European leaders plan to intervene in power & gas markets to try and ease an escalating energy crisis. Talk of intervention is the easy part. It will be a lot more challenging turning that talk into effective action across the next few weeks before winter.

“The risks of mistakes is high given such short lead times”

A range of emergency intervention measures are on the table. However the EU appears to be focusing discussions on four main options in preparation for the coming winter:

- A wholesale gas price cap

- Power price caps on some generation technologies (e.g. wind, solar & nuclear)

- Demand reduction measures

- Liquidity support for energy companies (e.g. credit lines, guarantees)

Some residential consumers & businesses across Europe are facing very tough conditions. Governments have an important mandate to protect vulnerable people and businesses from freezing & bankruptcy and to minimise the risk of supply cuts & blackouts.

Emergency intervention to achieve this makes sense. But it does not depend on hasty redesign of market price signals. Europe is in conflict with a hostile neighbour that has weaponised energy supply. This is the root cause of extreme prices and there is no ‘silver bullet’ solution via market intervention.

In this article we look at the potential impact of the 4 intervention options one at a time, in order of most problematic to most constructive. In some cases intervention may help stabilise markets and limit downside risks. In other cases it will likely make the crisis worse and cause enduring damage.

1. Wholesale gas price cap

LNG flows are currently the lifeline source of marginal supply to Europe (given Russian supply cuts). Europe is competing with the rest of the world for available cargoes in an historically tight LNG market. The world is short gas this winter not just Europe.

There are also significant constraints on how much LNG Europe can import given available regas & pipeline capacity. European hub prices reflect these constraints. The TTF price is currently the key market price signal enabling the NW European gas market to clear, via inducing adequate demand side response.

Capping wholesale gas prices in Europe exacerbates the crisis in two key ways:

- Demand side: Uninhibited European hub prices (e.g. TTF) are key to signalling the demand response required to balance the European gas market.

- Supply side: Capping hub prices directly interferes with the market price signal required to incentivise adequate LNG cargo flows to Europe (e.g. versus Asia).

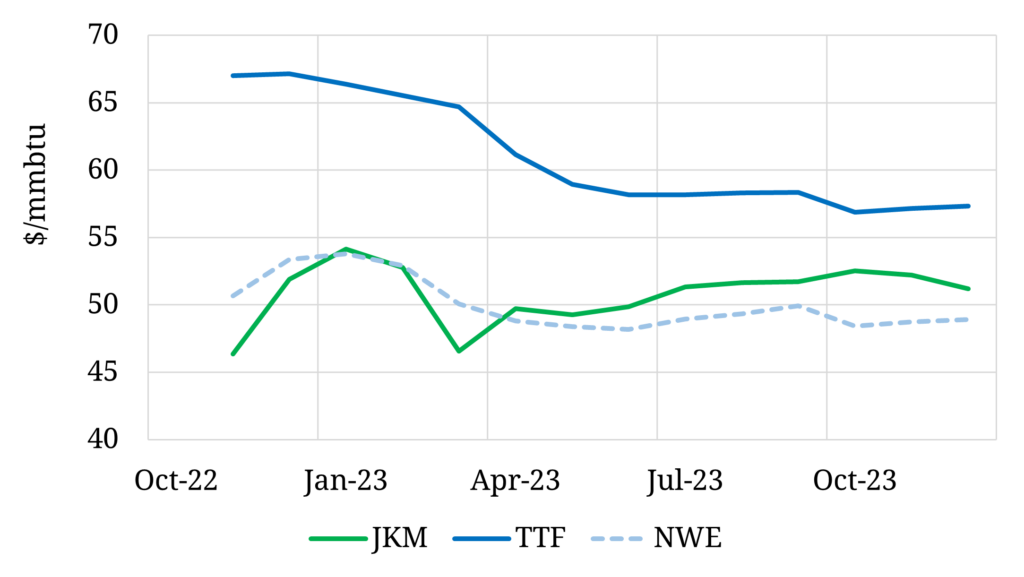

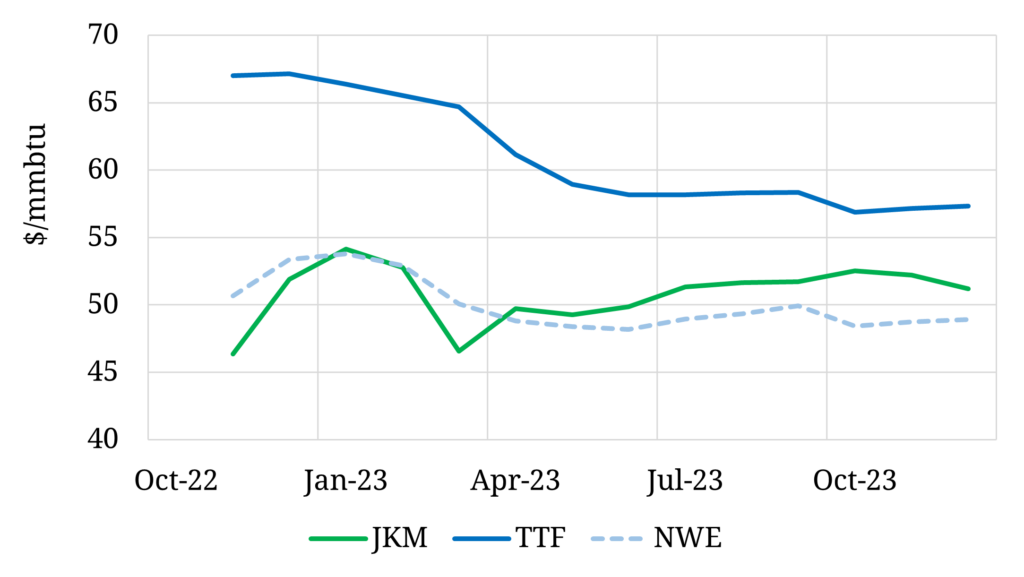

Chart 1 shows the current dynamics of 3 key price signals that are acting to clear both the European gas & global LNG markets.

