As the year draws to a close it’s time to look back at the hand we have been dealt by energy markets in 2023.

In today’s article we revisit the 5 surprises for 2023 that we set out in January. We also summarise 10 other surprises that have turned up as the year evolved.

Let’s recap what we proposed as our 5 surprises in early Jan 2023.

- Policy response shocks – policy surprises in response to the energy crisis, particularly in support of investment in flexibility

- Demand response surprise – a demand reduction in 2023 that passed all expectations

- Chinese demand comes roaring back – a strong recovery in Chinese demand for LNG & other commodities

- Gas & power price shocks – substantial moves in gas & power prices given inelastic supply & demand

- Business model pivots – strong performance & acquisitive behaviour of large balance sheet companies with trading capabilities.

A quick review of what has happened in each of these areas.

1. Policy response shocks

It is easy to forget how panicked policy makers were 12 months ago. We were in the midst of price caps, margin claw backs and mandated security of supply measures.

We have seen some further policy related surprises this year e.g. the failure of renewable auctions (mostly due to rising costs) and the ratification of an expansive Italian battery support mechanism. However most of the more interventionist measures from last year have subsided in 2023.

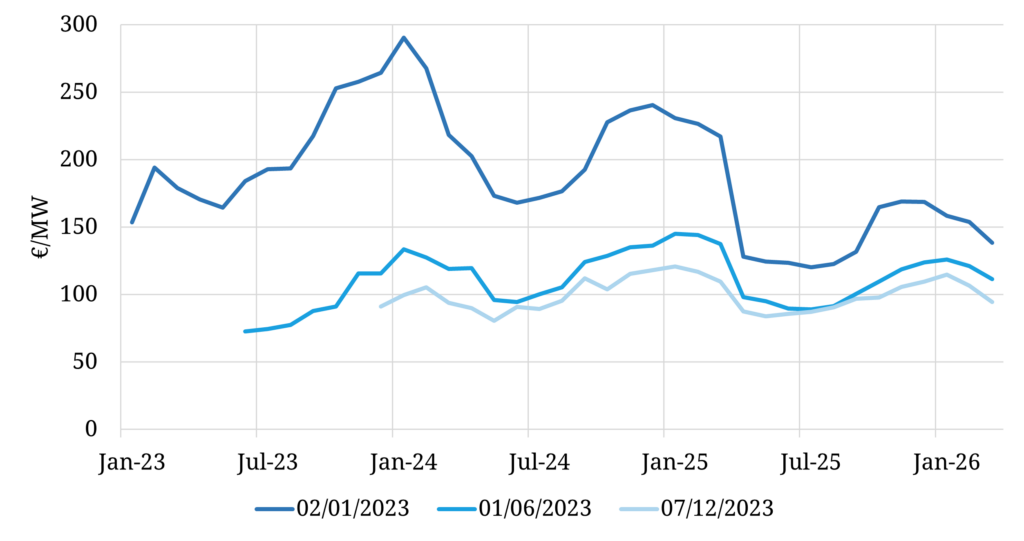

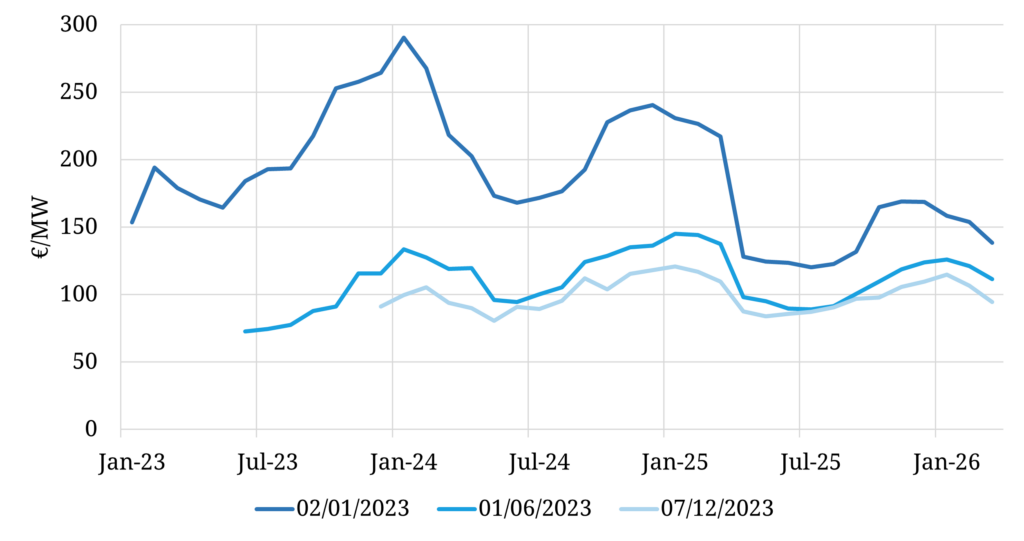

We were fearful that the crisis could have triggered some rushed and heavy-handed market redesign. This has fortunately not been the case, helped by a significant easing in market tightness, as represented by the evolution of the German power forward curve across 2023 in Chart 1.

