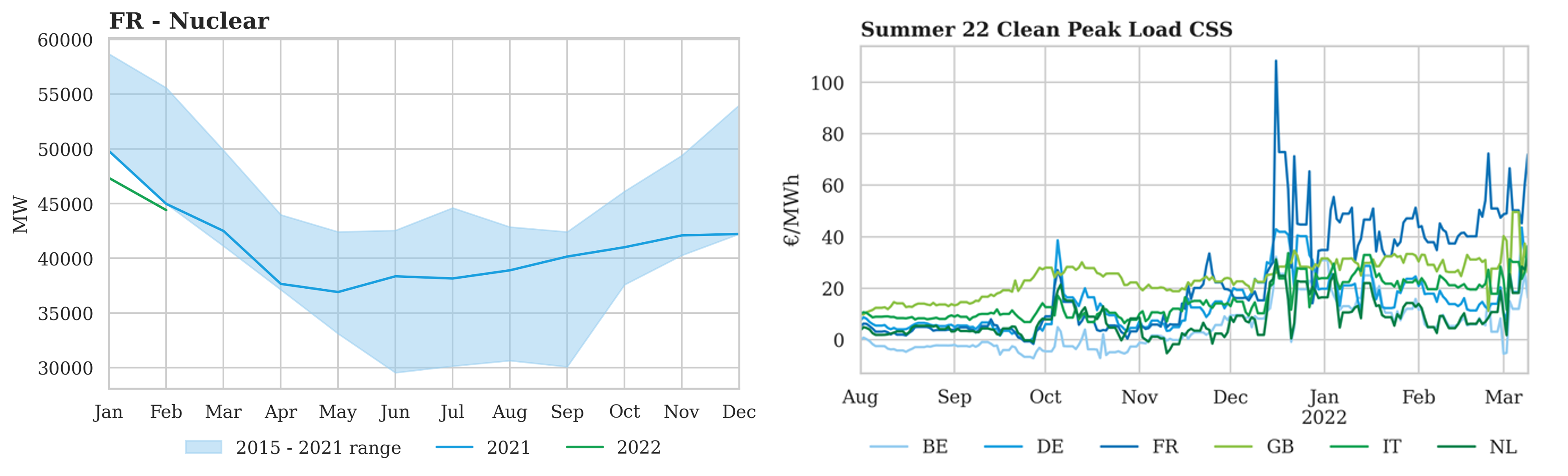

We wrote at the start of the year about the slump in French nuclear output following the faults discovered at the Civaux & Chooz plants in mid-December. This aligns with the large spike in forward clean spark spread (CSS) levels in France (see chart on the right) around this time. EDF have since lowered 2022 nuclear output estimates by 45 TWh to 295 – 315 TWh, and 2023 by 40 TWh to 300 – 330 TWh due to a continuation of the control & repair programme following the issues discovered in December, and a generally heavy maintenance schedule.

The reduction in nuclear output can be seen clearly in the generation data (left hand chart) for the start of 2022 with Jan & Feb output levels below the 5 year range. Along with firm demand, this has driven a change in market dynamics, as France has moved from a typical exporter of power to a net importer across almost half of the settlement periods in Jan & Feb. High prices to incentivise imports can also be seen in the forward CSS levels in Summer 2022, which remain elevated compared to surrounding NW European markets.