Chart 1: Three key price signals acting to balance gas markets

Source: Timera Energy, CME, Spark Commodities

The reason that TTF (dark blue line) is at a ~20 $/MWh premium to Asian JKM prices (green line) has nothing to do with speculation or rent seeking by market players. It reflects the price signal required to balance the NW European gas market given acute constraints around regas capacity to enable imports of LNG. This is reflected in the steep discount of the value of LNG cargos off the coast of NW Europe (blue dashed line).

Mess with these price signals at your peril. Attempting to cap TTF prices and close the gap with Asian prices will directly impede Europe’s ability to balance its gas market i.e. it will make the crisis worse.

Even a diluted version of a gas price cap that is applied at a consumer vs a wholesale level is counterproductive and likely to cause distortions.

2. Power price caps

Extreme prices have seen revenues of gas producers and power generators surge. The same prices are inflicting extreme pain on households and businesses. It is understandable why it is a policy priority to find a solution to redistribute value from the former to the latter.

Windfall taxes are messy but have been used already (e.g. in Italy & Spain). The clear advantage of a tax solution is that it can be implemented without disrupting market clear pricing mechanisms in the middle of a crisis.

There are two key high stakes implementation risks with intervening via price caps (vs e.g. windfall taxes):

- It interferes with wholesale market price signals required to maintain orderly operation of the power market through the crisis

- It damages investor confidence and undermines the massive investment required to resolve the crisis & achieve energy transition.

A 200 €/MWh day-ahead price cap on inframarginal generation technologies is being discussed. This is likely to have messy unintended consequences e.g. unintentionally capping coal plant output, resulting in greater gas demand or causing distortions between day-ahead, balancing & forward market prices.

The equitable aim of taking from producers to give to vulnerable consumers is clear. But the risks of mistakes is high given such short lead times.

30 years of effort has gone into developing an increasingly integrated network of European wholesale power markets. It is far from perfect. But shotgun intervention that impacts price signals across this integrated network of markets will very likely exacerbate the current crisis to increase aggregate damage (even if that damage is redistributed).

3. Demand reduction measures

Russian supply cuts, low hydro storage levels & poor nuclear availability mean that if there is a cold winter, markets may not be able to effectively clear… at any price. Against this backdrop it is very important to define a clear plan & mechanism for reducing demand if acute volume shortages occur.

One of the drivers of extreme pricing across the last month has been forward markets pricing in a risk premium given a lack clarity on the structure of demand side intervention. Markets are used to pricing electrons & molecules based on supply side flexibility, not demand side destruction & intervention.

While conditional intervention makes sense, it will be difficult to achieve effectively in practice. At the core of a successful model is a clear mechanism that allows the competitive ‘bidding off’ of industrial demand to protect residential & commercial consumers.

Timing is very tight to implement something for winter. It will likely need to be driven primarily at a country level given the complexity in EU coordination of rationing energy. Clarity, transparency & simplicity are key.

An effective demand side intervention framework is a key insurance policy for the winter, but the risk of things going wrong from poor implementation are significant. For example mandated reduction of power sector gas supply may unintentionally transform the risk of gas supply cuts into blackouts.

There is also a key link between demand reduction and price caps. Market wide price caps (e.g. as being implemented in Spain and the UK) achieve exactly the opposite of demand reduction. They effectively reduce incentives to consume less energy.

The blanket price cap announced by the UK last week is a particularly misguided intervention. As well as capping incentives to cut demand in a crisis, it effectively pushes an estimated £150 bn of energy bills onto the next generation.

4. Liquidity support

Announcements are flowing thick and fast on government backed liquidity support extended to energy companies. These include Uniper (multiple drawdowns), Fortum, Axpo and $23bn of Swedish government credit guarantees for Nordic & Baltic companies.

Equinor last week estimated at least a $1.5 trillion collateral requirement to cover margin calls given extreme prices. Depending on the evolution of prices this number may be conservative.

These margin calls mostly relate to the prudent execution of the core business of energy companies in hedging & delivering electrons & molecules to customers.

For example a power generator selling futures contracts to hedge forward generation exposure across the next 3 years faces huge margin calls to support its hedge positions. These futures exposures are covered by physical generation of power (across 3 years), but margin calls can drive the company into insolvency today.

Liquidity support is an important intervention backstop because it protects against a rapidly escalating systemic crisis. Credit is about confidence and once that is shaken it is very difficult and costly to restore.

The key challenge with liquidity support is not ‘if’ but ‘how’. Credit lines & guarantees should ultimately reduce the burden on consumers & taxpayers (vs a credit crisis). But ensuring this requires targeted & effective intervention, transparency, stringent conditions and most of all the right incentive structure (to align company incentives with those of the taxpayer).

Mistakes here are unlikely to exacerbate the crisis but they may cost the taxpayer.

Temporary emergency measures vs structural reform

One clear line of logic cuts through the current haze of intervention uncertainty. If policy makers attempt a shotgun implementation of structural market reforms by winter they will almost certainly make the crisis worse.

The European power & gas system is a highly complex network of interconnected markets. Implementing effective emergency interventions in time for winter already represents a huge challenge. Any attempt at structural reform at the same time is inviting unintended consequences.

Europe’s energy markets are far from perfect. There are a range of longer term structural issues with energy market design that need to be addressed in order to enable effective energy transition. But the next 6 weeks is about keeping the lights on.

The policy focus should be clear and time limited emergency interventions that buy time for structural reform.