The chart illustrates how most of the easing occurred across the first half of the year, particularly in Q1 as Europe emerged from a mild winter.

Chart 1: German power forward price evolution

Source: Timera Energy, ICE

The fact that policy makers were serious in their crisis response helped to calm markets. But as it turned out, the biggest single factor that dampened the crisis this year was a huge reduction in gas & power demand.

2. Demand response surprise

The question we asked when we posed our second surprise in Jan – “What if in 2023 demand response in power & gas markets surpasses all expectations?”. The potential causes we cited were economic weakness, industrial demand destruction, commercial & industrial response to higher prices & changes in residential consumption behaviour.

This is a fair reflection of exactly what has happened across 2023. Gas demand across Europe has been down 15-20% compared to pre-crisis levels, driven by:

- industrial demand destruction & offshoring

- a reduction in gas demand for power generation (reflecting lower power demand)

- a structural shift lower in residential demand.

Power demand across Europe has also seen similar declines this year. Warm weather has supported lower demand, but there are more structural forces driving demand reductions in a post-crisis Europe.

3. Chinese demand comes roaring back

We invoked images of a roaring tiger back in January. The outcome was closer to a dozing lap cat.

We flagged two factors that did transpire in 2023: (i) China would move quickly away from its lockdown policy and (ii) it would assertively stimulate its economy. But neither of these factors was enough to spark a surge in commodity demand.

