the beginning of August.

While freight rates typically follow a seasonal pattern, reaching their peak in Q4, this year’s rally has started earlier than usual. This early surge is a response to the unusually low availability of conventional European storage flexibility in September. This build of cargoes on the water is expected to subdue European LNG deliveries over September and October, and could support record deliveries in November, particularly given the expansion of European regasification capacity.

The substantial volume of LNG deliveries expected in November serves as a safety net for the market in case of an early onset of cold weather this winter. This provides some mitigation against potential upward price pressure.