The Russia – Ukraine conflict has just triggered one of the most substantial shifts in European energy policy history. The Russian share of the European gas supply mix has ranged from 30-40% across the last 5 years. The EU has this month announced its ambition to reduce this to zero by 2030, with political pressure mounting for an acceleration to 2027.

“Expect a much more dynamic relationship between Europe & Asia competing for marginal LNG supply”

Part of this pivot away from Russian gas is being targeted via gas demand reduction. But there are major policy, cost & technology hurdles to overcome in order to achieve substantial demand reductions this decade. Electrification is the most obvious route but it comes with an inconvenient circularity: with gas as the dominant marginal generation fuel in Europe, higher power demand results in more gas burn.

On the supply side, domestic gas production, Norwegian imports and North African supply are effectively flowing at maximum capacity. Small increases may be possible at the margin, but there is limited ability to substantially increase supply from any of these sources by 2030 given upstream constraints.

That leaves LNG as the only meaningful supply alternative to Russian gas. This is true both:

- In the short term (i.e. weeks to months), if Russian flows are cut as a result of the war

- In the long term (i.e. years), as Europe reduces its reliance on Russian pipeline imports.

The EU has not put it in these terms, but a pivot away from Russian gas is effectively a pivot towards LNG. And Europe’s appetite for LNG is already having a profound impact on market pricing & flow dynamics.

What is 2022 telling us about Europe as a marginal buyer?

European LNG imports hit record monthly highs across both Jan & Feb 2022, as show in the left hand panel of Chart 1.

Import volumes this high are the result of European buyers paying a premium to divert LNG from Asia. The resulting decline in Asian LNG imports (vs 2021) can be seen in the right hand panel of Chart 1.

Chart 1: European & Asian LNG monthly imports (2022 vs previous 5 years)

Source: Timera Energy, LNG Unlimited

The Ukraine war has supported European demand for LNG, but there were already other drivers in place behind the surge in European LNG imports this winter. These include:

- A relatively mild Asian winter with high inventory & contract levels (given caution after the price shock from last winter)

- An Asian power sector pivot towards coal (e.g. in China), given very high LNG prices

- Other demand destruction or substitution given high LNG prices e.g. spot demand reductions in India from refineries & industrial buyers.

Chart 2 shows Chinese & Indian LNG import demand reduction in 2022 vs previous years. These two buyers are typically the most sensitive of the ‘Big 5’ Asian buyers to higher spot prices.

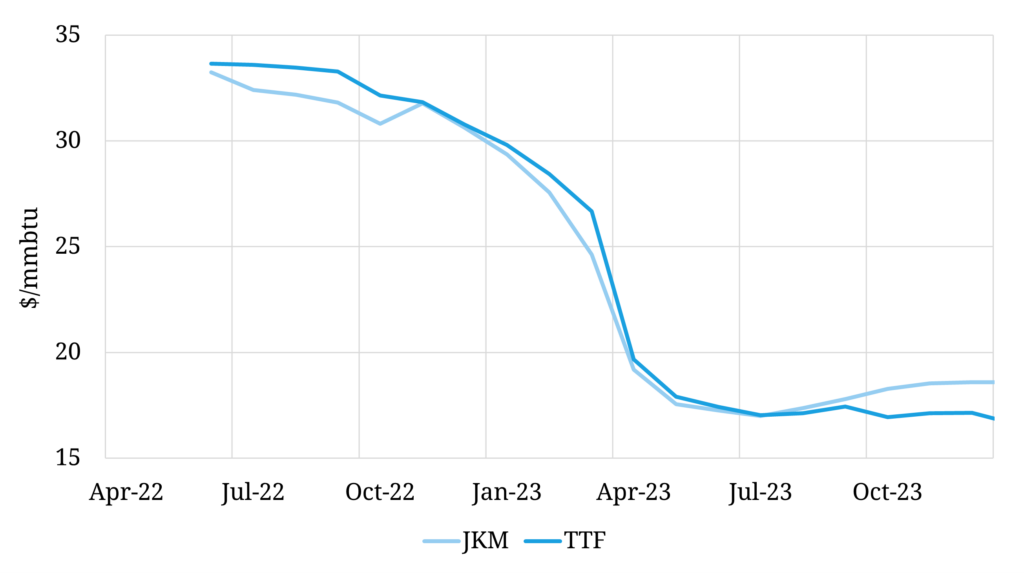

Europe’s requirement for LNG to balance its gas market has seen European TTF prices rise aggressively through Asian JKM levels.

This dynamic was already in play in late Dec 2021 when a TTF spot price premium over JKM saw rerouting of LNG on the water towards Europe. The premium of TTF over JKM prices then extended out across the front of the forward curve as a result of the Russian invasion and associated surge in risk premium on Russian supply as shown in Chart 3. Constraints on import capacity have also seen DES NW Europe prices drop to a significant discount to TTF.

Key swing supply to meet Europe’s incremental demand is coming from the US Gulf Coast, West Africa and the Middle East. This is effectively shifting flows from the Pacific to Atlantic and reducing average shipping distances.

LNG market regime shift

The dynamic of Europe bidding through Asia to become the marginal global buyer of LNG has been rare historically (and only ever for brief periods). But Europe’s pivot away from Russian gas is set to drive a market regime shift.

Under this new regime expect to see a much more dynamic relationship between Europe & Asia competing for marginal supply. Europe’s role in the LNG market is transitioning from being a sink for global LNG oversupply (e.g. 2019-20), to a direct competitor for LNG with other markets (particularly Asia).

This is likely to manifest itself in the death of a structural premium of JKM over TTF. Instead we are set to see more dynamic TTF vs JKM spread inversions as a price signal to balance the LNG market across the Atlantic & Pacific basins. This will have important implications for the level of correlation and volatility of TTF vs JKM price spreads, as well as for less liquid spot markers (e.g., West India, South America).

The market regime shift and associated pricing dynamics also have profound implications for LNG portfolio value & risk. This is a key theme of our work with clients in 2022 and we will explore it in more detail in articles to follow.