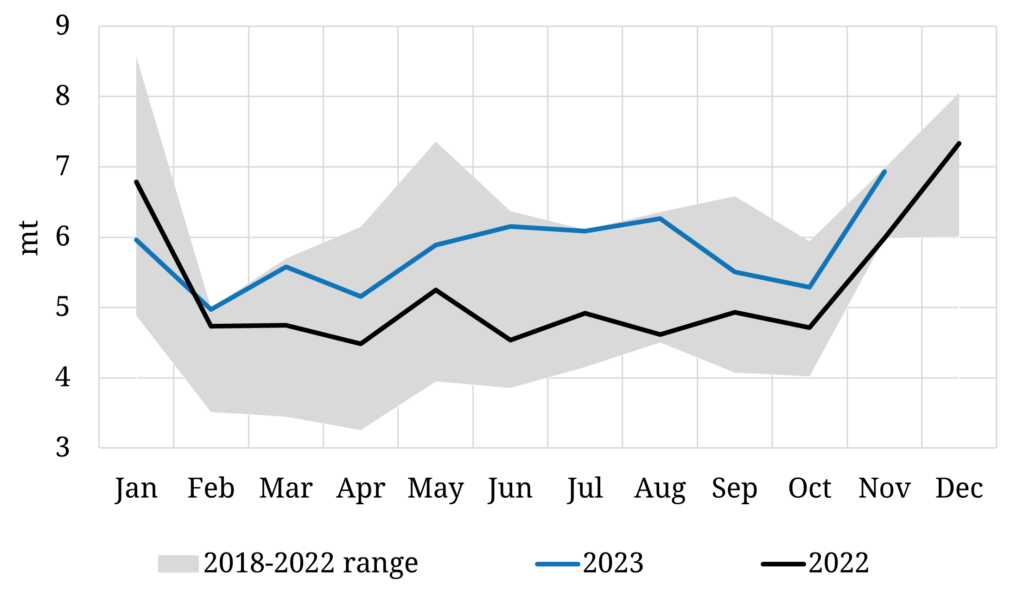

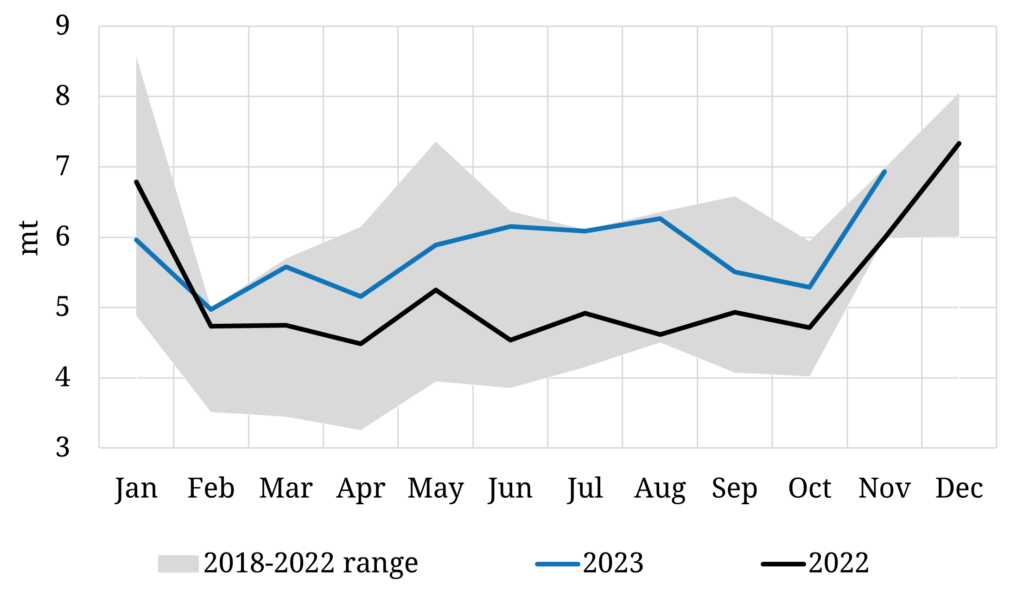

That said, Chinese LNG demand has recovered in 2023, particularly across the second half of the year as show in Chart 2.

Chart 2: Chinese LNG demand (vs previous years)

Source: Vortexa, Timera Energy

We are seriously considering doubling down on this surprise again in 2024. There are plenty of challenges facing the Chinese economy, but further stimulus could mean that the sleeping tiger may still have its roar.

4. Gas & power price shocks

The price shock in 2023 has been the opposite of those experienced in 2021 & 2022. Prices have fallen by more than anyone expected (including us).

A pronounced easing in European gas market tightness has been the biggest factor behind this decline. Demand has fallen (as we set out above) at the same time Europe has benefited from strong volumes of LNG imports.

As we set out in January, global gas market pricing dynamics are currently driven by relatively inelastic supply & demand. That means it doesn’t take a huge shift in market balance to induce major price moves.

We expected substantially higher gas & power price volatility in 2023 given this backdrop. There have been some major price swings, but volatility has surprised to the downside (albeit structurally higher than pre-crisis). The price decline across the year has been more of a steady easing, helped by a substantial gas storage buffer and weak demand.

5. Business model pivots

The energy crisis caused some casualties, particularly amongst smaller balance sheet companies with inadequate risk management practices (e.g. independent retailers). But systemic risks were contained by liquidity backstops from policy makers and commercial lenders.

Established large balance sheet companies have weathered the crisis well. This is particularly true of those with strong trading & risk management capabilities enabling value capture from volatile market conditions. But there has not been the strong pick up in M&A activity that we flagged as a potential outcome in January.

The largest impact on energy company business models in 2023 has not come from the fall out of the energy crisis, but from a surge in cost of capital. Central banks raised interest rates faster and higher than just about anyone expected. This acted to drive up the cost of both debt & equity capital to fund investments and other business activities.

Other 2023 surprises

Here is a summary of 10 other surprises that caught our attention this year:

- Economic resilience of European economies to the energy crisis

- How fast the crisis eased in Q1 2023

- Wind & solar project cost increases & component failures

- Renewable auction volume shortfalls

- Impact of Inflation Reduction Act in attracting capital to the US

- Crude price weakness (despite increase in US marginal production costs)

- Lithium price crash (easing pressure on battery costs)

- Very high European gas storage levels

- Price surge (63 £/kW/yr) in UK capacity market

- Extent of impact of Panama canal delays on LNG market

We’ll be back in mid-January with our 5 surprises for 2024. But first an update on Timera happenings this year.

Timera year end news

We finish the year with a round up of interesting Timera client work this year, that provides an insight into where flex asset investors and owners are focusing:

- Batteries: We have supported several GW of battery investment this year, but for the first year the GB market was not the biggest focus. Continental European battery investment trumped GB this year, with Germany & Italy particularly strong.

- Hydrogen: Greater clarity around policy support is driving momentum behind hydrogen projects, particularly electrolysers. Our work here has been boosted by a big step forward in the evolution of our stochastic electrolyser modelling framework.

- LNG portfolios: We have seen a strong increase in work supporting large LNG portfolios value, acquire & manage assets (e.g. US export deals, European regas & Asian sales contracts).

- LNG Bridge: Our LNG Bridge model continues to be implemented by leading LNG companies as a portfolio valuation & optimisation modelling solution.

- Gas-fired generation: We have seen a resurgence in CCGT related work in 2023, covering asset valuation, offtake contracting & hedging strategies. There has also been stronger interest in gas peakers, supported by higher levels of price volatility across the last two years.

- Long duration storage: LDES has struggled to scale so far in Europe given inadequate policy support. But a combination of maturing technologies and policy developments have seen growing interest in LDES investment, from longer duration batteries to compressed air technologies.

- Transactions: We continue to support buy-side investors with commercial due diligence & valuation work. In 2023 this has included supporting multiple client bids for battery portfolios in GB, DE, IT & Benelux as well as debt financing of flex power assets. We have also supported several large LNG transaction processes.

The common theme across all of this work is the flexibility required to decarbonise energy markets.

To support this work we have continued to expand our team in 2024 and are actively recruiting.

This is our last feature blog article for 2023. We will be back with more features from mid-Jan 2024 and in the meantime we’ll continue to publish snapshot articles.

Happy Christmas and all the best for 2024!